Creating Efficient Processes for Spend Management: Fundbox and Airbase by Paylocity

Key Takeaways

- Saved several days each month by automating receipt collection and reporting.

- Greater visibility and control over spending.

- Increased protection against fraud.

- Easy-to-use system for requests and approvals.

The Problem: Establishing consistent, efficient processes

Fundbox is a San Francisco-based startup on a mission to transform B2B payment flows. The company’s payment and credit network gives businesses cash advances against their outstanding invoices, helping them keep operations nimble with ready-access to capital when it’s needed.

As a fast-growing company, Fundbox sought to make its accounting processes more efficient to make it easier for their finance department to process increasing transaction volume and set up software-enabled workflows that would let the team handle future growth without adding more employees.

Tracking expenses correctly was a major obstacle. “Getting receipts from everyone was pretty difficult,” says Deirdre Mullen, Controller. “If someone left, if they had a recurring charge, it was hard to figure out how to cancel it.”

For Lori Rosenberg, Accounting Manager, repetitive activities like submitting expense reports were also time-consuming for employees, with corporate credit card holders spending “countless hours categorizing their expenses.”

Without a comprehensive tool like Airbase by Paylocity, Fundbox faced manual expense tracking and the inconvenience of chasing people at month-end close for receipts.

Helen Quang, Senior GL Accountant, sums up Fundbox’s situation: “We needed a product that would help us track expense owners, obtain receipts easier in case of an audit, and establish a built-in approval hierarchy.”

The Solution: Bringing Airbase by Paylocity on board

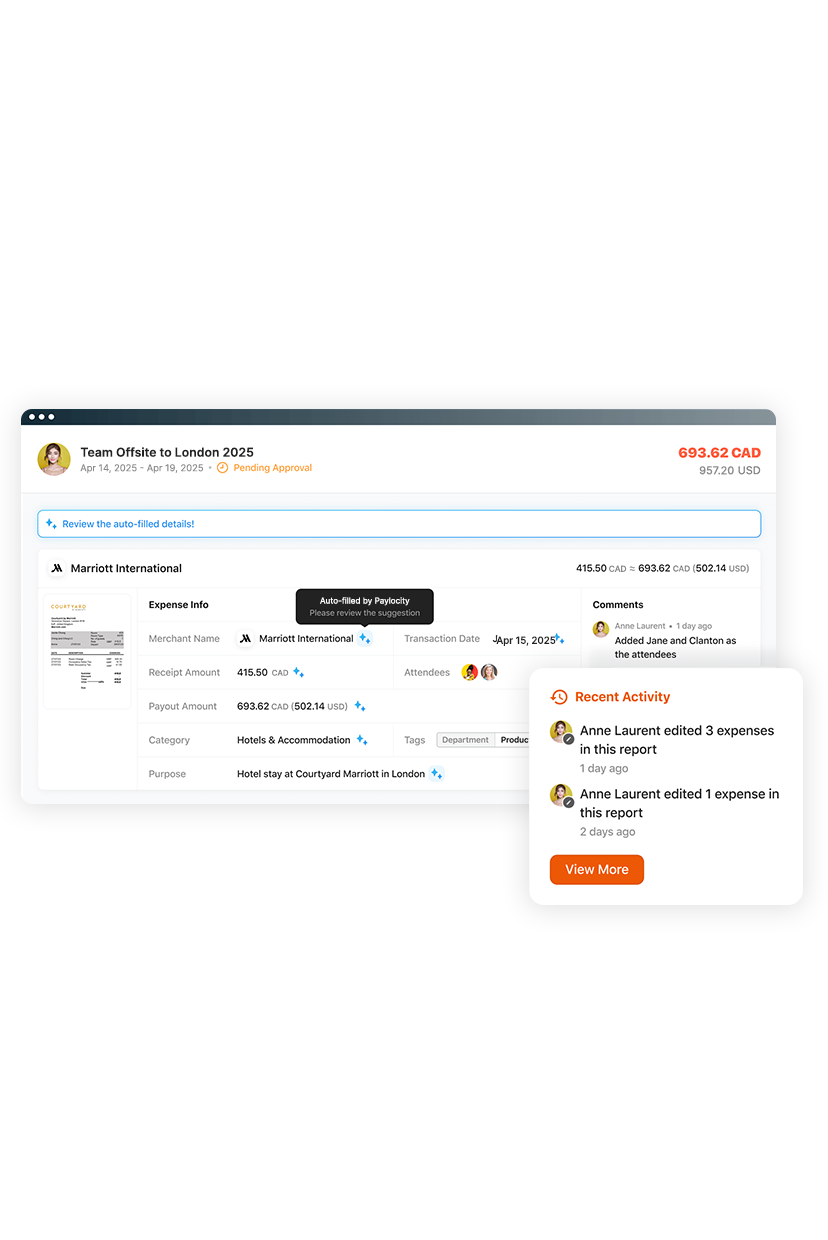

Features, accessibility, and customer service were all crucial for Fundbox when looking for a solution. Helen was drawn to Airbase by Paylocity because of its approvals system and automated routing.

Airbase by Paylocity worked closely with Fundbox to ensure a smooth implementation; collaborating on training sessions to make sure that employees understood the new process for requesting and approving spend.

“We decided to use Airbase because we had such a good experience with the team. We got great customer service during our trial. It’s a very easy product to use, so we haven’t had a ton of questions from our employees.”

Deirdre Mullen, ControllerEasy process for requests, approvals, and capturing receipts

Fundbox employees appreciate having a clear workflow to request spend and get it approved. According to Helen, it’s a change that has made life much easier for the team: “My employees really love Airbase. A lot of them have come up to me and told me, ‘This is an amazing platform.’”

The platform also makes it simple for users to view their own spend in real-time. “We have to follow a budget guideline and make sure that every charge falls within that budget,” Helen explains. “It’s helped keep employees accountable for their own charges and transactions and makes sure nothing falls through the cracks.”

One Airbase by Paylocity feature is a particularly big hit for Helen: notifying spend owners about missing receipts and prompting them to upload them. “We’ve saved one or two days a month trying to chase after individuals for their receipts. This has helped immensely.”

A better way to report

Fundbox’s Accounting Manager, Lori, noticed a faster and more accurate reporting process with Airbase by Paylocity. Previously, getting all of the accounting information in the right place meant connecting many disparate systems and doing a lot of manual work.

“We no longer have to go into Expensify to do the reporting, and because Airbase is updated in real time, we can sync through all the transactions into NetSuite without going into different platforms. This saves us about five hours a month.”

Lori, Accounting ManagerThe Results: Cutting costs and preventing fraud

In the past, Fundbox faced challenges with third-party fraud and lost cards, which was particularly tasking for Deirdre because she would have to get replacement cards and work with spend owners to update vendor payment information.

Airbase by Paylocity virtual cards have helped to secure Fundbox’s finances, mitigated the extra work caused by lost cards, and provided Deirdre’s team more precise control over spending.

The virtual cards have also given Fundbox more control over vendors. “Previously, if we stopped a subscription with a software, they could still keep charging us. Now, that’s not the case. Virtual cards are a lot easier for our staff, too, as they can send a request on Airbase and get a card number.”

Having greater visibility into company expenses, Deirdre is now better equipped to detect wasteful expenses and help the company spend in a smarter way.

“We’ve noticed that sometimes we have duplicate Spotify licenses for the office, or everyone is individually paying for one type of license, but we would get a much better rate with a group discount. It’s definitely helped save us money in some areas.”

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.