Expense Management Automation: A Game-Changer for HR

Picture this: HR receives another email from an employee asking about their delayed reimbursement for a new wellness program. Meanwhile, the finance team is drowning in paper receipts, chasing missing documentation, and manually entering data from handwritten reimbursement requests. The wellness program is starting to feel like a source of stress — the exact opposite of HR’s intention.

Sound familiar? This scenario plays out in many organizations, creating friction between departments and frustrating employees who simply want to be reimbursed, whether it’s for a wellness stipend, travel expenses, or office supplies.

Manual expense management undermines employee trust and creates unnecessary administrative work. Now, HR departments have a unique opportunity to transform this process by championing AI-driven, paperless expense management that puts employees first while streamlining operations for everyone.

Let’s explore how HR can use expense management automation to empower employees, reduce administrative overhead, and strengthen workplace satisfaction.

Key Takeaways

- Manual expense processes erode employee trust and morale by causing delays, complex submissions, and cash flow strain.

- AI-driven expense automation eliminates errors, enforces compliance, and speeds up reimbursements through OCR and real-time policy checks.

- Automation frees HR and finance to focus on strategic work while improving spending visibility and employee satisfaction.

Common Challenges with Expense Management: HR’s Perspective

Manual expense management creates a cascade of problems HR has to deal with. When employees repeatedly face delayed reimbursements or complicated submission processes, it affects their perception of the organization and their willingness to incur business expenses.

Delays can also impact morale and employee wellbeing. According to a PYMTS.com report on reimbursements, almost 40% of employees who use their own money for business expenses and then submit expenses have experienced personal cash flow issues due to delays in reimbursement processing.

Meanwhile, HR and finance teams juggle follow-up calls, missing documentation, and error corrections.

Learn More: Guide to Employee Expense Reimbursement

What is Expense Management Automation?

Expense management automation transforms the traditional expense reporting process by using technology to handle routine tasks automatically.

At its core, automated expense reports use optical character recognition (OCR), artificial intelligence, and machine learning to extract data from receipts, populate expense reports, and enforce company policies in real-time.

Modern automation platforms integrate multiple technologies to create seamless workflows.

- OCR technology reads receipt information.

- Generative AI automatically fills expense reports with accurate vendor details, dates, and amounts.

- Smart algorithms cross-reference submissions against company policies, flagging non-compliant expenses before they reach the approval stage.

Manual vs. Automated Expense Management

The difference between manual and automated approaches is clear:

| Manual Process | Automated Process |

| Employees collect paper receipts | Employees capture receipts via mobile app |

| Manual data entry into expense reports | Automatic data extraction and report population |

| Email or paper submission to managers | Real-time policy enforcement |

| Time-consuming review and approval with complex or uncertain approval chains | Streamlined digital approvals that automatically route to the correct stakeholder |

| Manual reimbursement processing | Automated reimbursement processing |

| Frequent follow-ups for missing information | Complete audit trail maintenance |

The Benefits of Expense Management Automation

HR departments that champion automating expense reports see immediate improvements across multiple areas:

1. Enhanced Employee Experience

Automation eliminates the most frustrating aspects of expense reporting. Employees can submit expenses instantly using their phones, receive immediate policy feedback, and get reimbursed faster. This improved experience translates to higher employee satisfaction and fewer HR inquiries.

2. Increased Accuracy and Compliance

One in five expense reports contains an error, and it costs an average of $52 to correct just a single expense report, according to The Global Business Travel Association.

Automated systems virtually eliminate data entry errors and ensure consistent policy enforcement. Real-time policy checks prevent non-compliant submissions from entering the approval workflow, reducing the need for corrections and follow-ups.

3. Time Savings for HR and Finance

HR teams spend less time fielding expense-related questions, while finance teams process reimbursements more efficiently with pre-approved, complete submissions (no more receipt chasing!).

4. Better Cost Control and Visibility

Automated systems provide real-time spending visibility, enabling proactive budget management and identifying spending patterns that manual processes often miss.

This data empowers HR to make more informed decisions about expense policies and employee benefits.

Case Study: Transforming Employee Expense Experience

Arcadea Group wanted a good employee experience for expense management. Busy employees simply don’t have time for complicated expense processes, and management needs a quick view of approval requests.

By automating expense reports, Paylocity for Finance delivers exactly what they need to keep things running efficiently.

“We want to make any administrative work easy for employees so streamlining the expense process is really important. Employees can quickly scan the receipts, and the system automates the rest of the process. It helps the employee and helps the finance team,” says Shaun Teo, Director of Finance.

How To Automate Expense Management

Successfully implementing expense management automation requires strategic planning and HR leadership:

Choose the Right Provider

Evaluate platforms based on user experience, integration capabilities, and policy flexibility. The best solutions offer intuitive mobile apps, robust reporting features, and seamless integration with existing HR and payroll systems.

Configure Expense Policies and Workflows

Work with finance and legal teams to define expense policies, creating clear, enforceable rules that the system can apply automatically. Design approval workflows that reflect your organizational structure while minimizing bottlenecks.

Provide Comprehensive Training

Invest in thorough training for both employees and managers. Focus on mobile app usage, policy understanding, and approval processes. Well-trained users achieve higher adoption rates and fewer support requests.

Monitor and Optimize

Use system analytics to identify friction points and optimize opportunities.

Regular review ensures the system continues meeting employee needs while supporting organizational goals.

Key Features of Expense Automation Software

When evaluating expense automation platforms, HR should prioritize these essential capabilities:

Mobile Receipt Capture

- Receipt scanning for paperless expense management

Intelligent Data Extraction

- OCR technology for automatic data reading

- AI-powered vendor and category recognition

- Integration with credit card transactions

Policy Enforcement

- Real-time compliance checking

- Configurable spending limits and categories

- Automatic flagging of policy violations

Streamlined Approvals

- Automated, customizable approval workflows

- Mobile manager notifications

- Escalation rules for delayed approvals

- Ability to identify slow approvers who create bottlenecks

Automated Expense Reports

- One-click expense report generation

- Batch processing for multiple receipts

Integration Capabilities

- Seamless payroll system connectivity

- ERP and accounting software integration

- Single sign-on compatibility

Audit Trail Maintenance

- Complete transaction documentation

- Compliance-ready reporting

- Automated record retention

- Automated receipt enforcement

Advanced Automation: The Paylocity Advantage

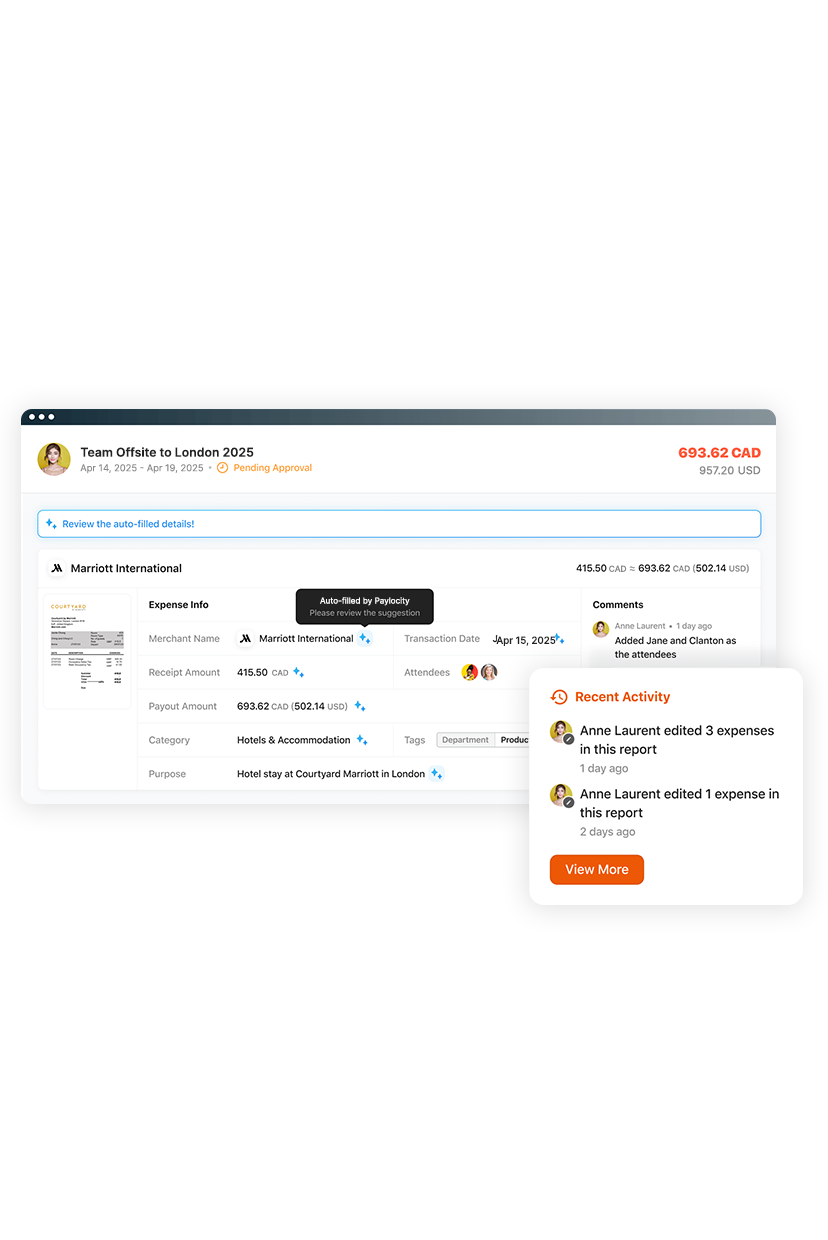

Paylocity for Finance represents the next evolution in expense management automation, combining robust OCR with generative AI to create an intuitive user experience:

- Instant receipt processing: Employees simply photograph receipts using the mobile app, email them to a dedicated inbox, or upload directly.

- Smart data extraction: Advanced OCR technology extracts vendor information, dates, and amounts while generative AI auto-fills expense reports, including GL coding and memo fields.

- Intelligent policy enforcement: Built-in controls check expenses against company policies in real-time, instantly flagging non-compliant submissions before they enter the approval workflow.

- Batch processing: Employees can upload multiple receipts simultaneously, with the platform processing them concurrently to create a consolidated report.

- Streamlined approvals: Managers receive instant notifications with all necessary details and policy checks readily available, enabling quick, informed decisions.

- Automated reimbursement: Approved expenses trigger automatic reimbursement processing with direct bank account deposits based on stored employee information.

- Audit-ready documentation: Every transaction maintains a detailed audit trail, ensuring compliance and simplifying audit processes.

Empowering Employees Through Smart Automation

By focusing on user-friendly technology that eliminates administrative friction, HR can transform a traditionally painful process into a competitive advantage for talent attraction and retention.

Expense management automation can play a role in empowering employees to focus on their core responsibilities by ensuring accurate, compliant, and timely reimbursement. For HR leaders ready to make a lasting impact on employee satisfaction, automating expense reports will make an impact.

Discover how Paylocity can transform your expense management — contact us today!

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.