This case study was written before Paylocity acquired Airbase. The key insights, processes, and outcomes highlighted are still applicable to Paylocity for Finance.

KongBasile Consulting and Airbase by Paylocity: Making Finance Easier for Startups

Key Takeaways

- KongBasileConsulting (KBC) uses the Airbase by Paylocity spend management system with clients who seek a comprehensive approach to managing company spend.

- Airbase by Paylocity is increasingly seen as the easiest to use AP software, by both KBC and its clients.

- Airbase by Paylocity’s continually expanding product roadmap makes it the right choice for more and more of the companies that KBC serves.

KongBasileConsulting (KBC) provides financial consultation and outsourced accounting to tech startup companies. KBC focuses on providing clients an amazing experience by employing top talent, which enables them to service an impressive roster of high-growth and complex clients. Lyft, Webflow, TaskRabbit, Gusto, Eventbrite, and Lever are just a few of the storied names that have, in their earliest days, relied on KBC for finance and accounting help. The consultants at KBC offer guidance on how to set up scalable financial operations. As accountants, they focus on effective accounting solutions to automate low-value work.

To learn more about KBC’s bird’s-eye view into the spend management space, we had a conversation with principal Spencer Falbo, manager Raymond Abellera, and director Robyn Mahoney to learn more about their experience using Airbase by Paylocity with their clients.

The Unique Perspective of Software-Agnostic Accounting Consultants

Robyn observed that many startup and early-stage companies don’t have solid requisition processes for software. By the time they become clients, many companies will have adopted software that is not optimal. Some are attracted to a specific promotion or use what their friends use rather than thinking about comprehensive solutions that will scale with them.

The time, effort, and cost of replacing systems can be a barrier to switching to better solutions, and KBC consultants often find themselves having to make do with inherited systems. This, however, does not keep the KBC team from staying current and advising on the best setup.

According to Raymond, a key value-add KBC brings is “our ability to benchmark tech companies based on our deep experience with them. We consult on what is needed for a company at a particular stage and advise on processes that will help them as they grow so that there are fewer pain points.”

An internal team at KBC monitors the market for new software products and developments in best practices. Vendors present at their team meetings, and staff share knowledge and recommendations. KBC makes a point to ask clients about their decisions to migrate away from certain tools and what they liked and disliked about them.

Accordingly, KBC has kept an eye on the Airbase by Paylocity platform from early on in its existence and has even served as a beta tester on many of Airbase by Paylocity’s features as they’ve rolled out. Spencer notes that KBC’s feedback is very often implemented in future updates, making the platform work better for KBC and its clients as time goes on.

KongBasile Consulting Trusts Airbase by Paylocity

Consultants at KBC have a vested interest in their client’s software choices. As Spencer explains, “We’re interested in solutions that can scale with the company so that we don’t have to replace systems often. Because we’re acting as in-house accounting, we want tools that are going to make us efficient in our work and benefit our clients.” Accordingly, KBC guides clients to appropriate software solutions that will last in the long term.

KBC prefers software that saves time both for them and their clients. A key component of this is automation.

“We don’t want to do a lot of time-consuming manual work so we’re always interested in ways to automate accounting workflows. Unnecessary manual work is not good for team development and it’s not good for morale, nor is it good for the client’s bottom line.”

Robyn Mahoney, Director at KongBasile ConsultingAirbase by Paylocity’s native integrations with common general ledgers, such as QuickBooks and NetSuite, prevent the manual work that needs to happen with other bill pay solutions. Robyn gave the example of mirroring NetSuite rules in Airbase so that expenses are funneled into the right place without manual intervention.

Airbase by Paylocity’s Easy Implementation Encourages a Positive Spend Culture

In general, all three of the KBC pros we talked to feel that implementing Airbase is straightforward. They also note that Airbase by Paylocity makes clients think about their spend in new ways. According to Raymond, Airbase by Paylocity “hits all the areas that we try to impart on our clients. Airbase makes it easier for them to visually see the importance of controls as opposed to a theoretical concept of controls.” For some of KBC’s clients, the most difficult part of Airbase by Paylocity onboarding is the mindset shift.

According to Spencer, "Airbase forces you to think more about your control structures in order to work well with the system. This is particularly evident around corporate card spending where traditionally approvals don’t happen before spending occurs. We want to ensure that we have the appropriate approval structure in place. Just having those conversations is a mindset difference."

Airbase by Paylocity promotes a change in spend culture, helping clients to think more about controls and how to implement safe practices. In addition to the approval workflows built into card transactions, Spencer pointed out that because Airbase by Paylocity handles all non-payroll spend, the platform can control for overspending.

Airbase by Paylocity is the Logical Choice

As an all-in-one spend management platform, Airbase by Paylocity has had an increasingly positive reaction with KBC’s clients and its internal team. And, as features continue to be added, Airbase by Paylocity becomes the right choice for more companies. “It does well, especially integrating with general ledgers,” Raymond tells us. “And it’s fairly simple.” Not having to switch between platforms for bill pay, reimbursements, and corporate cards is a big plus. According to Spencer, “Everybody loves the fact that it’s one login.”

Robyn enjoys “the ability to have a separate virtual card for every service and link each service to a specific person provides visibility into who is spending what. We can identify subscription duplicates to find efficiencies and eliminate redundancy in addition to ensuring spend documentation is complete.”

Airbase by Paylocity’s new higher cashback rate makes Airbase by Paylocity a clear financial win in many cases. In addition, Spencer notes that Airbase’s pre-funded card model allows for higher spend limits for smaller startups.

In addition, Spencer appreciates “not only having the virtual card side of the business but also being able to compare payments from the bill payment to the credit card side to ensure a secondary control, to ensure that we’re not overpaying on expenses.”

“The team’s happy with it, the clients are happy with it. Logically, it makes more sense.”

Spencer Falbo, Principal at KongBasile Consulting

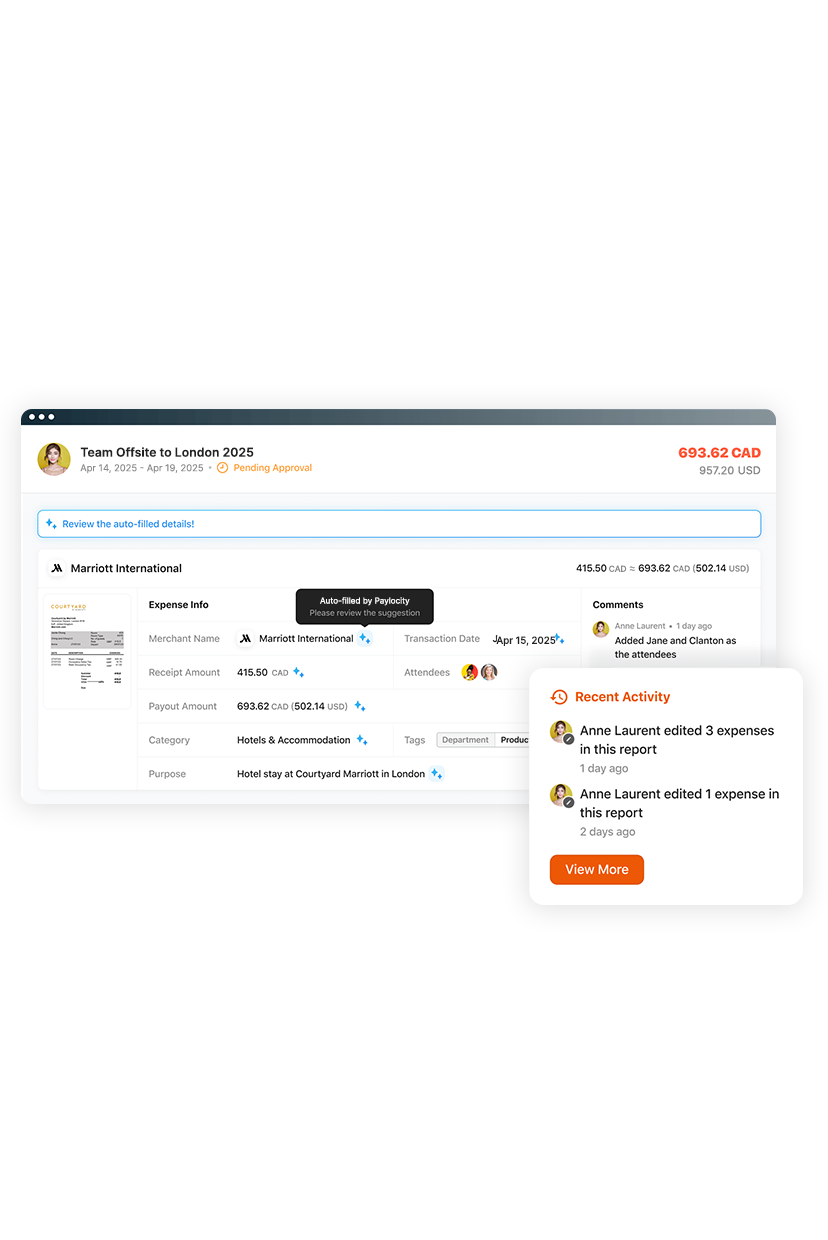

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.