resources

Benefits of Payroll Automation for Your Company

March 20, 2023

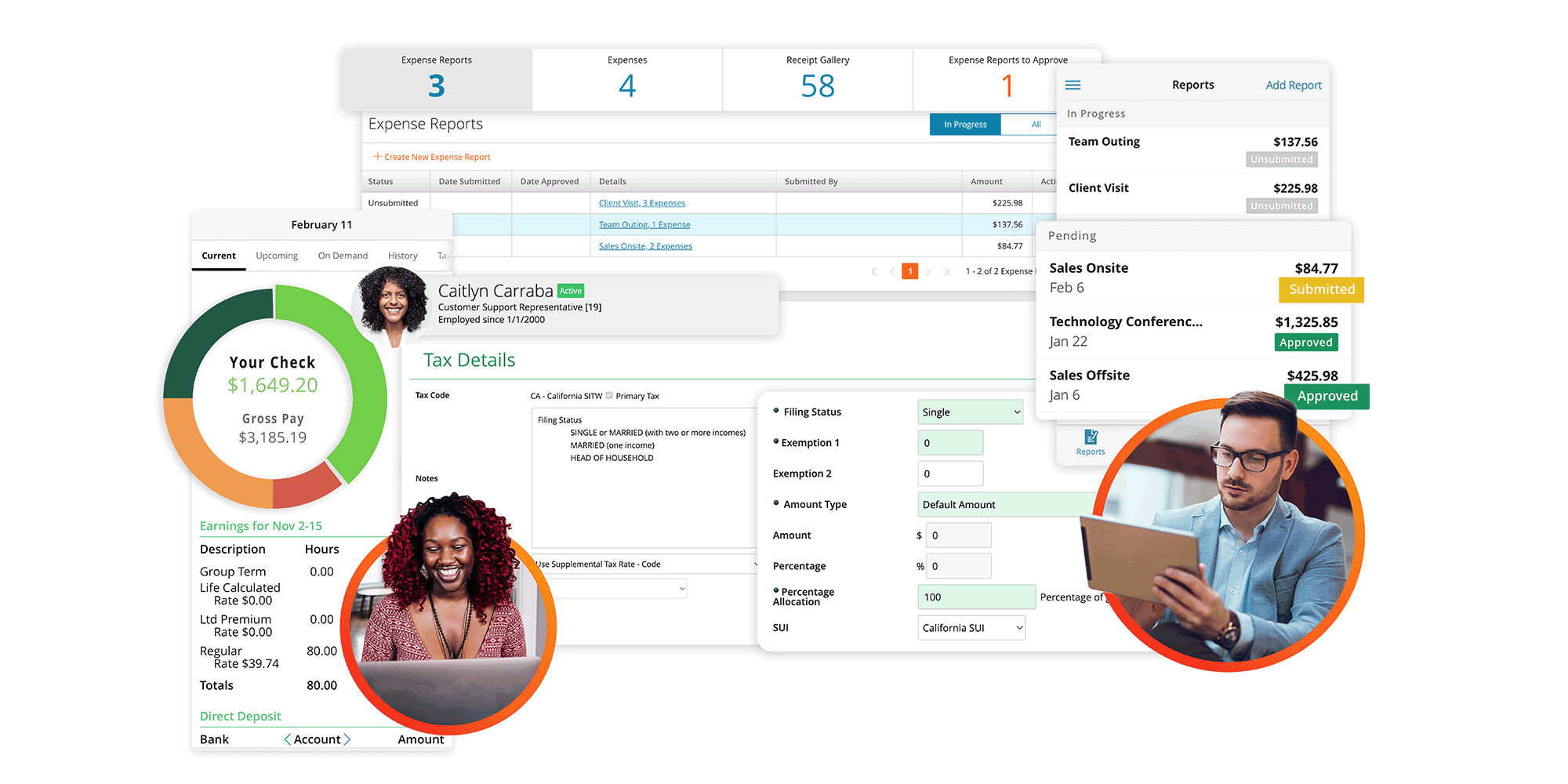

Automated payroll systems have so many features and benefits that can completely transform your payroll process.

Blog Post

Running payroll can be daunting task: employees with multiple tax codes to apply, dozens of possible deductions, hourly and overtime wages to calculate. And that’s just the basics.

Can you imagine trying to process all this data for hundreds of even thousands of employees with just a calculator and spreadsheet?

Thankfully, that doesn’t have to be the case. Modern payroll automation software helps alleviate this mountain of responsibility by streamlining payroll processes that otherwise would take hundreds of hours for your staff to manually complete.

In this article, we’ll explore how payroll automation accomplishes these savings by examining what exactly it is, what the technology can do, and its benefits for your company.

Key Takeaways

- Automated payroll systems complete tedious aspects of payroll processing without the need for manual human labor.

- Payroll automation provides numerous benefits, including improved efficiency, lower costs, fewer errors, faster processing, and greater data security.

- Other benefits of payroll automation software include employee time tracking, filing payroll taxes, and storing employee documentation digitally.

What's an Automated Payroll System?

An automated payroll system is a software platform that automatically completes many tedious aspects of payroll processing in place of manual human labor. This includes all the standard calculations and steps from deductions to direct deposit, as well as less common ones, like collecting garnishments or tracking tips.

Regardless of the task, payroll automation simplifies payroll processing to allow HR teams and their overall organizations to focus on bigger, strategic efforts.

What Can Payroll Automation Do?

One of the best ways to understand automated payroll is to see the specific tasks it can accomplish.

Maintain and Run Payroll Data

The first and most obvious feature of an automated payroll system is how quickly it calculates and processes an organization's payroll data. Ranging from tax codes to garnishment deductions to end-of-year bonuses, an automated system can account for and compute everything an organization needs for payroll to process accurately.

HR teams no longer even need to make deposits, as an automated system can store and use an employee's direct deposit information to transact net wages instantly. Adjustments to employee data can be entered, stored, and applied to future payrolls just as easily.

Provide Extra Payroll Flexibility

In addition to processing payroll quickly, automated payroll systems can also provide extra access for employees who need their wages at times outside their normal pay periods. On-demand pay features can provide extra support when unexpected expenses arise without creating additional work for HR and payroll teams.

Track Employee Hours and Timesheets

To know how much non-salary employees have earned, organizations must know how much those employees have worked. Payroll automation software also gives employees a centralized place to enter their hours, move shifts, record any overtime, and submit everything for supervisor approval.

Similarly, such timekeeping features allow management to track, audit, and report on how many hours their workforces are putting in. Leadership can review and make decisions based on such data faster than ever before.

Collect, Pay, and File Taxes

Payroll taxes can be a confusing and stressful part of running a payroll, especially when you have employees working in many different states.

Automated payroll systems can monitor the applicable taxes for different areas and industries, correctly apply those taxes to employee wages, and then remit those wages to the appropriate government agency.

Tax codes can be updated as laws change, and employers never need to worry about deducting the wrong amounts or missing a tax filing deadline.

Maintain and Store Important Documents

The best automated payroll systems will also make documentation entry and storage a breeze. Whether it's new hire information on the employee's I-9 or tax declaration on their W-4, payroll automation gives HR teams a quick way to record and save such material.

Some systems can even integrate this with the other onboarding steps a new hire completes to keep the experience as convenient as possible.

Enable Employee Self-Service

Finally, payroll automation also allows employees a simple and convenient way to update or review their employment information via a self-service portal.

Changing an address or marital status is as simple as logging into the system, entering the new information, and clicking save. Viewing upcoming paychecks or adjusting pre-tax deductions are just as simple to find and update.

Regardless of the specific need, the best automated payroll systems will make it easier than ever for an employee to manage their data.

Four Benefits of an Automated Payroll System

With so many bells and whistles, it easy to understand why payroll automation is so beneficial. It provides several benefits to organizations of all sizes.

1. Higher Efficiency with Lower Costs

Clearly, the biggest benefit of automated payroll is how much more efficiently and quickly it gets payroll processed than manual systems. This is especially true for organizations with hundreds, or even thousands, of employees on the payroll.

At a certain point it becomes impossible to handle that much data and calculation with even multiple payroll specialists. Payroll automation can handle that same workload in a fraction of the time, which allows HR teams to focus on more important projects.

2. Reduced Risk of Human Errors

No one enjoys making a mistake, but they do happen. People can accidentally forget to enter something, mix up pieces of data, or incorrectly apply a certain deduction.

By using advanced technology to process and calculate everything, automated payroll systems avoid such mistakes and reduce the risk of human error interfering with employees receiving their wages.

3. Timely Payroll Processing

Altogether, faster and more accurate payroll processing means employees are far more likely to get their paychecks on time, every time.

Payroll automation helps make that a reality and reduces the stress of everyone involved. This, in turn, means happier employees, a more motivated workforce, and a better workplace environment for everyone.

4. Greater Information Security

Not as readily obvious is the benefit of increased security that payroll automation provides. Employee information no longer needs to be shared across email or printed files where all sorts of accidental and intentional security risks are present.

Instead, everything is maintained in a secure, central location where only the relevant and appropriate members of an organization can access it.

How Can Payroll Automation Make Life Easier for You?

The entire purpose of payroll automation is to simplify and streamline the payroll process for everyone who uses it. By integrating all aspects of the payroll process in a single platform, Paylocity's automated system can save organizations hundreds of hours from time tracking to tax compliance. Request a payroll software demo today!

Save Time with Stress-Free Payroll Solutions

Payroll doesn’t have to be complicated, but it does have to be right. Stay compliant, collect employee data, and streamline tax filing – all while putting time back in your day with our automated payroll software. With the assurance of an error-free workflow, you can get back to what matters most – your people. Learn how our modern solutions get you out of the tactical and back to focusing on the bigger picture.