Corporate Card

Summary Definition: A type of company credit card assigned to certain roles, teams, or projects for various business expenses.

What is a Corporate Card?

A corporate card is a company-issued payment card that employees use to make approved business expenses for their organization. Unlike personal or small business credit cards, corporate cards are tied directly to the company’s corporate credit account, allowing for centralized billing, clearer oversight, and simplified expense management.

Corporate credit cards are typically used for travel expenses, procurement, and other operational costs, with built-in features like customizable spending limits, automated accounts payable integration, and access to rewards programs.

Key Takeaways

- Corporate cards give companies centralized control over employee spending, making tracking, managing, and enforcing policies across the organization easier.

- Understanding the different types of corporate credit cards is crucial for selecting the right one based on company size, liability preferences, and spending needs.

- While corporate credit card programs offer clear benefits like cash flow flexibility, automated expense management, and rewards, they also have stricter eligibility requirements and need dedicated oversight to be effective at scale.

What is the Difference Between a Corporate Card and a Business Card?

Although they seem similar, corporate cards and business credit cards serve different needs.

A corporate card is designed for larger organizations to centralize control over a large workforce’s business spending, usually via integrated expense management tools and set spending limits. Cards are issued based on corporate credit and financial strength, not the employee’s. As such, they typically come with additional eligibility requirements (e.g., minimum revenue, employee count, business credit score, etc.).

Business credit cards, conversely, are better suited for small business owners or sole proprietors. They often rely on the owner’s personal credit, which means the employee or owner is personally liable for charges made on the card.

In short, business credit cards are easier to obtain, but lack the built-in controls, reporting capabilities, and liability protections found in most corporate card programs.

How Do Corporate Credit Cards Work?

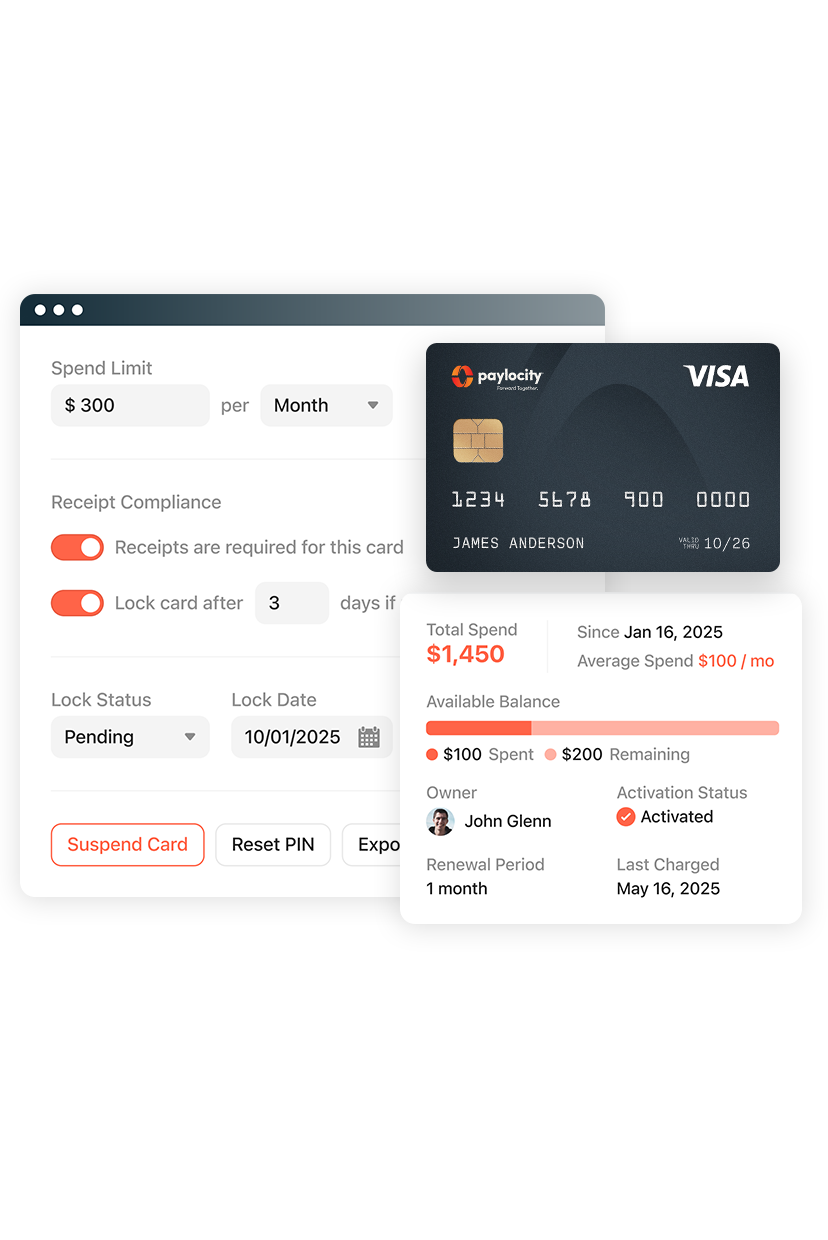

Instead of reimbursing employees for everyday out-of-pocket expenses (e.g., fuel, food, transportation, etc.), physical and virtual corporate cards charge the purchase directly to the organization’s corporate credit account. Moreover, cards and spending limits can be assigned by role, department, or project, instead of individual employees.

Different Types of Corporate Cards for Businesses

Before creating a corporate credit card policy or corporate card program, organizations should consider certain operational factors, such as their size, structure, and spending needs. Ultimately, the best corporate credit cards for an organization should balance these characteristics with various card features, rewards, etc.

| Card Type | Description | Best Uses |

|

Revolving Credit Card

|

Offers a revolving credit line with a month-to-month balance carryover

|

Managing large cash flow and high-volume expenses |

| Standard Charge Card | Requires full repayment each month | General, everyday expenses |

| Prepaid Card | Preloaded cards with a set amount of available funds | Projects or teams with fixed budgets or temporary workers |

| Virtual Card | Digital cards created for single purchases or online transactions | Secure vendor or service payments and remote employees |

Corporate Credit Card Benefits and Downsides

When implemented thoughtfully, the best corporate cards can transform how organizations handle purchasing, budgeting, and employee expenses. However, like any financial tool, they also come with limitations.

Company Credit Card Advantages

- Automated Expense Management: Many corporate card programs have dedicated corporate credit card expense management software or integrate with existing expense management software, streamlining everything from transaction tracking to receipt capture and monthly reconciliation.

- Improved Cash Flow and Payment Flexibility: Corporate cards consolidate payments and defer cash outlays, giving finance teams more flexibility to manage working capital and vendor cycles.

- Valuable Rewards and Incentives: Some corporate credit card programs offer cashback, points, or travel perks, adding value that can offset operational costs or be reinvested in the business.

- Stronger Compliance and Audit Readiness: Configurable approval flows and category restrictions help enforce corporate credit card policy guidelines, making audit preparation faster and easier.

Company Credit Card Disadvantages

- Qualification Barriers: Most corporate card issuers require businesses to meet certain criteria, such as minimum revenue, number of cardholders, or established credit history.

- Administrative Complexity at Scale: As programs grow, corporate credit card management can strain internal resources if not supported by the right tools.

- Potential Fees and Liabilities: Some cards come with annual fees, interest on unpaid balances, or liability implications if employee misuse isn't properly managed.