Employer retirement plan considerations

Since retirement plan laws vary widely, employers should consult their state’s agency for all state retirement plan requirements and deadlines. Some states, for example, mandate compliance only for businesses of a certain size. Moreover, some states require employees to enroll automatically in a plan and contribute from their wages. Employees wanting to opt out of said plans may need additional information or assistance.

Employee retirement plan considerations

Most state-sponsored retirement plans are set up as Roth IRAs, with employee contributions occurring after payroll and income taxes are withheld. However, some states (e.g., Minnesota) allow employees to contribute before such taxes are applied, similar to how a Traditional IRA operates.

Pre-tax contributions reduce an employee’s taxable income and overall tax liability, resulting in immediate tax savings. Post-tax contributions, conversely, offer tax-free withdrawals during retirement, including any accumulated interest or earnings, provided the withdrawal meets the IRS’ qualified distribution criteria.

Employers in a state with a mandatory retirement plan law must choose between adopting a state-sponsored retirement savings plan or offering their own private plan.

State-sponsored plans, such as auto-IRAs, are often the simplest option. They’re inexpensive to set up and have minimal administrative requirements. They’re designed to reduce obstacles for small businesses or those new to offering retirement benefits.

However, even the best state retirement plans have shortcomings. For example, auto-IRAs usually have tighter restrictions on how much an employee can contribute each year ($7,500 in 2026 for those under 50) and don’t allow employers to match employee contributions.

Conversely, private plans, such as 401(k) accounts, have significantly higher contribution limits ($24,500 in 2026) and may entitle the employer to certain tax credits that offset setup and administration costs. Moreover, allowing employer contributions can make these plans much more appealing when retaining employees or attracting new hires.

Simply put, state-sponsored plans can be affordable and simple for employers to use but also limited in how much they benefit employees. Private plans often offer more options and benefits but can be more expensive and time-consuming to manage.

Empower retirement savings with Paylocity

Sixty percent of workers are likelier to stay with their current employer if the organization offers a retirement savings plan. That makes it one of the most important priorities considered next to competitive salaries and flexible work hours.

In other words, even when a state doesn’t require one, it pays to have a robust retirement savings plan employees can count on.

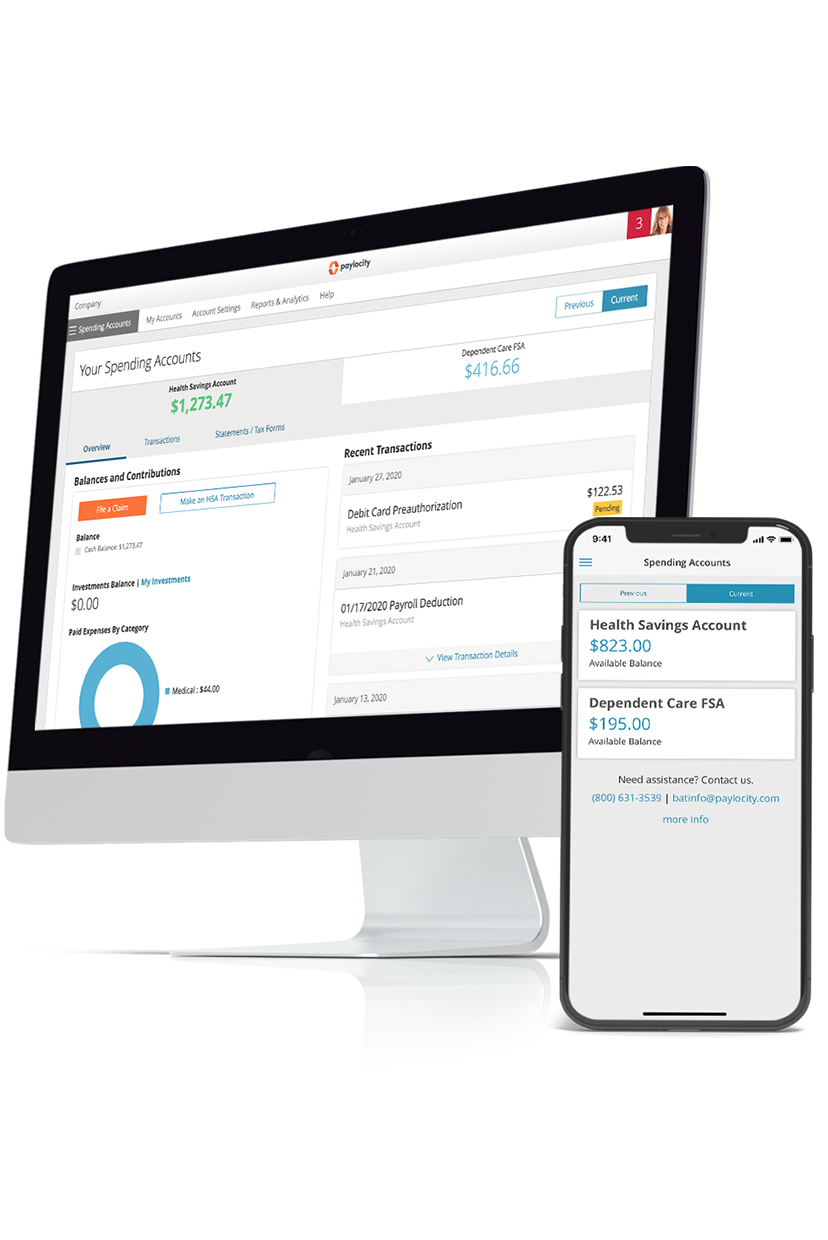

This is where having the best payroll and benefits administration software can make a world of difference — particularly platforms that offer employees multiple options by integrating with both private and state-sponsored retirement savings providers.

Request a demo today to see how much easier benefits administration and retirement savings can be with Paylocity.