resources

13 Must-Have Payroll Software Features

January 02, 2024

Payroll software is essential for navigating the modern-day workforce. These are the 13 features to look for in HR and payroll software.

Blog Post

Skip to end of table of contents

Before the introduction of payroll software, payroll was a tedious, labor-intensive, and error-prone process. Manual entry and incorrect documentation could lead to delayed employee payments — not to mention the headaches for HR and payroll practitioners.

The first payroll solutions were initially seen as a luxury, but organizations worldwide now recognize the importance of payroll accuracy and the need for automation software can deliver.

What Is Payroll Software?

Payroll management software automates and streamlines the process of paying your employees for their work. These programs calculate gross wages based on hours worked, calculate and deduct taxes and benefits premiums, and generate an ACH or direct deposit file. Most organizations with even a handful of employees use payroll management software.

What Are Some of the Most Important Payroll Goals and Objectives of the Payroll Process?

The most important objective of the payroll process is accurate and timely compensation for the work performed. If your organization is experiencing frequent payroll errors, the payroll process likely needs to be refined.

What Payroll System Features Should I Have?

It’s common to assume all payroll software features are the same. In fact, many business owners choose a payroll management software based on price alone under this assumption. Unfortunately, they often discover too late that it doesn’t meet the needs of the organization and lacks critical payroll functions.

When building the business case for payroll software and comparing solutions, take into consideration these key features of full-service payroll systems:

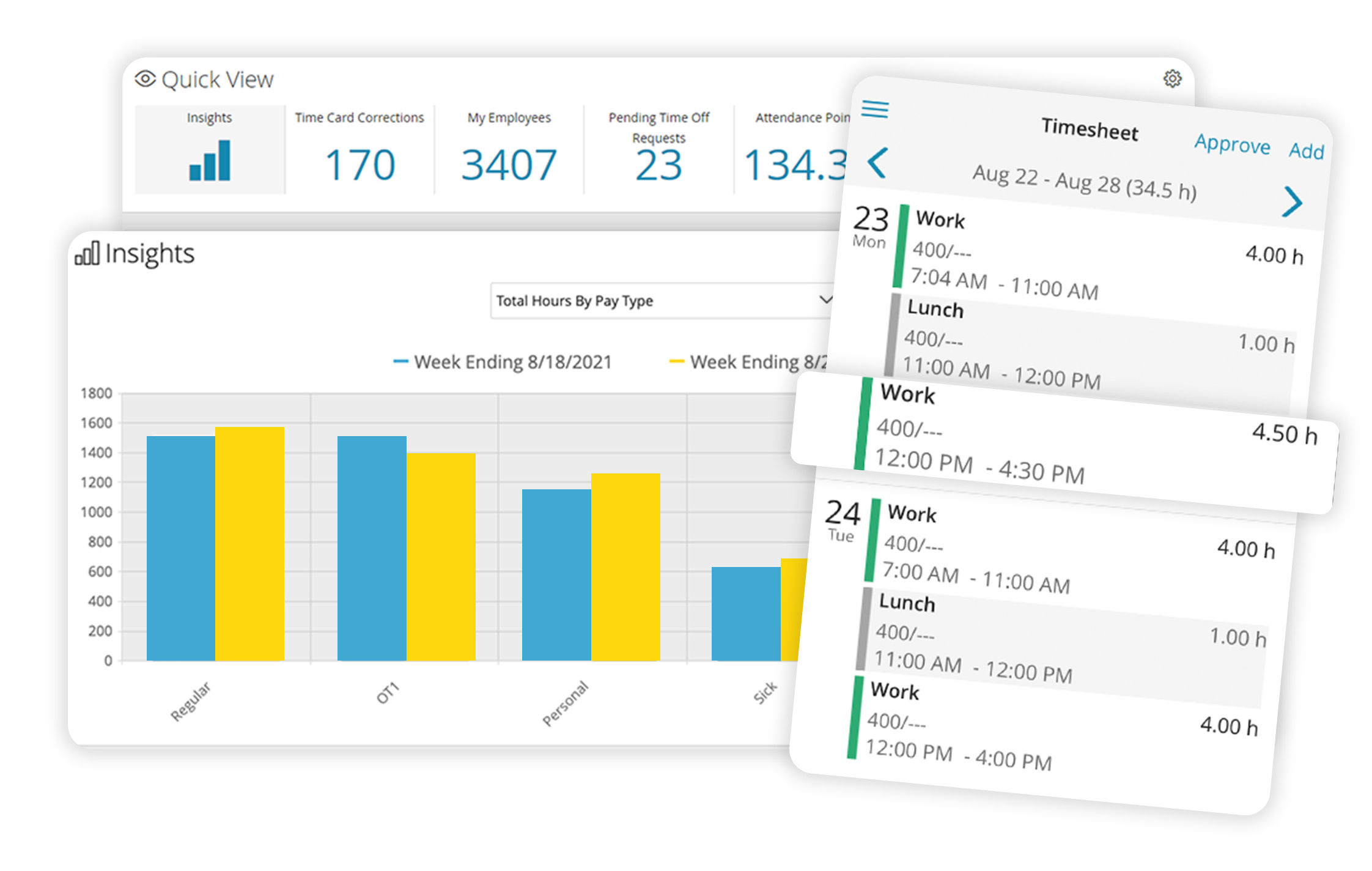

1. Time Tracking Integration

If you have hourly employees, you'll want to choose payroll software that offers a time tracking module or integrates with your time tracking software. This negates the need for manual entry, improving efficiency and accuracy overall.

2. Direct Deposit

Direct deposit is one of the single most important payroll software features to your employees and candidates. Employees and job-seekers expect instant, convenient access to their paychecks. It also reduces the burden on you, the employer, by eliminating the need to print and distribute paychecks.

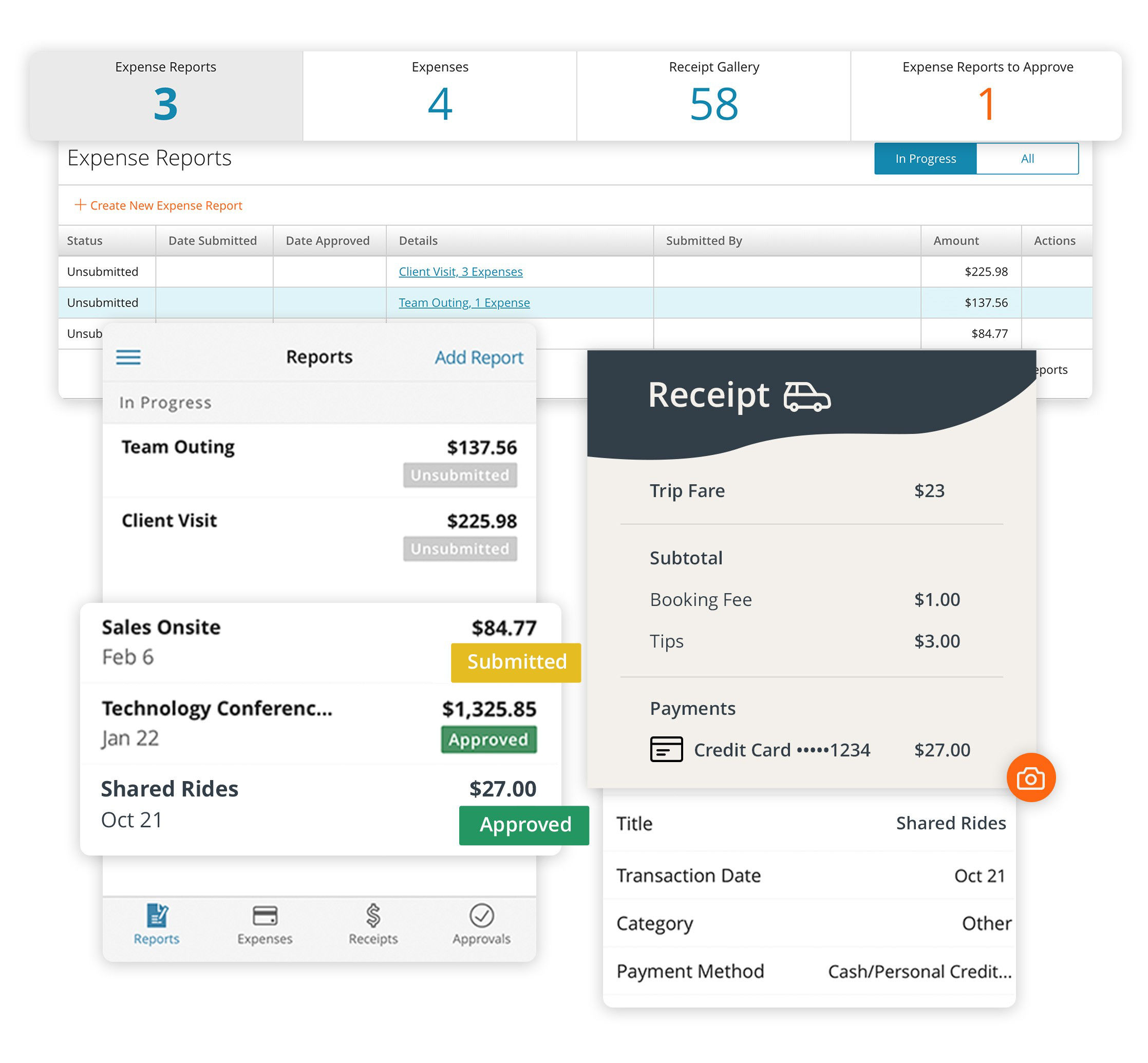

3. Expense Management

If your industry involves reimbursable employee expenses, like travel and lodging, then software with expense management capability is an absolute must. These solutions automate the expense report and payment processes, saving time and improving the timeliness of reimbursement. It also ensures records are accurate and easy to find when needed.

Read More: Guide to Employee Expense Reimbursement

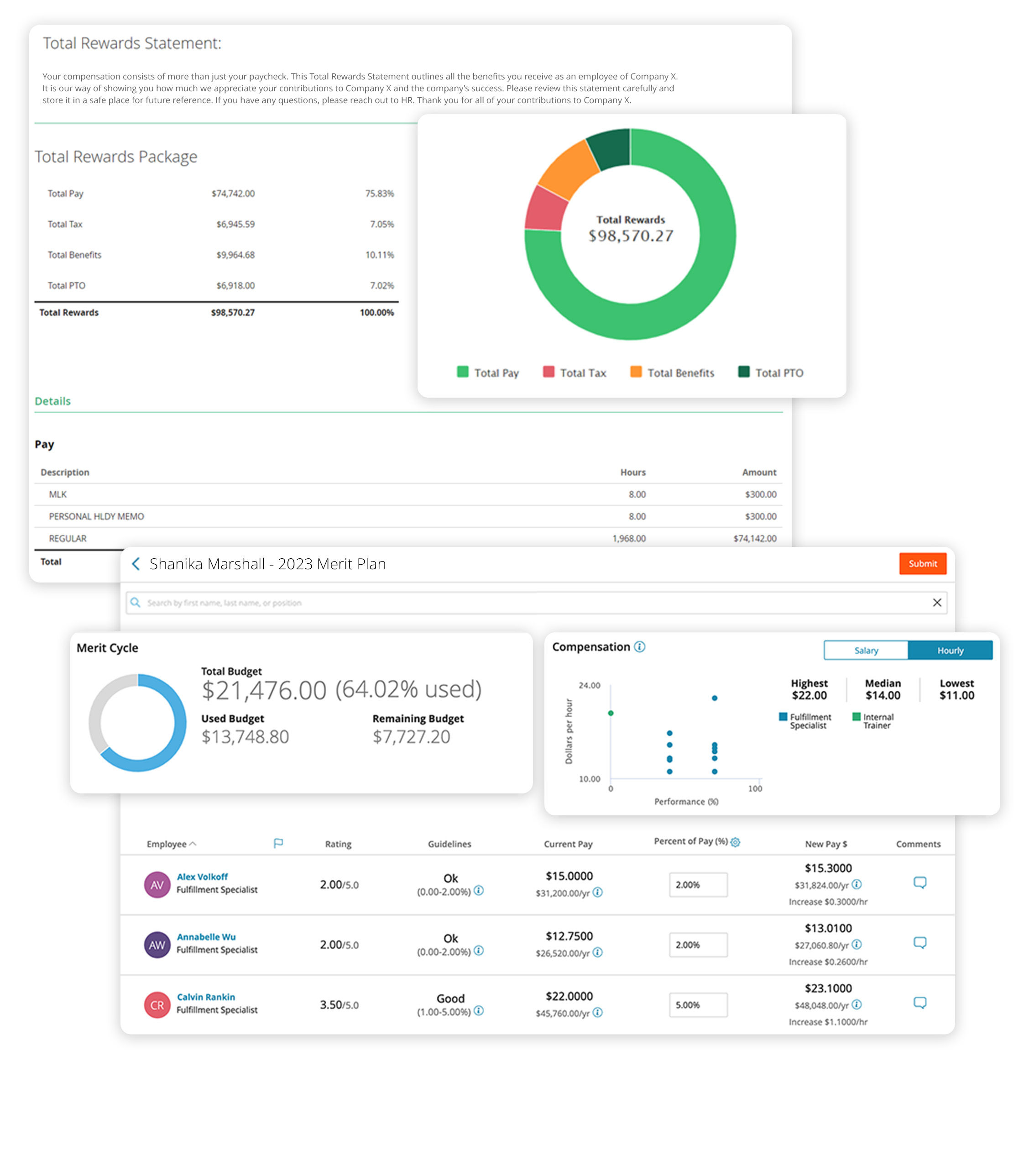

4. Compensation Management

Fair, competitive pay is table stakes in today’s war for the best talent. Compensation management tools help with managing and allocating a compensation budget that is in line with an organization’s larger goals.

This makes it easier to attract and retain workers in a cutthroat marketplace and strike the balance between rewarding your employees without compromising your organization’s bottom line.

Plus, with data insight capabilities, you can easily and efficiently make the case for merit increases, one-time bonus payments, cost of living increases, and more.

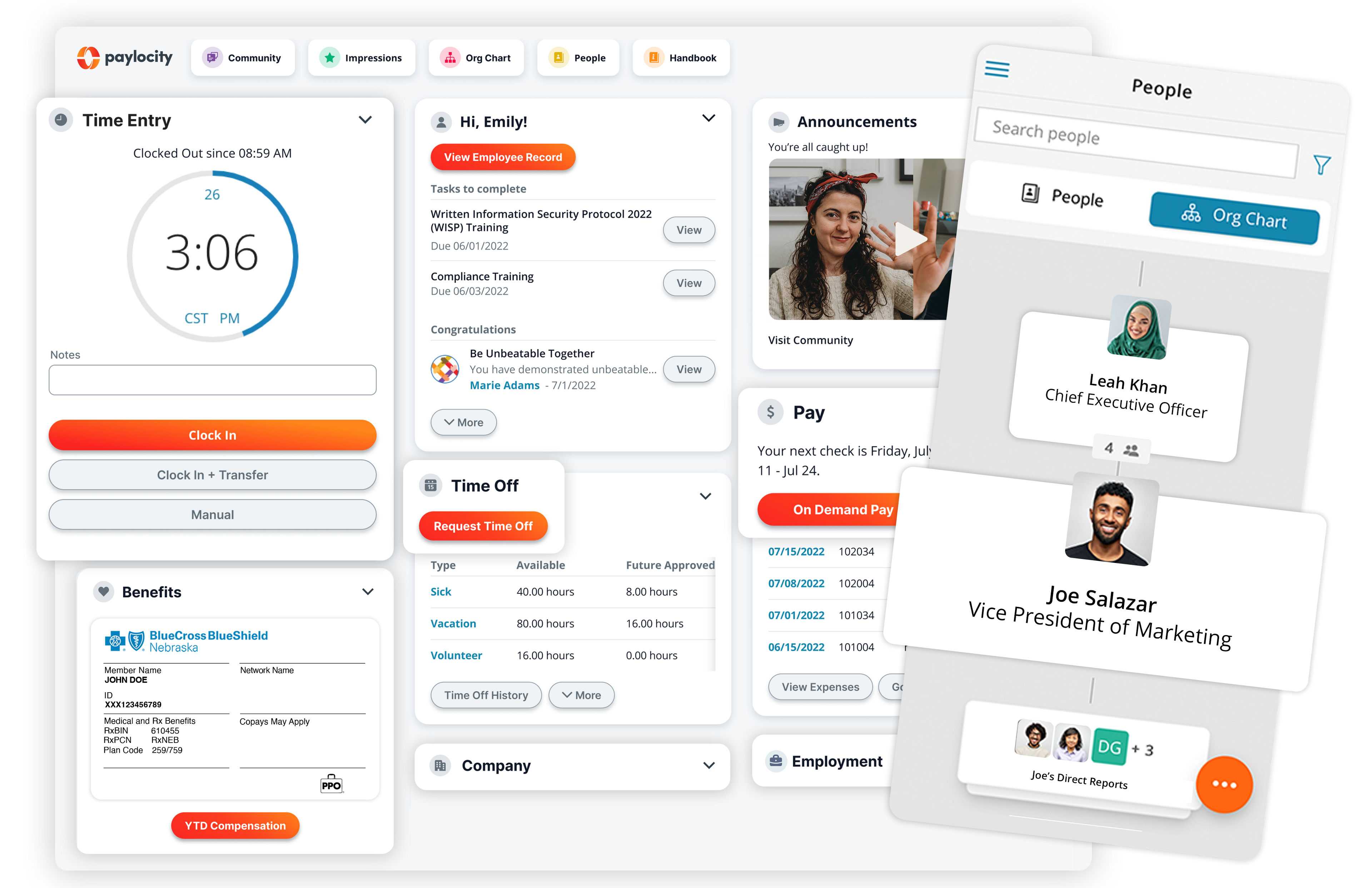

5. Employee Self-Service

Employee self-service offers two primary benefits. It gives employees access to make certain changes to their profile themselves (like their bank account number or home address), and it gives employees direct access to their vacation balances, pay stubs, and W-2 forms.

The result? Your HR crew spends time working on culture and accountability rather than clerical tasks.

Read More: What is Employee Self-Service (ESS)?

6. Payroll Reports

The ability to run payroll reports is critical — as is the ability to customize these reports. Payroll software should have out-of-the-box reports that can be set up quickly for easy insights.

However, every organization is unique, so also make sure your payroll platform can build customizable reports. Customizable reports give you the ability to create bespoke datasets around your company’s most critical metrics.

Ask what kind of reports you'll be able to run so you know whether you'll have access to the data you need before committing.

7. Payroll Auditing and Error Reporting

Payroll errors are costly. The best payroll software won’t be hands off — it will work to catch errors before they occur.

Look for software with built-in pre-submit audits that can proactively flag if something looks irregular, for instance a terminated employee being paid or someone receiving double their typical pay.

The system should also account for any changes that happen in the middle of a pay period, and correctly compensate with prorated or retro pay.

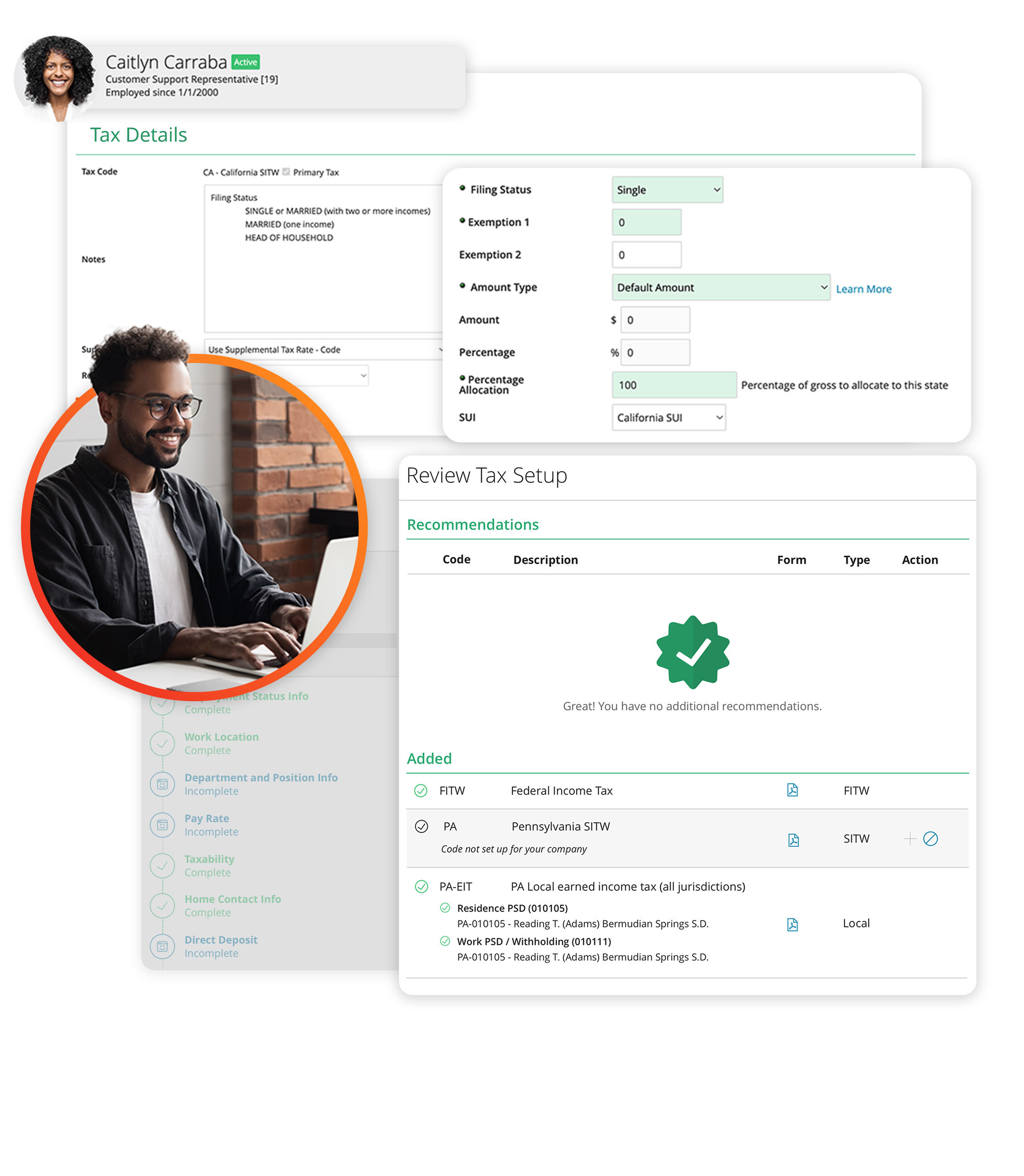

8. Tax Filing

The best payroll systems will have built-in tax tables that are automatically updated as tax rates change, taking the guesswork out of deductions, and streamline the tax filing process. Your payroll management software should automate tax filing and the generation of W-2s.

9. Integrated Payroll

In a landscape where no two businesses' tech stacks look the same, one constant is that no matter what size your organization is or what industry you’re in, you need payroll integrations that plug seamlessly into your unique ecosystem of existing programs, apps and partners — all while meeting the needs of your company and your workers.

Payroll integrations allow you to automate the flow of data to and from your HR and payroll platform. This way, you can leverage the systems you need without the hassle of disparate data, time-consuming management, or poor user experience.

In other words, you get a one-stop shop with one login. When it comes to HR and payroll software features, the ability to easily integrate new technology into your current platforms is a must.

10. General Ledger Mapping

Your general ledger is a critical tool for maintaining accurate financial records. And if you’re running payroll manually, logging your payroll expenses each pay period is a tedious process.

The best payroll platform will make the process of mapping activities, like earnings, deductions, and taxes, are represented in your general ledger seamlessly.

Look for a solution with self-serve functionality so you’re empowered to create and update the mapping to fit your organization’s unique accounting needs.

Once you have your bespoke account mapping built, the payroll platform will create journal entries for seamless transfer to your general ledger. And if your accounts change, no worries! You can update the mapping yourself without breaking a sweat.

11. Wage Garnishment

Managing garnishments can be complex, and when it comes to wage garnishment orders, compliance is imperative. Choose payroll software that includes garnishment management for the most accurate and efficient process.

Read More: What is Wage Garnishment? And How Does it Work?

12. Global Payroll

In today’s remote-friendly work landscape, organizations are no longer limited to hiring local talent. You can pick from the best of the bunch — on a global scale — and add highly skilled and experienced remote workers to your workforce with the right payroll software.

A global payroll solution can help you manage the complexities that come with employing international employees, including managing foreign currencies, time zones, and compliance requirements.

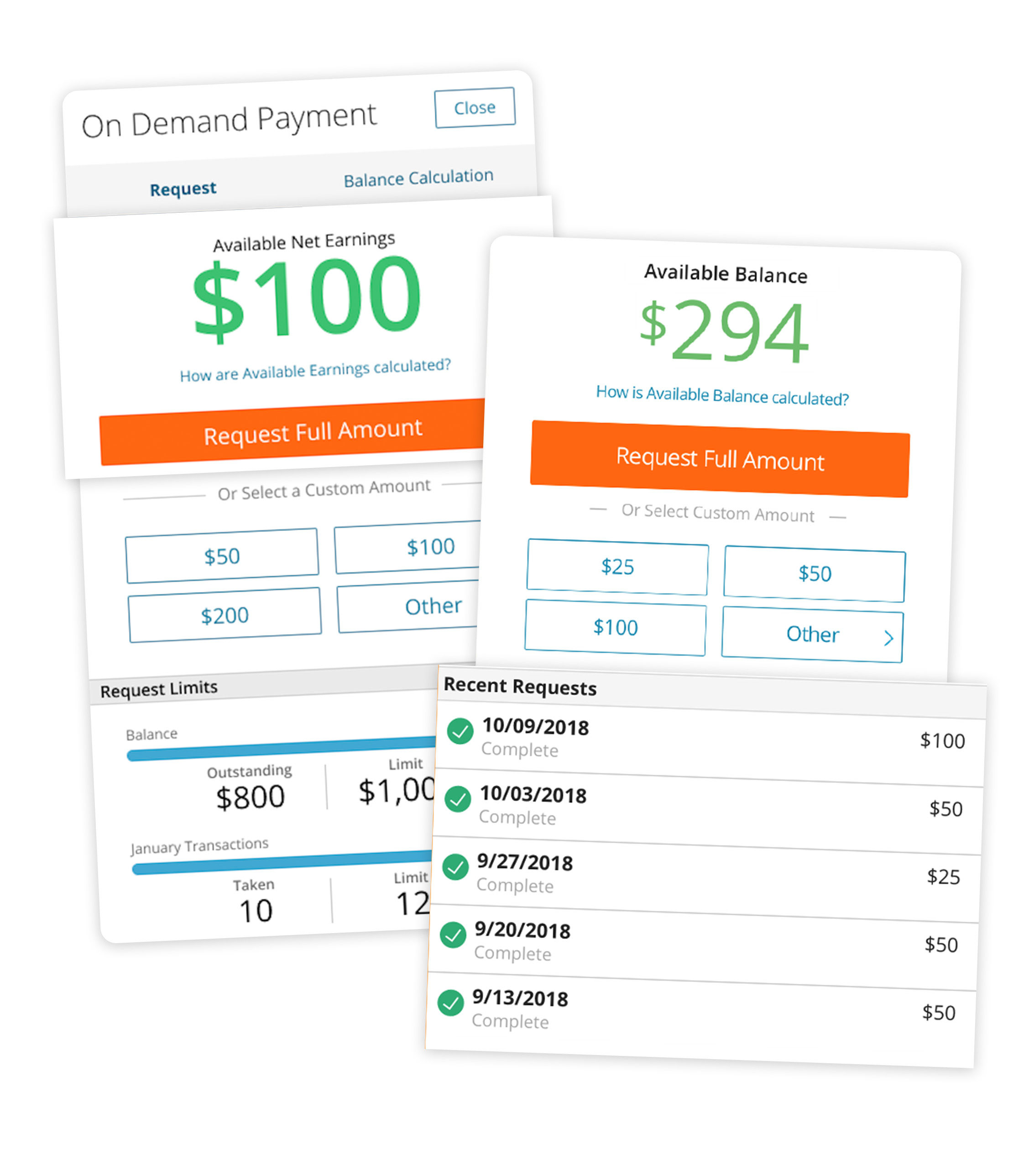

13. On Demand Payment

Payroll software can unlock modern payroll capabilities like On Demand Payment. This unique feature lets employees request a portion of their paycheck ahead of payday, so they can cover unexpected expenses or pay bills early.

Look for payroll software that makes it easy for employees to request payment on demand online or through a mobile app, without interrupting your normal payroll process.

The Benefits of a Payroll System

A payroll system offers many benefits, including:

- Streamlined payroll process for greater efficiency, which results in cost savings (fewer hours invested to achieve the same outcome).

- Improved accuracy and timeliness of paychecks. In fact, payroll mistakes are twice as likely in organizations that don't use a third-party solution.

- Simplified compliance with DOL standards, current and changing tax rates, and records retention laws.

- Better accessibility to important data presented in a meaningful and customizable way, driving more informed decisions.

- Support for business growth. Scaling requires automation and artificial intelligence.

Any organization with employees or independent contractors can benefit from full-service payroll software. Even a small business with one employee will likely find manual payroll to be inefficient and error-prone.

However, it's important to note most payroll vendors design their solution for clients that meet certain size criteria. For example, software designed for small business payroll might not be as cost-effective for large organizations with 1,000 or 10,000 employees.

How to Streamline and Automate Payroll

To automate your payroll, you’ll need a payroll system that provides the following key features to reduce errors and streamline processes:

- All essential payroll functions in one easy-to-use suite

- Automated workflows for faster and easier approval processes

- Self-service capabilities for employees to easily access and update their data

- Compliance dashboard baked into the platform

- Simple and customizable reporting solutions to make informed business decisions

Your time is precious, and the last thing you want to do is spend time digging for information — or chasing employees down for theirs.

The beauty of automated payroll management software is it makes it easy for you (and your employees) to access the information you need quickly and offers a number of time-saving benefits:

- Reduced processing time

- Improved accuracy and compliance

- Accurate, on-time payments

- Data consistency

- Easier tax compliance

- Better data security

Streamlining and automating payroll functions is one of the safest and most effective ways to save time and money, ensure your business is protected, and enhance the employee experience around HR and payroll functions.

How to Choose a Payroll Provider

When it comes to selection and implementation of a payroll solution, practice makes perfect. These tips can help you avoid common mistakes and make the right selection, whether it’s your first time or you’re making a payroll software switch.

- Engage shareholders early. Ask those involved in the process which payroll software features are important to them and invite them to demo different options prior to making a decision.

- Explore the support available once you implement the software. Will you have access to a tech support line? What’s the average ticket response time?

- Check out online reviews before making a commitment. Are their clients generally satisfied? Do they have a high BBB rating?

- Discuss any considerations unique to your business with the account manager to ensure the system can accommodate them. For example, do you have variable deductions like cafeteria charges? A per-piece compensation structure? Complex shift differentials? Those are important things to know in advance.

- Appoint a superuser and provide them with additional time to become proficient so they can serve as an expert and trainer for others within the organization.

Sometimes, businesses already have an HR and payroll solution in place but need to switch vendors to grow and succeed. If you find yourself in this position, fear not. Countless organizations have successfully shifted to new vendors, and you can too, by following our tips for switching payroll companies that make the transition easier and more efficient.

Download our Buyer’s Guide: Make a Stress-Free HR & Payroll Switch

Why Choose Paylocity's Payroll Software?

As you look for the right payroll processing solution for your business, you'll find that there is no shortage of options to consider. At Paylocity, we urge business owners and decision-makers to go back to their list of critical features. Compare each potential solution to that list before making a final decision.

Paylocity's HR and payroll software features check all the boxes:

- Time tracking

- Direct deposit

- Expense management

- Compensation management

- Employee self-service

- Payroll reporting

- Tax filing

- Payroll integrations

- Wage garnishment

Request a payroll software demo online today.