AI Expense Management: Automate, Simplify, Empower

Submitting an expense report — or processing a stack of them — rarely lands on anyone’s list of favorite tasks. Sorting receipts, decoding policies, and slogging through manual entries sap both morale and productivity. And on the other side of the reimbursement coin, finance professionals didn’t invest years in education and training so they could chase after receipts and explain expense policies repeatedly.

Enter AI expense management: a game-changing solution that uses the power of AI for expense tracking, reporting, and compliance, empowering employees and finance teams alike.

Keep reading to explore how AI expense management works, its benefits, and how the best platforms can transform your organization’s expense management.

Key Takeaways

- AI automates receipt capture, data entry, and coding, slashing admin time and eliminating manual mistakes.

- Advanced AI-powered systems actively flag spend-policy issues in real time and simplify audit preparation for finance teams.

- By removing tedious tasks from expense management, AI enables finance and HR professionals to make more valuable, forward-looking contributions.

What is AI Expense Management?

At its core, AI expense management is the use of AI to automate and optimize expense tracking, reporting, and compliance. Thanks to technologies like machine learning (ML) and optical character recognition (OCR), AI platforms streamline the entire expense lifecycle — from receipt capture to reimbursement.

Unlike traditional or many new automated systems, AI expense management tools actively learn from past data, improving accuracy and efficiency over time.

Why Expense Reporting Was Ready for Disruption

“I've used other programs where I just ended up paying for something because it was more difficult to expense it.” - G2 Review for Paylocity for Finance.

Why do so many employees delay expense reporting until the last minute or skip it altogether? The consequences go beyond the personal — missed reimbursements, inaccurate forecasts, and wasted hours add up, slowing organizational progress and sapping financial clarity. It’s impossible to get a real-time view of financials with so many delays and poor adoption of reimbursement processes.

A further hurdle for the finance team is time and energy spent manually reviewing receipts and cross-checking policy details. That time could be better spent on more strategic initiatives. Plus, having to act as the “policy police” can disrupt Finance’s relationship with other departments.

It’s no wonder an EY report, How AI can be leveraged for the finance function, identifies the opportunities in Finance.

“Perhaps no part of the enterprise has as many repetitive, routine tasks as the finance department,” states the report.

How AI Expense Management Technology Works

AI expense management platforms combine advanced technologies to deliver a seamless, touchless experience. Here’s a step-by-step view of how it elevates the process:

- Capture receipts instantly: Employees simply snap a photo of their receipt using the mobile app. They can also email it to a dedicated inbox or upload it directly.

- Automated data extraction: OCR extracts key details like vendor, date, and amount from the receipt.

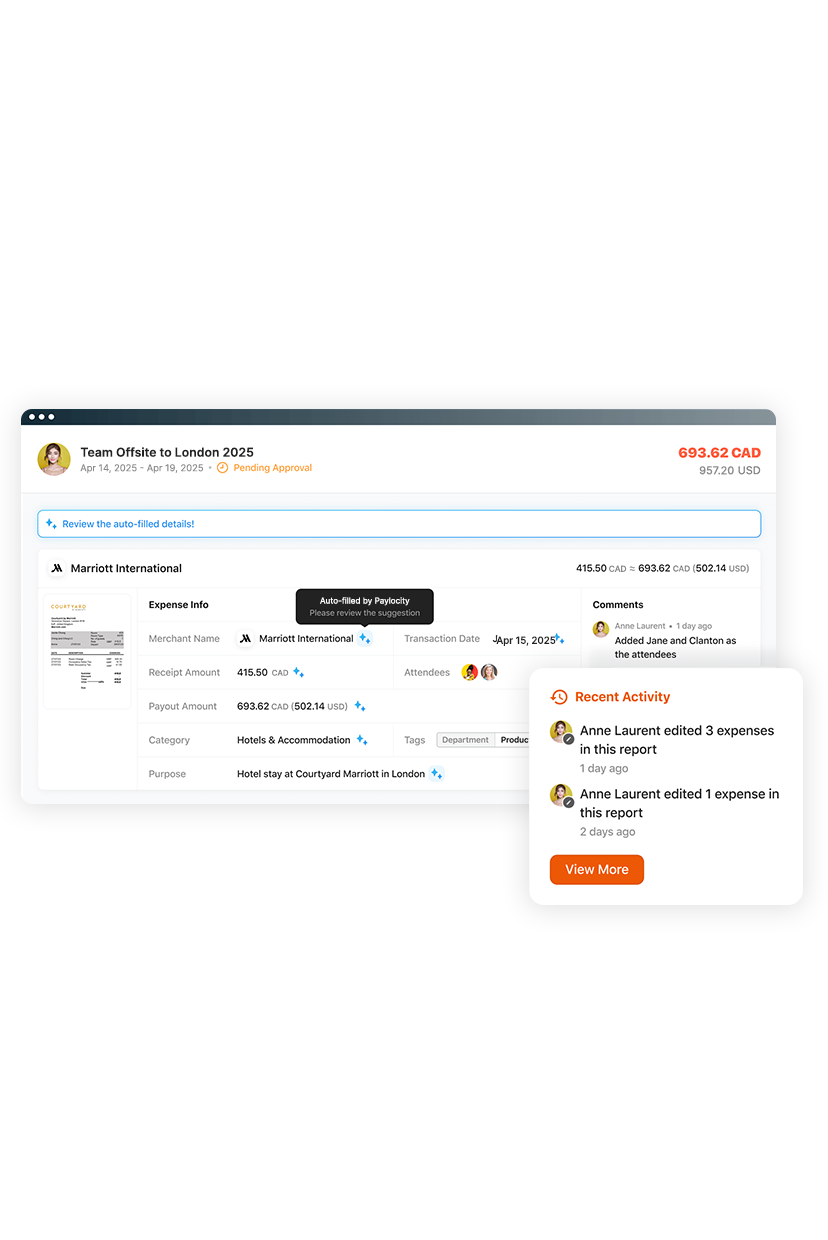

- Smart auto-fill: Generative AI auto-fills the expense report, including GL coding and memo fields, ensuring accuracy and compliance with company policies.

- Real-time policy enforcement: Built-in policy controls check the expense against company rules, flagging any non-compliant submissions instantly.

- Batch processing for multiple receipts: Employees can upload multiple receipts at once, and the platform processes them simultaneously, creating a consolidated report.

- Quick review and submission: Employees review the auto-filled details, make any necessary edits, and submit the report for approval.

- Streamlined approvals: Managers receive notifications to approve or reject the expense report, with all details and policy checks readily available.

- Automated reimbursement: Once approved, the platform initiates the reimbursement process, ensuring employees are paid back quickly and accurately.

- Direct payments: Funds are deposited directly into the employee’s bank account, based on information they provided.

- Audit-ready documentation: Every transaction is logged with a detailed audit trail, making compliance and audits easy.

Case Study: Transforming Employee Expense Experience

Arcadea Group wanted a good employee experience for expense management. Busy employees simply don’t have time for complicated expense processes, and management needs a quick view of approval requests.

By automating expense reports, Paylocity for Finance delivers exactly what they need to keep things running efficiently.

“We want to make any administrative work easy for employees so streamlining the expense process is really important. Employees can quickly scan the receipts, and the system automates the rest of the process. It helps the employee and helps the finance team,” says Shaun Teo, Director of Finance.

The Benefits of Automating with AI

Adopting AI expense management offers numerous advantages:

- Time savings: Automates data entry, coding, and reporting, freeing up employees and finance teams for strategic tasks. Employees simply snap a photo of a receipt; OCR swiftly extracts the critical information — date, vendor, amount — reducing time and error risk.

- Error reduction: Manual data entry is inherently error prone. Those misplaced decimals, mistyped vendor names, or incorrectly coded expenses can have far-reaching implications for both the employee and the company.

- Smart anomaly detection: AI constantly scans for duplicates, unusual purchase patterns, or out-of-policy claims, flagging potential issues before they become problems.

- Enhanced compliance: Enforces policies in real time and generates detailed audit trails.

- Improved employee experience: Simplifies the process, encouraging timely submissions and reducing frustration.

Addressing Risk and Security Concerns

While AI expense management offers unparalleled efficiency and accuracy, addressing security concerns is critical. These platforms handle sensitive financial data, including employee information, receipts, and payment details, so robust security measures are a top priority.

Advanced AI systems incorporate encryption protocols to safeguard data both in transit and at rest, ensuring it remains protected from unauthorized access. Compliance with data privacy regulations, like GDPR or CCPA, is another essential feature, ensuring organizations meet legal standards while maintaining transparency.

With the right security protocols in place, advanced AI systems play a significant role in preventing fraud by detecting anomalies and flagging suspicious transactions. Automated audit trails provide transparency and accountability, simplifying compliance reviews.

How to Choose an AI Expense Management Provider

When selecting an AI expense management solution, consider the following:

- Integration: Ensure the platform integrates seamlessly with your existing HR and finance systems.

- Ease of use: Look for intuitive tools that simplify the user experience.

- Customization: Choose a provider that allows you to tailor policies and workflows to your organization’s needs.

- Security features: Verify the platform meets industry standards for data protection and compliance.

- Consolidation: Streamline operations and get a unified view of all spend with a comprehensive HR and finance solution.

Implementing AI Expense Management at Your Organization

Implementing AI expense management is easier than you might think. Here’s how Paylocity simplifies the process:

- Onboarding and training: Our team provides hands-on support to ensure a smooth transition.

- Integration: Paylocity’s platform integrates with your existing systems for a unified experience.

- Customization: Tailor workflows, policies, and reporting to fit your organization’s unique needs.

- Ongoing support: Benefit from continuous updates and expert guidance to maximize ROI.

Unlock Your Team’s Full Potential with Paylocity

By automating routine tasks, Paylocity’s AI expense management platform empowers your teams to focus on what matters most: driving strategic growth and supporting employees.

With features like real-time policy enforcement, automated reporting, and audit-ready documentation, Paylocity streamlines operations and enhances compliance.

Ready to transform your organization’s expense management? Request a meeting today to learn more about our AI-powered solutions.

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.