SAN FRANCISCO - Dec. 17, 2020 – Airbase, provider of the leading spend management platform, today released results from an exclusive survey of 745 finance professionals at small and midsize U.S. businesses that reveal the most important issues facing finance teams as they adjust to a post-COVID work landscape.

The Airbase Annual Survey of Finance Professionals, which posed questions to finance and accounting employees at companies across sectors and with between 50 and 1,000 employees, found that technology platforms have enabled finance teams to shift to working from home with relative ease. The survey also found that a lack of investment in advanced tools means finance teams still waste many hours each month on manual tasks such as bank account reconciliations, coding transactions to the general ledger, and making purchase requests.

Though working from home was relatively uncommon for finance teams prior to COVID-19, the survey found a mere 7% of respondents had difficulty adjusting to their new work-from-home environment, while only about one quarter (24%) expect to fully return to a traditional office after all stay-at-home restrictions are lifted.

Looking forward, finance and accounting professionals plan to invest in technology to support their Top 5 Priorities for 2021:

- Improve or change finance operations by adding new systems or processes (41%)

- Improve data security and privacy (34%)

- Automate accounting tasks (32%)

- Increase focus on financial planning and analysis (31%)

- Focus on real-time reporting and data analytics (30%)

Finance professionals are eager to optimize how they spend their time at work, whether that’s in an office or at home. Avoidable manual labor, in tasks such as reconciliations and documentation gathering, still occupies much of their time. More than one-third (38%) of respondents say they spend over 25% of their time on manual tasks, with 11% of teams spending over 50% of their time on manual work. What’s more, one in five finance and accounting teams spend most of the month closing the books. This is costly, in terms of both time and money, at a moment when efficiency is paramount for business success.

Unfortunately, aside from wasting time on manual processes, the majority of financial teams also report not having enough visibility or control over non-payroll spending, such as employee expenses and software subscriptions. Only 41% of respondents report having visibility into spend before it happens through strong pre-approval processes, and one in three estimate that more than 5% of their companies’ budgets are wasted on unnecessary, duplicative, or zombie spending.

Despite the immense difficulties posed by COVID-19, one of the most encouraging discoveries from the research is just how well companies met the adversity of 2020. Nearly three-quarters (71%) of companies expect to meet or exceed their revenue targets for the year. Just 29% of companies were below expected performance in 2020, and over half (54%) of them expect growth next year.

Airbase Founder and CEO Thejo Kote was not surprised by the survey results. He believes finance professionals now know what tools they’ll need to thrive in a post-COVID world. “When you’re growing your business — as 54% of respondents plan to in the next 12 months — keeping track of where money is being spent can be quite difficult,” said Kote. “For businesses to succeed after the pandemic subsides, it’s important they equip their finance teams with the right tools so they get full visibility into every penny spent outside of payroll and don’t waste time on inefficient manual processes.”

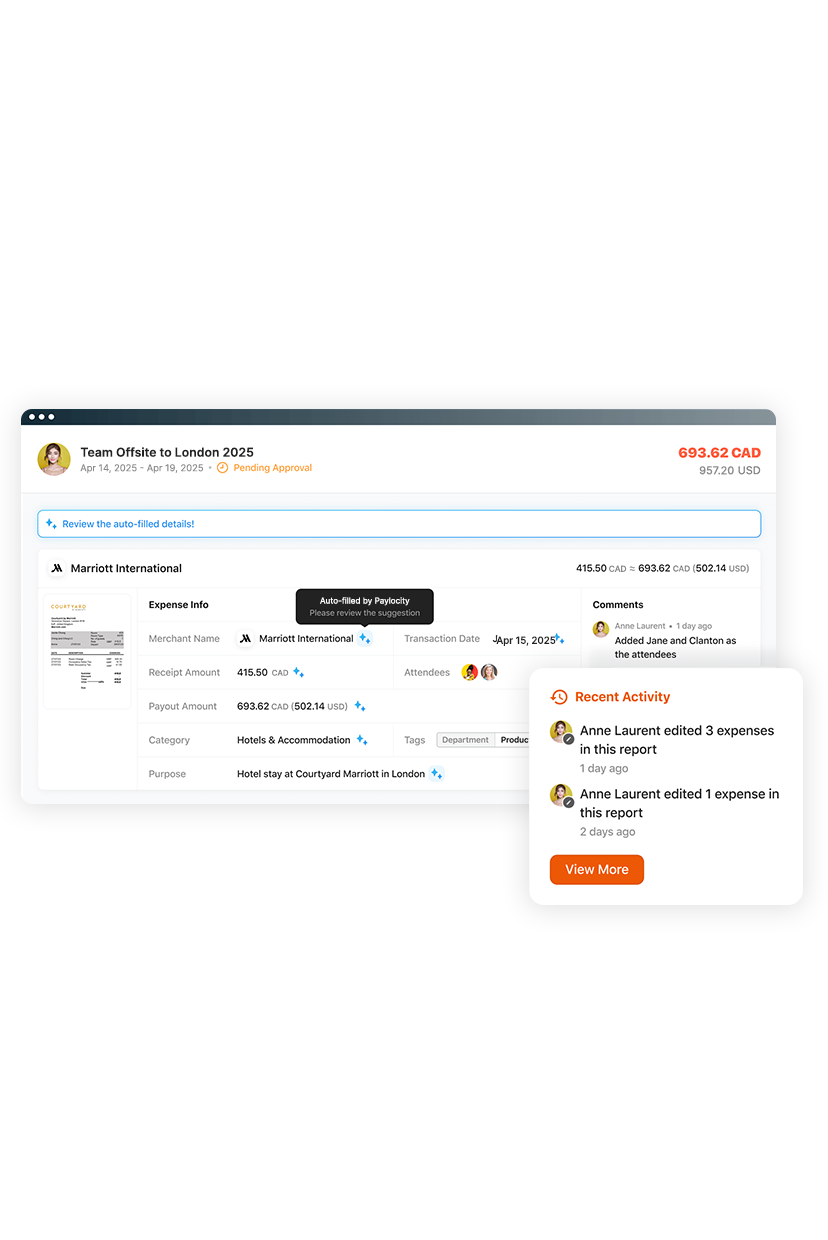

Airbase solves the problems of purchase requests, payments, and accounting together in a single integrated platform. This holistic approach lets Airbase offer control, visibility, and automation where other spend management tools can’t. Now finance teams can track and oversee exactly when, where, how, and by whom money is spent at a fraction of the effort. By offering new levels of control and visibility, Airbase frees up funds for mission-critical investments and enables sustainable, more predictable growth.