This guide was written before Paylocity acquired Airbase. The key insights, processes, and outcomes highlighted are still applicable to Paylocity for Finance.

Business Expense Policy Template with Examples

Expense Policy Guidelines: Overview.

For example: Our Employee Expense Company Policy outlines work-related expenses and sets procedures to authorize expenditure and request reimbursement when required. All expense management takes place in Airbase by Paylocity, which can be accessed via desktop or mobile app.

Employees wishing to spend company money submit a request in Airbase by Paylocity, and the system will route the request to the appropriate approver, or set of approvers. Communication takes place in Slack or email so that your purchase needs are responded to quickly and efficiently.

Airbase by Paylocity captures approvals and transactions in real time, so financial information is always up to date, and employees and finance team members have clear visibility into the status of every expense request.

1. State the purpose

The purpose of this policy

For example: This expense policy example outlined applies to all employees who spend money on work-related activities. We created our Employee Expense Policy to provide clear guidelines on how employees can make work-related purchases. Requests for expenses are handled through Airbase by Paylocity, which applies automated rule-based policies to ensure compliance, and to route all requests through the correct approval chain. This reduces the burden on employees to follow complex procedures and policies. An overview of our policy is provided below.

Employee expense categories

Our expense policy covers two types of expenses:

- Expenses the company pays for directly.

- Expenses that employees pay themselves, then submit for reimbursement.

2. Specify policies regarding payment type

For example: Airbase by Paylocity accommodates all payment types: virtual cards, physical corporate cards, reimbursements, and purchase orders. Employees are encouraged to use virtual cards for recurring or single vendor expenses that can be paid with a card. Physical card purchases should be restricted to in-person purchases only.

3. Specify receipt requirements

For example: All purchases over a threshold of <amount> require a receipt. Receipts are uploaded into Airbase by Paylocity at the time of purchase and will be attached to your specific transaction. Physical receipts can be uploaded directly to the mobile app by taking a photo with your mobile device. Invoices can be uploaded.

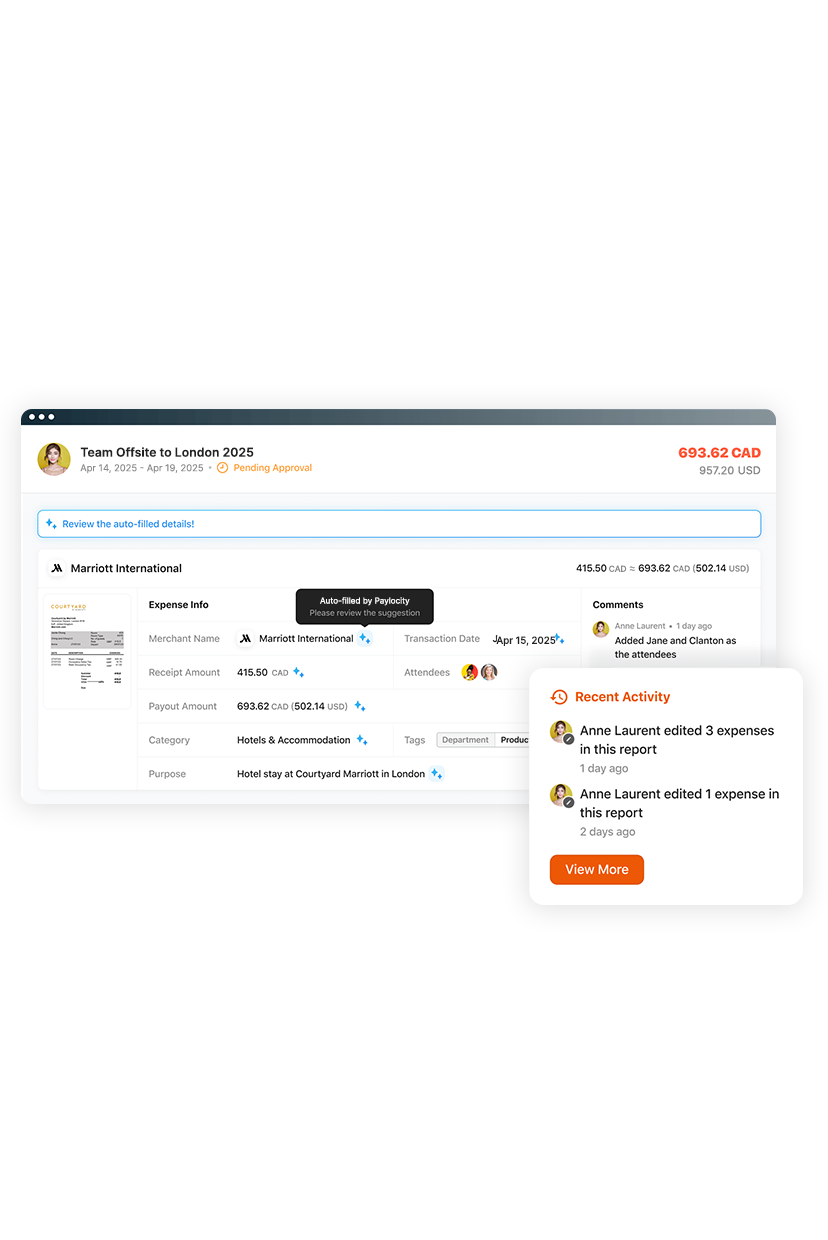

Airbase by Paylocity will automatically populate your expense request details using OCR technology. Built-in ML extracts all necessary fields, GL category, date, amount, and merchant/vendor and generative AI assigns a purpose based on past patterns.

4. Specify procedures

Expense procedures

For example: Expenses the company pays for directly: In Airbase by Paylocity, submit a request for an expense, either one-time or recurring. Airbase by Paylocity automatically routes your request to the correct approver(s), and flags out-of-policy requests based on our rule-based policies, so employees simply fill out the required fields. You will be asked to supply a category (from a drop-down menu) and tags for the purchase. Consult your manager or the accounting team at the time of request if you are not sure how to categorize the expense. Some of your expenses will be automatically categorized.

For example: Expenses for reimbursement: Request a reimbursement through Airbase by Paylocity by completing the required fields and attaching any related receipt(s) if required. Airbase by Paylocity will only accept requests for reimbursement for items that are on our eligible expenses lists (see below). Receipts can be uploaded into Airbase by Paylocity, and OCR technology will pull the relevant details. A reimbursement request is automatically routed to the correct approver(s). Once approved, funds are automatically deposited into your bank account, based on the banking information you provide within Airbase by Paylocity. Requests for reimbursement can occur at any time and will be processed immediately.

5. Specify acceptable travel expenses

Covered expenses upon approval

Travel expenses.

For example: Travel expenses refer to all transportation and accommodation costs an employee has while traveling for business, including:

- Accommodation.

- Transportation fares, by air, rail, or ship.

- Cab or rideshare charges.

- Legally required documentation, such as travel visas.

- Rental cars and gasoline.

- Required medical expenses, such as vaccinations.

- Meals (breakfast, lunch, and dinner) to a maximum of <amount> per day.

- Other approved expenses as required for the trip, such as materials for presentations.

6. Identify partnerships and how to access

Partner relationships

For example: We want all employees to have a positive, safe experience while traveling, but we also want to avoid unnecessary costs. To obtain maximum value for our travel dollars, we have partnered with a number of accommodation and transportation providers. Please book with these services whenever possible.

<list>

Travel should be booked in ___________ class, unless there is a valid reason to upgrade. Please work with your manager when making travel arrangements.

7. Specify acceptable business expenses

Business expenses

For example: We want to make sure that all employees have what they need to do their jobs. Approved expenses may include software subscriptions and office supplies, as well as expenses related to business entertainment, such as client dinners. If you have specific questions on what constitutes a business expense, please contact your manager.

8. Identify any special expense or benefits programs

Expenses for remote workers

For example: It’s important that remote workers are comfortable and productive at home. We cover expenses related to creating a remote work environment, such as:

- Office supplies to a maximum of <amount>.

- Co-working space fees to a maximum of <amount>.

- Computer equipment and software to a maximum of <amount>.

- Internet access charges to a maximum of <amount>.

- Telephone landline charges to a maximum of <amount>.

- Stipends for special benefits, such as meals during virtual events.

Benefits that the company will pay for:

For example: We provide additional benefits to our employees. Requests for these benefits follow the same procedures:

- Gym memberships to a maximum of <amount>.

- Mobile phone expenses to a maximum of <amount>.

- Wellness programs to a maximum of <amount>.

- Childcare expenses to a maximum of <amount>.

- Continuing education and training expenses to a maximum of <amount>.

9. Identify expenses the company will not pay for

Ineligible expenses

For example: Employees are responsible for the following:

- Personal expenses, including utilities and mortgage payments for remote workers.

- Personal services (e.g., beauty treatments while traveling).

- Personal purchases, such as souvenirs, gifts, or clothing.

- Upgrades to transportation or accommodation, unless approved by manager.

- Any fines as the result of travel or while driving a company vehicle.

- Personal subscriptions.

- Personal travel, including side trips while on a business trip.

- Unauthorized business meetings.

10. Identify who to contact with questions

For example: Consult your manager first for any questions regarding this policy guide. The HR team is responsible for maintaining and updating these policies. Please contact <email> if you are unable to resolve your question with your manager.

Recommended additional reading:

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.