From Receipts to Reports, Expense Reimbursement Software Saves Time and Sanity

Businesses know that employees should receive expense reimbursements promptly. But “promptly” means different things to different companies. It could be six months before expenses are paid.

That’s simply too long.

While, yes, HR, accounting, and finance teams must approve any reimbursement that crosses their desks, you can hardly blame workers for demanding shorter turnaround times.

The fix? Many business professionals are turning to expense reimbursement software (ERS), a digital solution that automates and streamlines tracking, submitting, approving, and reimbursing employee expenses.

In this article, we’ll explore different ERS solutions, their benefits, how to choose the right option, and how to implement one in your organization.

Key Takeaways

- Expense reimbursement software streamlines the entire employee reimbursement process, from receipt scanning and approval workflows to real-time reporting and compliance enforcement.

- Expense software reduces manual errors, strengthens policy compliance, speeds up approvals, and improves financial visibility.

- Key features include automated expense tracking, receipt scanning with OCR, real-time reporting, mobile access, customizable workflows, and seamless integration with accounting tools.

What is Expense Reimbursement Software?

Expense reimbursement software is a specialized expense management tool designed to streamline the process of tracking, reporting, and reimbursing business expenses. This software helps companies manage employee expenses efficiently by automating expense reporting and ensuring compliance with company policies and regulations.

Key functions include receipt scanning, expense categorization, approval workflows, and reimbursement processing. By leveraging these features, businesses reduce their administrative burden, minimize errors, and improve overall financial transparency.

Are There Different Types of Expense Reimbursement Solutions?

More businesses are transitioning to the cloud, but on-premises solutions are still widespread. There are perks and drawbacks to both:

Cloud-based Solutions

Access software from a provider without downloading or maintaining local infrastructure. Cloud solutions reduce business expenses without sacrificing quality.

- Pros: Accessible from anywhere, automatic updates, and more affordable and scalable.

- Cons: Requires an internet connection and has potential security concerns.

On-premises Solutions

Expense management software is installed on local servers or end-point devices.

- Pros: Complete control over data and highly customizable.

- Cons: Higher upfront costs and requires constant (expensive) IT maintenance.

Hybrid Solutions

Business-critical functions are on local servers or devices, while team members access less-essential data or services through cloud-based platforms.

- Pros: Combines the benefits of cloud-based and on-premises solutions and helps migrate to the cloud.

- Cons: Can be complex to set up and manage.

Your specific needs will guide you toward a solution that works best for your organization. As cloud-based services become more mainstream, businesses are using hybrid reimbursement software as part of their digital transformations, where enterprise resource planning (ERP) software migrates from on-premise to the cloud.

Benefits of Expense Reimbursement Software

While most business processes have dedicated software to make life easier, many business owners don’t realize that reimbursements have modernized, too.

If you’re thinking about switching from manual to software-assisted reimbursements, here’s why you’ll be happy you did:

- Reduced human errors: Manual processes invite human error and are time-consuming. ERS automates calculations and data entry, shaving time off workflows and reducing costly errors.

- Policy compliance: ERS software lets you automatically enforce spending limits, checking expense policies in real time. Prevent internal theft and overspending AND pay your team on time.

- Improved financial visibility: Automated processing integrates with other business tools for real-time reporting and expense tracking. Never miss an expense, and get the most accurate data for better budgeting and forecasting.

- Streamlined approval: Expense reimbursement tools automate workflows. They quickly get you from needing approval to paying out. Employees like that. And that appreciation pays dividends when it comes to retention.

The biggest gain is greater accuracy and insight into budgets and forecasting. Every dollar matters when it comes to making operations more efficient. Implementing a tool that streamlines the workflows and tracking needed to hunt down each dollar means more effective financial management.

Key Features of Expense Reimbursement Software

You’re looking for a better way to operate when it comes to managing expenses. These are the key features to look for:

- Automated expense tracking: Automatically track and categorize expenses while reducing the manual effort required and minimizing errors. Automated expense tracking ensures that all business expenses are accurately recorded and categorized.

- Receipt scanning: Scanning receipts and extracting relevant information, such as date, amount, and category, is crucial. This feature simplifies submitting expenses and ensures that all necessary details are captured accurately.

- Customizable approval workflows: Create custom approval workflows that make it easy to prepare expense reports for expedited approval.

- Real-time reporting: Generate real-time reports on expense data that highlight business spending patterns. Reporting helps leaders make informed financial decisions and improve budgeting and forecasting.

- Integration with accounting software: Expense management software can integrate seamlessly with your existing accounting software, such as QuickBooks or Sage Intacct. This integration streamlines the expense reimbursement and accounting processes, reducing the need for manual data entry.

- Mobile accessibility: Access to expense reimbursement software on mobile devices is a basic necessity for modern businesses. Employees submit expenses, and managers approve them on the go — convenient!

How to Choose Expense Reimbursement Software

There is no shortage of reimbursement software options, but choosing the right one can make or break processes. Before signing any agreements, you must make a few critical considerations that will guide the decision-making process:

- Security features: Ensure your solution has comprehensive data encryption, security layers like multi-factor authentication, and robust disaster recovery. Software should carry industry compliance certifications, like SOC 2 and PCI-DSS, while staying in line with GDPR and CCPA regulations.

- Integration capabilities: Expense management tools should integrate with your broader tech stack, including ERP systems, accounting software, HR management systems, and travel booking platforms. These integrations improve tracking and reporting accuracy.

- Ease of use: New software must be user-friendly and intuitive. Verify that the software comes with documentation and training support for effective onboarding. Also, check for mobile app availability and OCR technology for receipt scanning.

- Budget considerations: Choose ERS tools that fit within your budget through various pricing models, like per user or per transaction. Also, consider implementation costs specific to your deployment method and estimate ROI potential with your finance department.

- Business needs and requirements: Contemplate how expense software fits your business model. Ask yourself how it will help as your company expands, and think about specific features you may need, such as international expense management or industry-specific demands.

Create Expense Reports with Reimbursement Software

Manual data entry and approvals make creating expense reports tedious and time-consuming. But with modern expense management software, it's a cinch! Here are the steps to create a report in minutes:

- Choose an expense management software: Select a provider that meets your company’s specific needs and policies. Ensure it has the features necessary to streamline your expense reporting process.

- Set up expense categories: Configure the software with expense categories that align with your company’s policies. This categorization helps organize expenses and make the reporting process more efficient.

- Scan receipts: Use the software’s OCR receipt scanning feature to capture and extract relevant information, such as date, amount, and category. OCR features further reduce manual data entry and ensure accuracy.

- Submit expenses: Submit expenses for approval through the software. You can do this individually, in batches, or automatically, depending on your preference and the software’s capabilities.

- Approve expenses: Managers can approve expenses using the software’s customizable approval workflows. Automatic workflows make it easy to approve all expenses promptly.

- Generate reports: The software generates real-time reports on expense data. These reports provide valuable insights into business spending patterns and help make informed financial decisions.

Implementing Expense Reimbursement Software

With the right software, implementation is straightforward. Follow these steps:

- Evaluate the company’s needs: Start by assessing your company’s specific needs and policies, including expense categories, approval workflows, and reimbursement processes. This assessment will help you choose the right software and configure it effectively.

- Choose an expense management platform: Select software that meets your company’s specific needs and policies. Ensure it has the necessary features to streamline your expense management processes.

- Set up software: Configure the software according to your company’s requirements and policies. This step should include setting up expense categories, approval workflows, and reimbursement procedures.

- Train employees: Train employees on how to use the software. Training includes instructions on submitting expenses and approving expenses. Proper training ensures that everyone onboards effectively. More importantly, training adds a level of familiarity to new software, so employees look forward to using it.

- Test software: Before fully launching it, conduct thorough testing to ensure it works correctly and meets benchmarks. Benchmarking and testing identify and resolve any issues before full implementation.

- Launch software: Roll out the software company-wide or in phases. Monitor the implementation process and make adjustments as necessary to ensure a smooth transition.

Learn More: HRIS Implementation: A Success Story

Stop Uncontrolled Spend with Airbase by Paylocity

Optimize your company’s spend management with Airbase by Paylocity. Get real-time visibility, faster financial close, improved planning, and stronger financial controls.

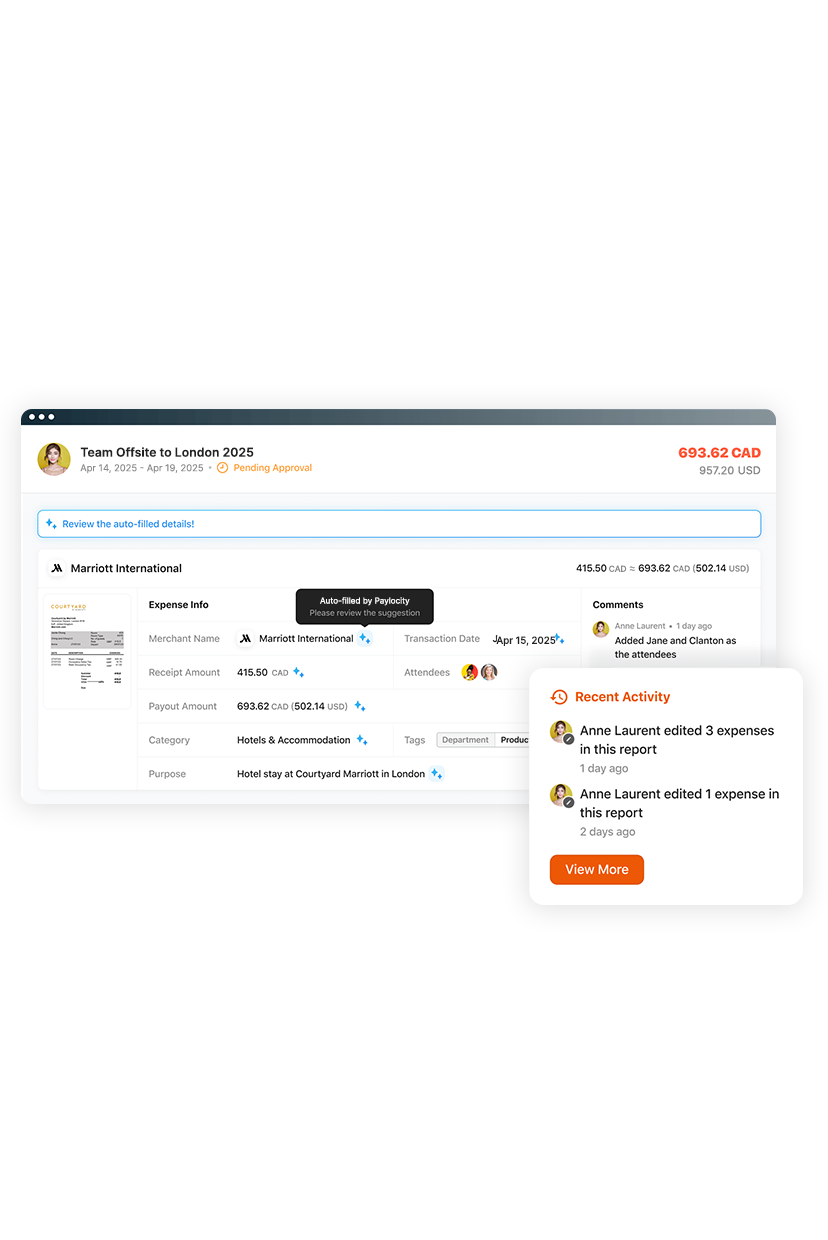

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.