Speakers

1099 Prep: What You Need to Know for 2024!

It’s that time of the year again. You’ve got year-end tax prep and the 1099 submission deadline looming. We’ll look at the reporting requirements, some important changes to federal and state 1099 reporting, and potential impacts on your company. With the help of tax expert Rebecca Colman from SOAProjects, we’ll identify areas of focus for year-end, including what you need to know to crush 1099 reporting.

Paylocity for Finance and Avalara will introduce you to ways you can automate W-9 collection, tax ID verification, reporting, and tax filing. You’ll also have an opportunity to ask your questions of the experts.

Key Takeaways:

- 1099 FAQs — the information you need and how to proactively prepare.

- An overview of changes to state and federal 1099 requirements that might impact your planning.

- Automation tools to ease the process.

- What to do if you get it wrong.

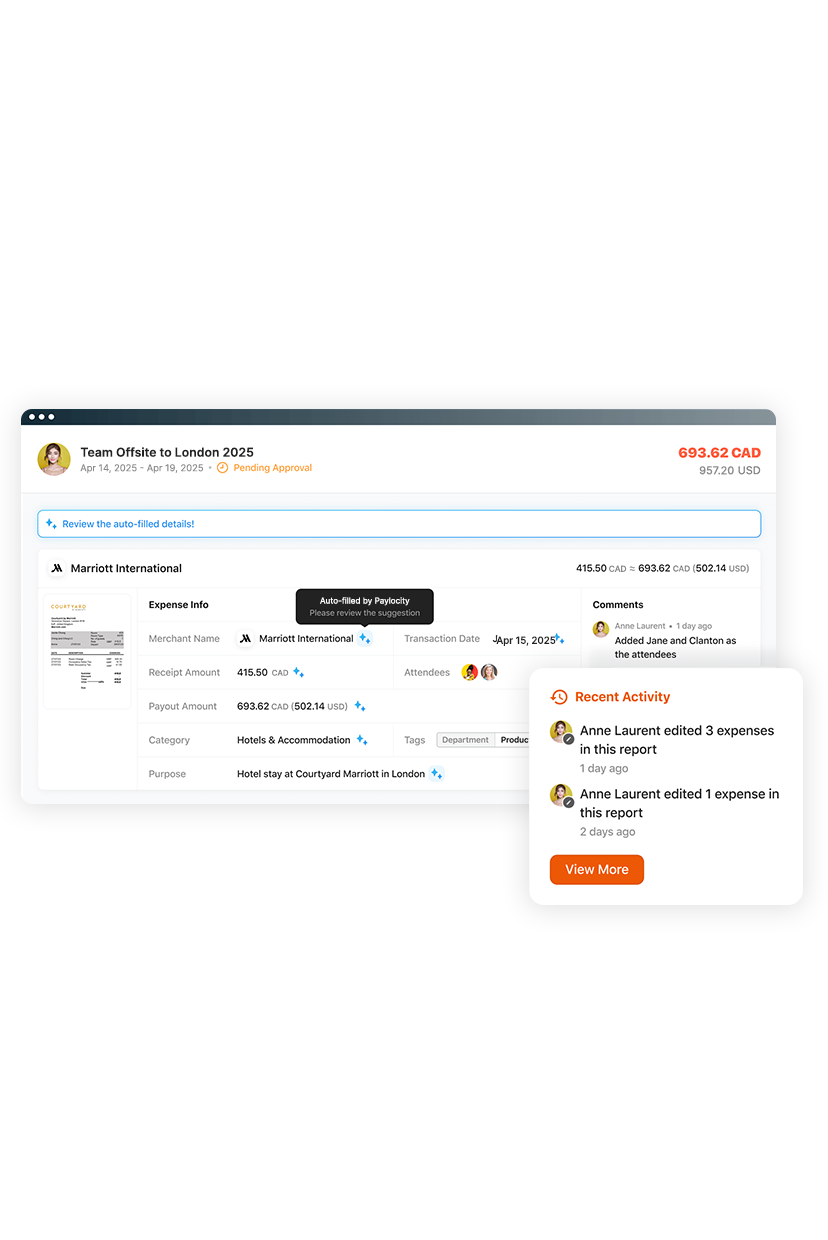

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.

?$Hero-Card$)