Corporate Card Reconciliation

Summary Definition: The systematic verification of company credit card transactions against internal financial documents to confirm expense legitimacy and proper classification.

What is Corporate Card Reconciliation?

Corporate card reconciliation is the process of verifying and aligning all transactions made using a company’s corporate credit cards with its internal financial records. This process helps ensure expenditures are recorded accurately, transparently, and consistently.

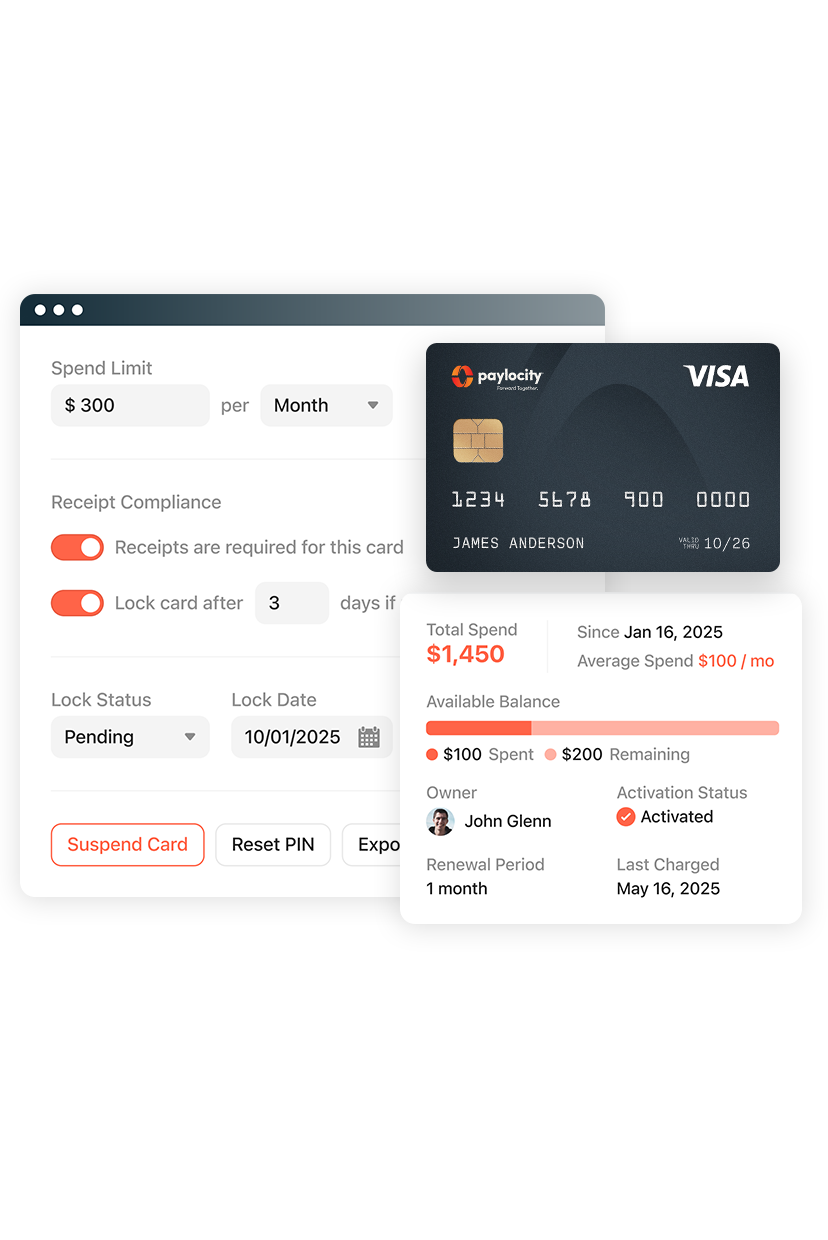

At its core, reconciliation bridges the gap between what’s spent and what’s accounted for. When implemented effectively, particularly through robust corporate card reconciliation software, it minimizes human error, uncovers anomalies, and provides clear visibility into spending behaviors across an organization.

Key Takeaways

- Corporate card reconciliation is the process of reviewing and verifying company credit card transactions to ensure they match internal records.

- Implementing automated reconciliation software streamlines the reconciliation processes, reduces errors, and enhances fraud detection and compliance.

- Following best practices, such as establishing a regular reconciliation cadence and involving cardholders in the reconciliation process, helps businesses maintain financial integrity and audit readiness.

Why is Corporate Card Reconciliation Important?

With the increased convenience of a corporate credit card also comes increased financial risk and complexity. Therefore, ensuring every transaction is accurately tracked and accounted for is essential to managing financial health.

For example, corporate cards are often used to make various purchases, including travel, subscriptions, vendor payments, and office needs. Without proper reconciliation, these charges may go unrecorded or misclassified, leading to uninformed financial decisions or budget forecasting.

Furthermore, the accessibility and frequent use of corporate credit cards make them vulnerable to intentional or accidental misuse. Reconciliation helps organizations spot suspicious activity early, such as duplicate charges, out-of-policy purchases, or unauthorized transactions, thus building safeguards against fraud.

Finally, many organizations require additional financial transparency due to compliance regulations. Agencies and stakeholders often expect regular reconciliation cycles as evidence of sound financial management. Keeping corporate card reconciliations timely and traceable helps such businesses meet documentation expectations and stay audit-ready.

How to Reconcile Corporate Credit Cards

Reconciliation is performed in one of two ways: manually or with automation through dedicated corporate credit card reconciliation software.

| Reconciliation Process | Concept Details |

| Manual |

|

| Automated |

|

While a manual process provides a granular, hands-on examination, it can be time-consuming, error-prone, and resource-intensive, especially for organizations with high transaction volumes or decentralized teams.

Implementing corporate card reconciliation software significantly reduces this manual workload, accelerates month-end closing cycles, and enhances overall accuracy, but may lack a sense of deeper familiarity with the data.

Corporate Card Reconciliation Best Practices

Whether an organization is implementing a new reconciliation process or optimizing an existing one, several best practices are available to strengthen process oversight and improve consistency.

- Maintain a Reconciliation Cadence: Conduct reconciliations weekly or monthly to catch issues early. Delays increase the likelihood of overlooked errors or unresolved anomalies.

- Standardize Procedures: Use a consistent format and workflow across all departments or locations. A repeatable process improves reliability and enables smoother onboarding for new team members.

- Centralize Documentation: Store all reconciliation records, including communications, investigations, and final approvals, in a secure, accessible platform to support audit readiness and historical analysis.

- Involve Cardholders: Have cardholders review their transaction summaries to verify legitimacy. This additional layer of review helps identify outliers and builds user accountability.

- Leverage Software-Enabled Cards: Many modern cards integrate directly with corporate card reconciliation software. These platforms automatically tag transactions with metadata, such as merchant names, expense categories, and project codes, thus reducing the need for manual data entry.

- Promptly Investigate Irregularities: Immediately address unusually large amounts, charges from unexpected vendors, or transactions outside business hours.

- Keep Discrepancy Records: Track how inconsistencies were resolved, including the findings, communications, and corrective actions. This creates transparency and ensures traceability during audits or internal reviews.