1. Platform Capabilities:

Do our individual siloed solutions cost us more than a single consolidated one?

Many of the standard AP and expense management software become increasingly expensive as a company grows and needs to purchase additional seats. What was once “free” is starting to cost significantly more. It is worth considering how today’s costs and anticipated future costs compare to a single-platform solution.

2. Depth of Features:

Does our system support expanding budget and analysis operations?

Real-time data, adjustable spend budgets, readily available interim reports, and comprehensive reporting across all payment types mean your teams and stakeholders can access the relevant data as they need it.

Does our system support expansion into new countries or developing subsidiaries?

Paylocity for Finance supports payments in 145 currencies at a fraction of the cost of other foreign currency payment choices. With multi-subsidiary, and multi-national capabilities, Paylocity is not just for the here-and-now.

3. Flexibility:

Are we happy with our software stack or is it time to rebuild?

Paylocity for Finance's multi-tier platform packages can offer you what you need, when you need it, based on your budget. Reflecting on cost and ROI, and asking whether your software stack facilitates the functions you need as you grow (e.g., moving functions in-house) is important at this stage of growth.

4. Integrations:

As headcount grows, can I automatically provision (and deprovision) new hires to my spend management system?

Paylocity for Finance integrates with your HRIS for automatic provisioning and deprovisioning.

As my company grows in size and complexity, such that we will need to migrate to an ERP, will my spend management system easily integrate into the new system?

Paylocity for Finance integrates with Oracle Netsuite, Sage Intacct, and all other ERPs, and is designed to transition from basic GL to ERP with ease.

Day-to-day, what integrations are available with Paylocity for Finance to make using our system easier?

Managing expenses and HCM on Paylocity's consolidated platform reduces manual tasks and keeps all your data in sync, so you can focus on what matters most.

5. Scalability:

Can our spend management system help us as we build out FP&A features?

With accrual projection capabilities, as well as real-time reporting, there are a number of ways Paylocity for Finance can help you obtain the data you need for expanding FP&A.

Are purchase orders starting to play an increasing role in our operations and can our system incorporate them?

Paylocity for Finance has extensive scope for purchase order functionality, handling any increased volume with ease. POs can be numbered in correspondence with the GL they’re linked to (if you have more than one), categorized, commented on, requested by employees directly, and so on.

6. User Experience

Are we moving any functions in-house and, if so, is it going to destabilize our system?

A comprehensive spend management system, such as Paylocity for Finance, should be versatile in how both internal and external stakeholders, and outsourced functions can collaborate. When moving functions in-house, you’ll find the settings and functions you need waiting for you — so that reconciling previous data and processes is made easy.

Are the policies and processes around spend that we’ve employed working?

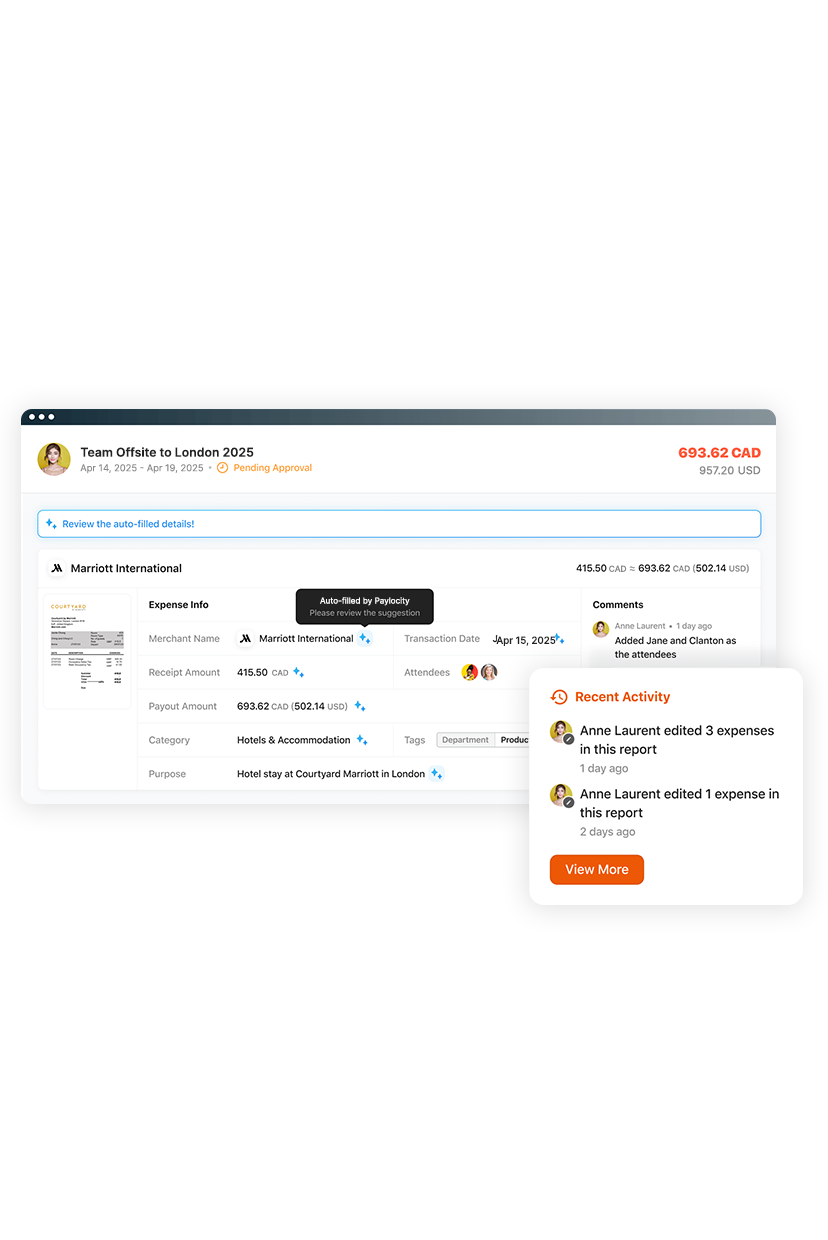

Paylocity for Finance offers adjustable spend limits, comprehensive approval workflows, and auto-categorization of spend, so your finance and management teams can quickly evaluate and control the spend that happens and its compliance with internal policy.