Nobody should feel like they are going through Benefits enrollment alone. Administrators need easy to use benefits administration software to manage employee enrollments and employees need straightforward user experience for reviewing and choosing plans.

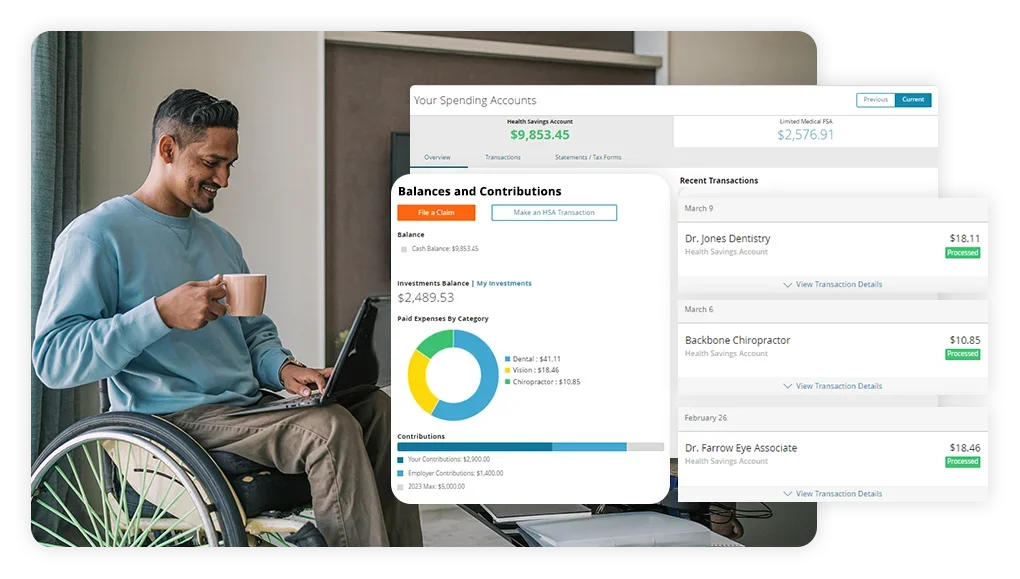

From mobile access to event notifications, reminders, and more, enrollment and day-to-day administration will be faster, smoother, and give you the confidence that you’re covered.