Expense Report

Summary Definition: A detailed record of an employee’s business-related expenditures that assists with reimbursement processing and financial compliance efforts.

What is an Expense Report?

Expense reports are detailed employee expenditure records for a specific period. They help businesses monitor spending trends, ensure proper reimbursement, and maintain regulatory compliance.

Modern expense report software helps businesses reduce administrative burdens, improve employee satisfaction, and avoid compliance violations or errors. For these reasons, many organizations partner with an expense management provider offering tools that can integrate with other finance or payroll services.

Expense Report Software Benefits

Businesses increasingly rely on digital expense report software to streamline and improve the reporting process. Said tools are designed to replace repetitive, manual tasks with automated systems that enhance precision while reducing administrative demand.

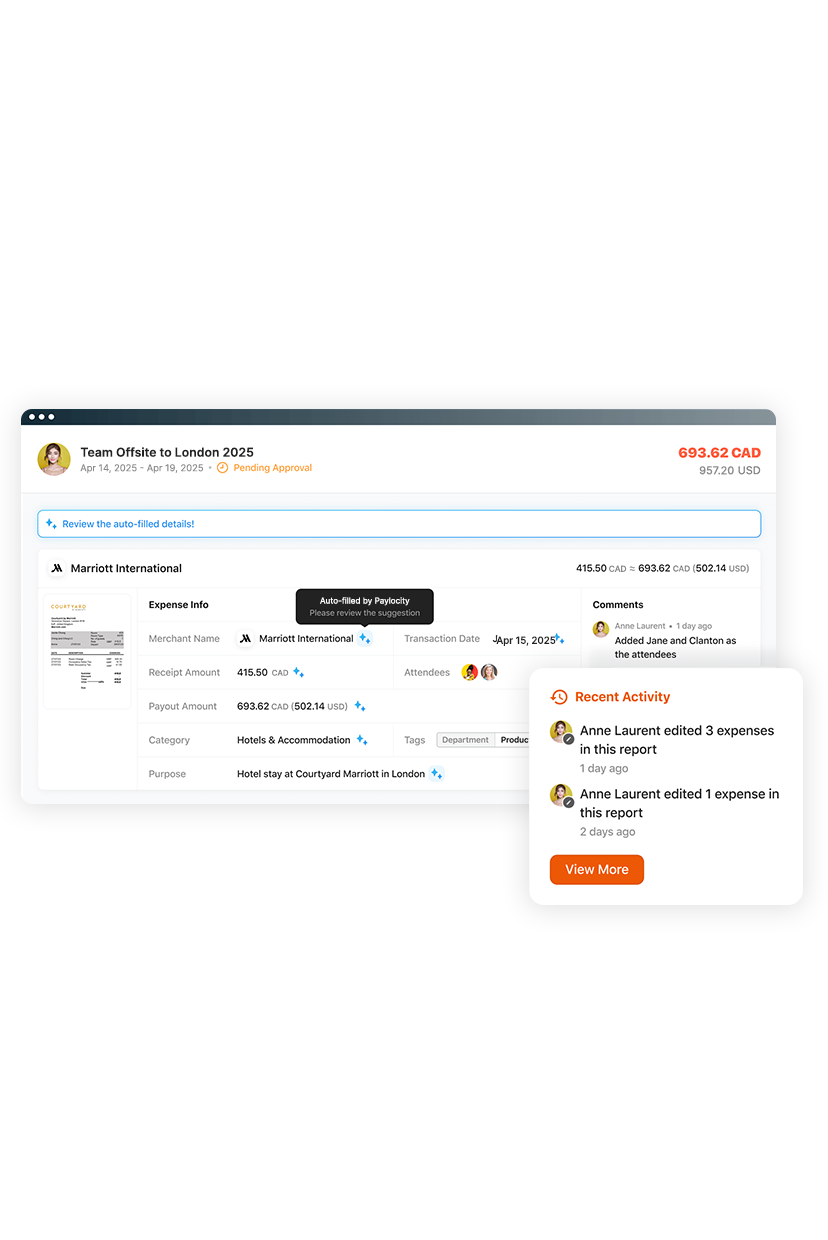

The primary benefit of using expense report programs is increased efficiency, as they eliminate process delays caused by human errors and communication gaps from manual entry. Furthermore, some tools include Optical Character Recognition (OCR) features that quickly capture necessary information from scanned documents, making reports more accurate.

Finally, many platforms are integrated with other accounting, finance, and payroll programs to provide businesses with seamless, comprehensive financial data, reporting, and insights.

Related Glossary Terms

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.