This case study was written before Paylocity acquired Airbase. The key insights, processes, and outcomes highlighted are still applicable to Paylocity for Finance.

Aspire Improves Accounting Operations with Spend Management

Aspire is a community intelligence marketing platform built for advocacy. It was founded in 2013 to help companies use the power of influencers to build their brands.

Dmitri Litin, Former Controller at Aspire, was looking for a platform solution to solve his spend management problem. Unlike many Airbase by Paylocity customers who start off seeking solutions to specific spend management challenges, such as corporate cards, expense reporting, or AP, Dmitri was in the market for a comprehensive spend management system with the broader goal of making life easier for the Aspire finance team and, ultimately, the entire company.

As he considered the alternatives, he wanted to make sure that the platform he selected improved performance without any hidden future financial costs or additional work, disruption, or friction anywhere in the company. His comprehensive evaluation matrix led him to Airbase by Paylocity.

The results show measurable success. It was taking the small finance team 21 days to close their books each month and Dmitri knew that, with the right tools, they could do much better. His efforts have paid off; the improved operational efficiency experienced with Airbase by Paylocity has cut that time-to-close in half. He also estimates that Aspire can delay an upgrade from QuickBooks Online to a more robust ERP like NetSuite or Intacct by a few years because of the enhancements created by their Airbase by Paylocity integration.

And perhaps the biggest change is what Dmitri describes as a shift in corporate culture. With Airbase by Paylocity, financial operations at Aspire now have greater accountability and faster response times. That means he can focus more on financial analysis.

Key Takeaways

- Eliminated the need for bill.com.

- Cut month-end close in half.

- Created a new spend culture of accountability and transparency.

- Consolidated all aspects of spend into one platform to make the company more agile and efficient.

The Challenge: Looking for a Comprehensive System

Dmitri is responsible for his company’s financial operations and, as an experienced controller, he takes a holistic approach to solving operational problems. Dmitri is committed to being efficient with company resources and wanted to make sure that he was investing in the best solution. “As someone building a startup, I must justify every single investment that I make.” Looking at the costs and benefits of a new system went beyond a standard ROI calculation. He was also interested in soft costs and benefits, like the burden of training and the amount of friction associated with getting approvals for spend.

Dmitri constructed a comprehensive evaluation methodology to compare vendors, one that considers a full grid of features and benefits with operational metrics assigned against both essential capabilities and nice-to-haves. In addition to these features, Dmitri also considered other factors, including the impact on the accounting team, the overall financial impact, the end-user experience for those making purchases, the training and onboarding effort required, and the downstream effects on operating teams across the company.

Dmitri understood that depending on the vendor’s business model, the ROI might change over time. “A lot of vendors will charge per user, so fast-growing companies pay more and more to onboard people. The resulting increased costs can outpace savings. Airbase has done away with this concern for a flat subscription fee. I don’t have to worry about adding people; I can just onboard them.”

Dmitri has been pleased with the way that purchase requests are pre-approved. “Removing friction around approvals allows us to make decisions quickly instead of getting bogged down in the bureaucracy of getting spend approved.”

“Our biggest challenges in regards to controlling our expenses in the past were around the approval workflows. With Airbase, we were able to establish a clear, repetitive, and consistent approval process. Because everyone is on Airbase and managers approve their teams’ costs, there is clear visibility and responsibility for spend.”

Dmitri Litin, Former Controller at AspireIQ

The Solution: A Platform for All Payments

Alison James, Head of Community, is in charge of events, where there are often a lot of expenses to manage. She uses the Airbase by Paylocity physical card for point-of-sale and smaller one-time purchases, and virtual cards for larger and recurring charges. She has found that the Airbase by Paylocity platform has been particularly helpful for keeping events organized.

Alison can create an event-specific card and share the card details securely to those making approved purchases, even if they are not in her department. Before Airbase, sorting out cross-departmental spending would have involved additional effort to account for spending and arrange reimbursements.

Alison says that the marketing department found the onboarding with Airbase was easy and that, in addition to the cards, they use the invoicing tool for paying certain vendors. She appreciates that the approval workflows give her company more control over spending and has set up recurring charges to flag her as the renewal date approaches so that she can evaluate the spend. As someone who’s admittedly “really bad at expense reporting,” Alison says that she is continuing to find ways to use Airbase by Paylocity to eliminate expense reporting altogether.

“Another clear benefit to this change in culture is that I’ve been able to shift my function from accounting enforcer to financial analyst.”

Dmitri Litin, Former Controller at AspireIQ

The Results: A New Spend Culture

As a result of improved approval processes, Dmitri says that the company has noticed greater accountability around costs. “I have been in organizations where there’s no direct accountability on spend. The culture that arises from indirect approaches is that there is less urgency on when, and from whom, approvals need to be sought. A single source of truth that provides visibility allows us to be much more direct and makes it clear that every dollar matters. Holding each individual accountable creates a culture of transparency.”

Another essential aspect of a spend management system that was critical to Dmitri was to have a single payment platform. He explains, “It’s huge that we can do purchase orders and credit cards from the same place — it saves us time and removes friction from our operations.”

Airbase offers full accounts payable capabilities, including corporate cards and bill payments through ACH or checks. With this type of flexibility, AspireIQ has been able to eliminate the need for Bill.com and optimize for payment type to earn additional cash back on purchases.

Noting other benefits from Airbase by Paylocity, Dmitri says that he now saves about $5k a month on wasted spend. While not a significant budget item for the company, it’s a measure of discipline and reflects Aspire’s commitment to operational efficiency. In addition to these savings, Dmitri can point to three intrusions into their cards that were avoided quickly and easily. He explained that, “Responding to a compromised card might have taken an accountant, controller, or department head five or six hours to assess and address. Now, a spend owner can handle these in five minutes.”

Dmitri emphasizes that of greater importance than the savings of time and money is the agility and nimbleness that Airbase by Paylocity affords his company. This responsiveness is felt both on the company’s execution of spend and its analysis of data. As for that long close, he says, “We’re looking to eliminate a monthly close and move to a rolling close.” A system like Airbase by Paylocity is a prerequisite to adopting this forward-thinking approach to finance.

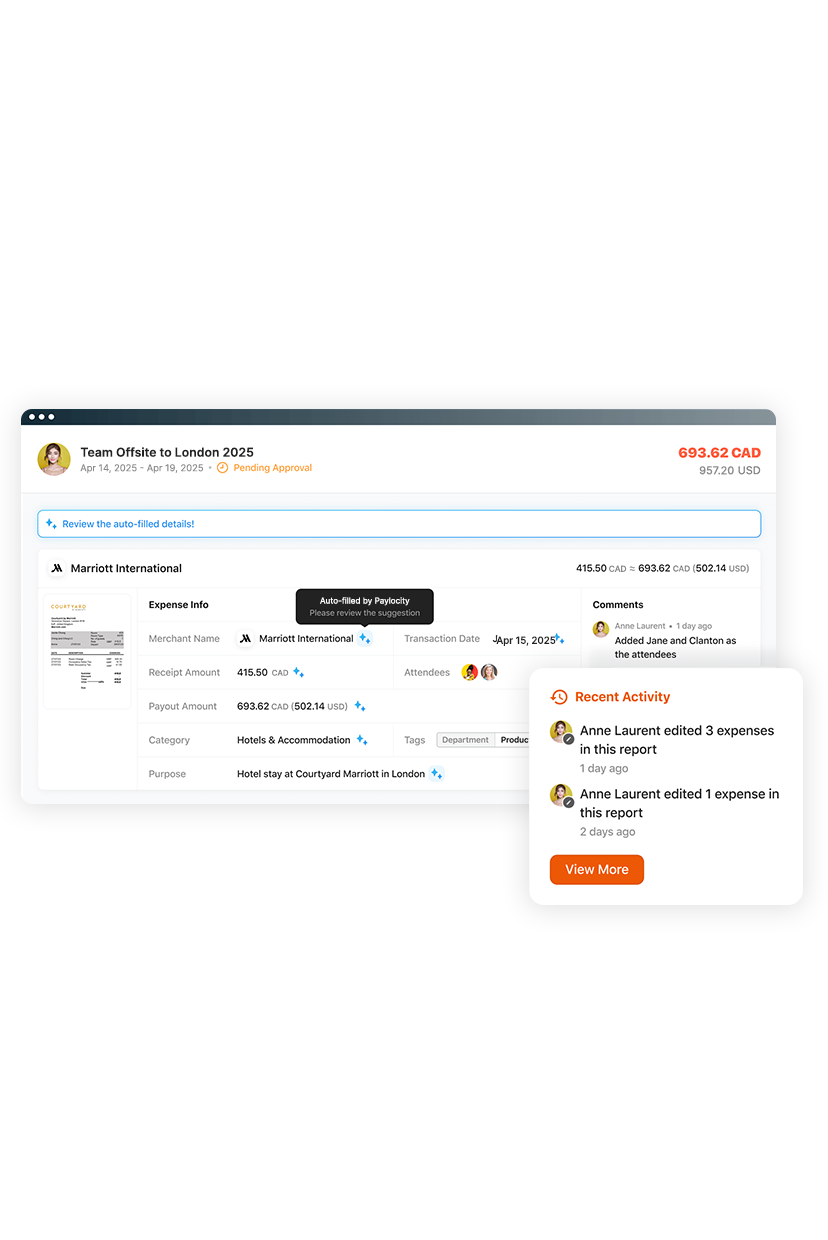

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.