Virtual Credit Card

Summary Definition: A digitally generated payment method that offers secure, customizable, and trackable business transactions.

What is a Virtual Credit Card?

A virtual credit card, or virtual CC, is a digital payment method that replaces traditional plastic cards with a secure, electronically generated card number, expiration date, and security code (i.e., card verification value or CVV).

Designed for online transactions and controlled spend management, a digital credit card allows finance teams to streamline purchases without exposing physical credit card information.

Key Takeaways

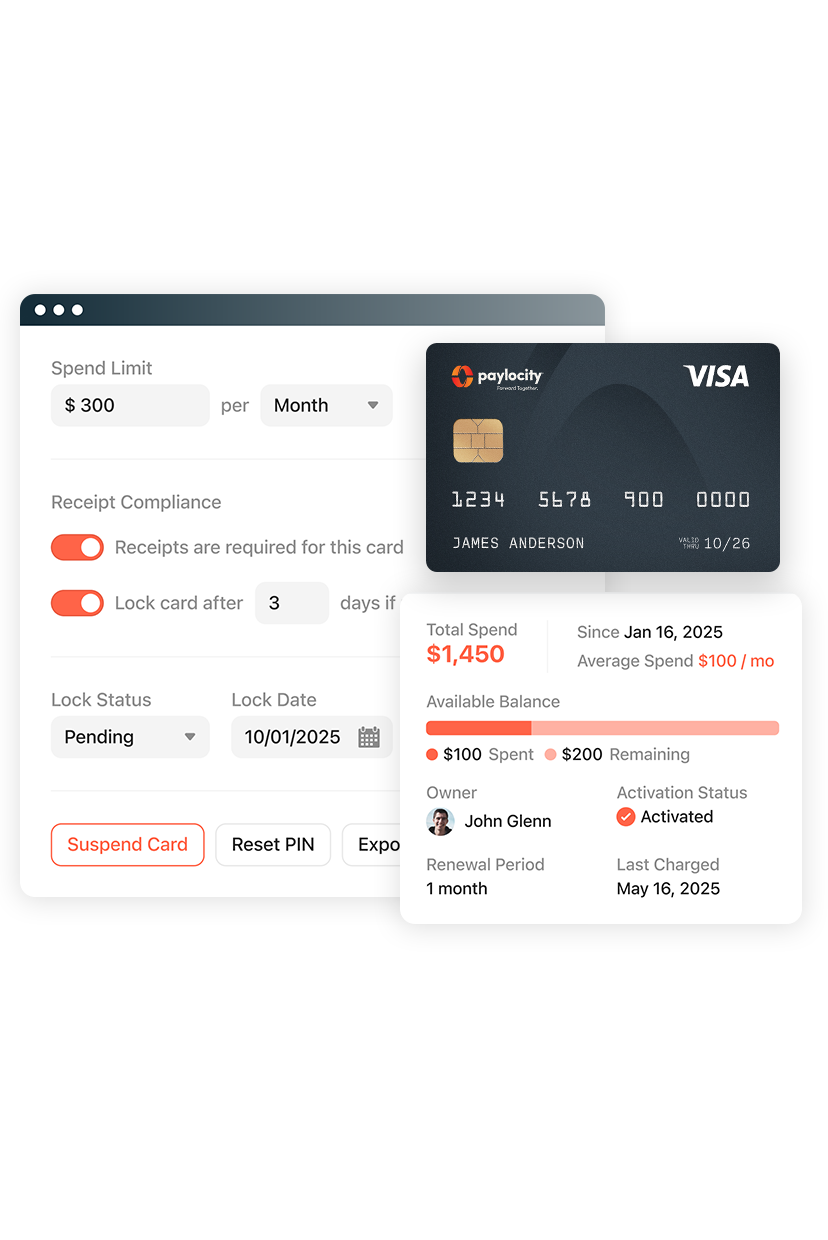

- Virtual credit cards are secure, digitally generated payment tools that provide finance teams with customizable spending controls like expiration dates and transaction visibility.

- Virtual cards can enhance expense management by reducing fraud risk, simplifying workflows, and streamlining payments.

- To get started, businesses can generate a virtual credit card through a trusted provider or spend management platform, enabling instant, policy-aligned usage and real-time tracking.

Why are Virtual Cards Important?

Virtual cards are a common payment option in finance and spend management due to their built-in security features, real-time tracking, and cost-saving potential. Their digital nature makes them a flexible alternative to traditional physical credit cards, especially for managing business expenses, by offering:

- Improved security: Because virtual credit card numbers differ from the underlying account’s primary account numbers, accounts are less vulnerable to fraud, data breaches, and misuse.

- Increased control: Finance teams can assign specific spending limits and expiration dates to each virtual credit card, reducing the risk of overspending and unauthorized transactions.

- Better visibility: Companies can monitor virtual credit card transactions in real time, helping identify fraudulent activity and streamline expense reporting.

- Reduced costs: Virtual cards can eliminate common fees associated with traditional credit cards, such as annual charges or some foreign transaction costs.

- Simplified workflows: Digital credit cards are also ideal for recurring purchases, vendor payments, and employee reimbursements, helping businesses automate and standardize payment processes.

Are Virtual Credit Cards Safe?

A virtual credit card can be a safer alternative to physical cards, especially for online and one-time purchases. Since each is digitally generated with a unique number, expiration date, and security code, it can be used without exposing a business’s main credit account(s).

Additionally, many virtual cards are designed for limited use, either for single transactions or short timeframes, which significantly reduces the risk of fraud or unauthorized reuse.

How Do Virtual Credit Cards Work?

Virtual credit cards are generated by a financial institution (e.g., a bank or credit card company), often via a spend management platform. Though companies predominantly use generated cards to make online payments, some also provide downloadable cards that users can add to a mobile device’s virtual wallet for offline transactions.

How Do You Use a Virtual Credit Card?

Digital credit cards can be used for a wide range of transactions, including:

- Paying for online expenses, such as software as a service (SaaS) arrangements, cloud computing services, and advertising campaigns

- Making travel arrangements (e.g., booking flights, hotels, and rental cars)

- Purchasing inventory and supplies from online and offline retailers

- Reimbursing employee expenses (e.g., travel, meals, lodging, etc.) as part of a corporate card program

Digital Credit Card Pros and Cons

Digital credit cards have several advantages, but a couple of limitations.

| Virtual CC Advantages | Virtual CC Disadvantages |

|

|

Regardless, a virtual business credit card can be an innovative, scalable solution for businesses focused on security, efficiency, and better expense management. They can be created instantly and assigned to individual employees, vendors, or recurring purchases, allowing finance teams to control how and where funds are used.

How to Get a Virtual Credit Card

Securing a virtual credit card for business is a quick process:

- Select a trusted provider: Choose a financial institution, credit card issuer, or spend management platform offering virtual card services. Look for key features such as real-time tracking, expense controls, single or multi-use cards, and compatibility with existing accounting systems.

- Open or verify an account: Businesses typically apply for a commercial or virtual credit account, then log in through the provider’s online portal or mobile app.

- Generate the Virtual CC: When verified, use the platform’s tools to create a virtual credit card by setting parameters, such as spending limits, expiration dates, merchant restrictions, or use cases (e.g., travel, subscriptions, vendor payments). Some platforms also allow automated card creation for recurring business needs.