resources

2018 ACA Affordability Percentage and ESR Penalties

January 18, 2019

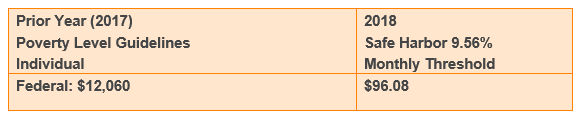

Employer sponsored health coverage is considered affordable if the employee required contribution for self-only does not exceed 9.56% of Poverty Level.

Alert

2018 Shared Responsibility Percentage

Employer sponsored health coverage for a 2018 calendar plan year will be considered affordable if the employee required contribution for self-only coverage does not exceed 9.56% of Federal Poverty Level.

Current year poverty level guidelines will not be available until the end of January or later, therefore IRS guidance allows employers to use the poverty guidelines in effect within six months prior to the first day of the employer’s plan year. This means an employer with a January 1, 2018 plan year start may use the 2017 federal poverty guideline amount to determine the 2018 ACA Federal Poverty Level (FPL) Safe Harbor monthly threshold amount. More details about the 2018 affordability percentage is available in Revenue Procedure 2017-36.

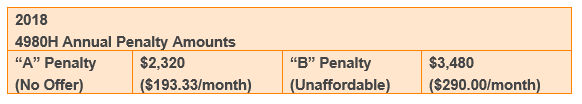

2018 Employer Shared Responsibility Penalties

Each year the employer shared responsibility (ESR) penalty amounts are adjusted for inflation. The calculation of the employer payment is not a flat annual amount; it is calculated on a monthly basis. Additional details regarding ESR penalty amounts are available in the HHS Notice of Benefit and Payment Parameters for 2018.

Employers who do not offer at least minimum essential coverage (MEC) to at least 95% of their full-time employees, may be subject to the “A” (no offer) penalty, if at least one of the full-time employees gets coverage in the Health Insurance Marketplace and receives a subsidy.

Employers who offer coverage that is not considered affordable to one or more employees or coverage does not meet minimum value (MV) requirements, may be subject to the “B” (unaffordable) penalty.

Thank you for choosing Paylocity as your payroll tax partner. Should you have any questions please contact your Paylocity Account Manager.

This information is provided as a courtesy, may change and is not intended as legal or tax guidance. Employers with questions or concerns outside the scope of a Payroll Service Provider are encouraged to seek the advice of a qualified CPA, Tax Attorney or Advisor.