From receipt capture to reimbursements, Paylocity automates expense management to save you time and effort.

Small Business Expense Management

Simplify spending, save time, and stay compliant.

Touchless expense management software for small businesses

Smart expense management capabilities

Painless expense reporting and reimbursement

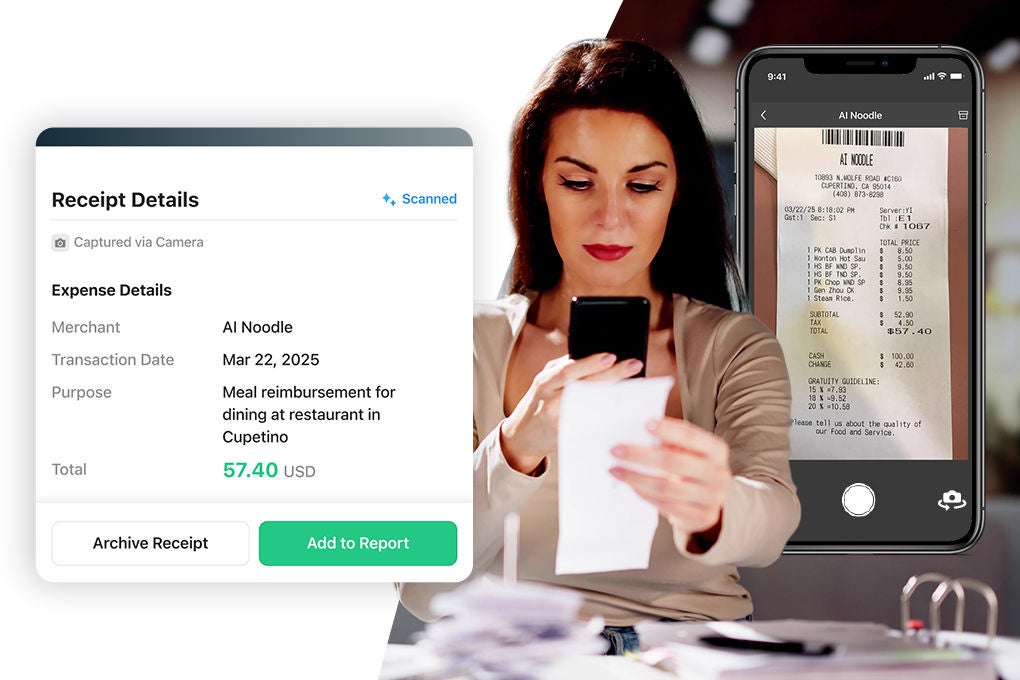

- Capture receipts with a snap of a photo and our AI-powered OCR automatically reads the vendor, date, and amount.

- Track mileage expenses by entering a starting point and one or more destinations. Mileage is automatically calculated.

- Reimbursements processed in just two days, separate from payroll, so employees get paid back quickly.

Automatic policy enforcement

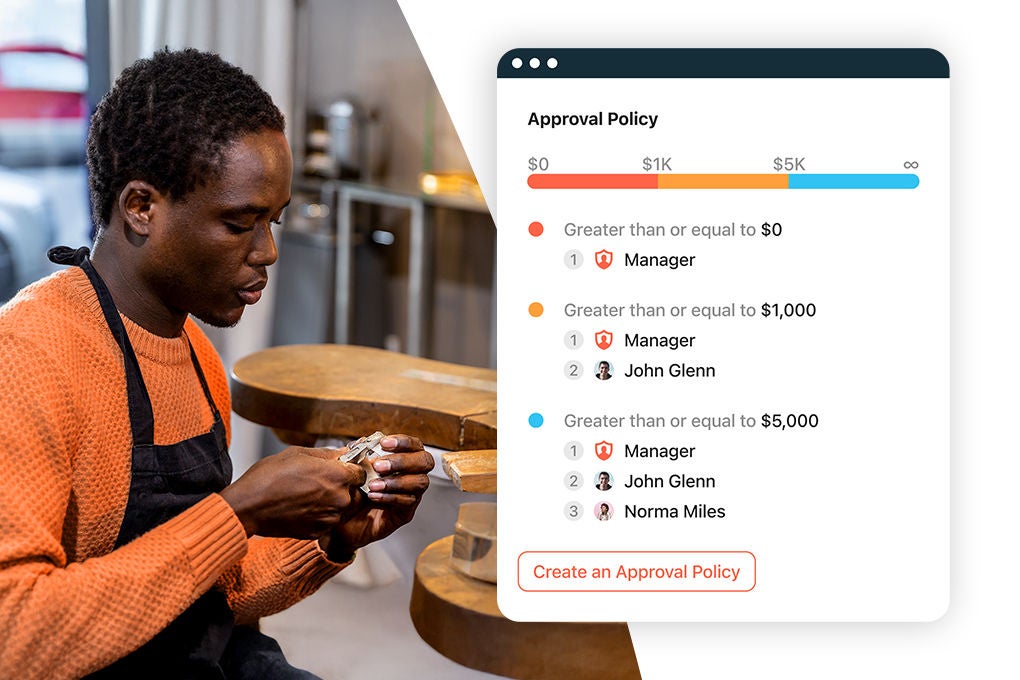

- Build your company’s expense rules directly into the system, setting limits for things like meals, hotels, or airfare.

- The system automatically flags expenses that are out of policy, so you can review them before they are approved.

- Set up approval workflows that send expenses to the right manager automatically, speeding up the whole process.

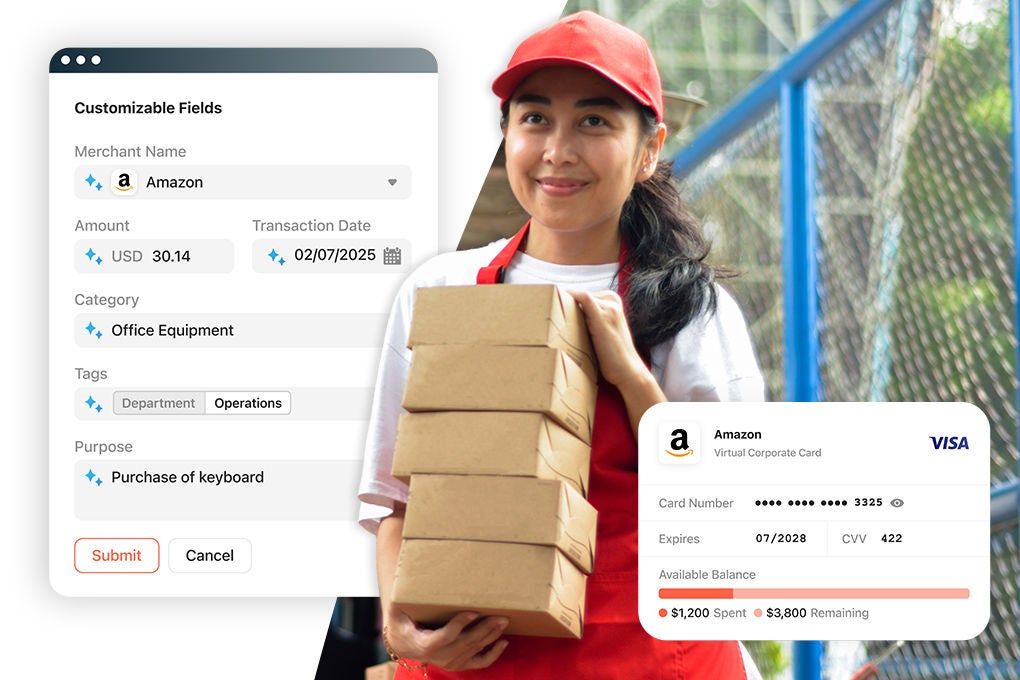

Real-time control with Corporate Cards

- Instantly create virtual cards for online purchases or issue physical cards for your team to use on the go.

- AI-automated receipt matching and GL coding, so every transaction syncs cleanly to your ERP.

- Get unlimited cash back on card purchases, turning your everyday business expenses into savings.

Scale your finance capabilities as your business grows

- Guided Procurement: Easily follow company rules on every purchase with guided workflows that route requests for fast, smooth approvals.

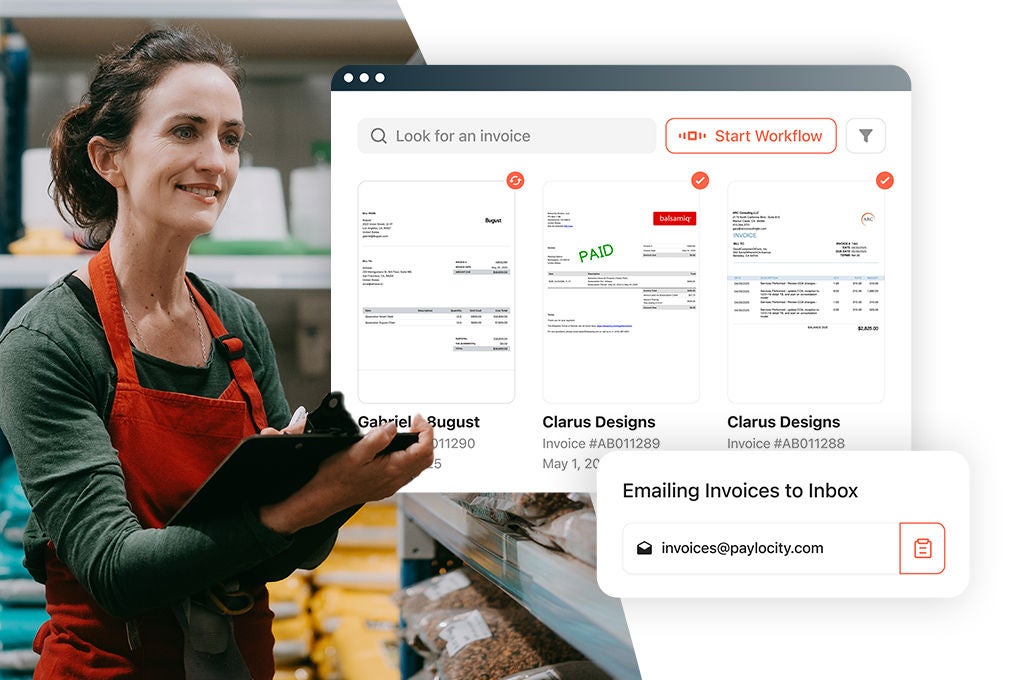

- AP Automation: Let our system handle invoice capture, coding, and payments — saving you time and reducing manual errors.

- Headcount Planning: Plan new hires with real cost data, so you can adjust staffing and budget confidently as your business changes.

Support that makes life easier

- Connect Paylocity to your favorite accounting tools. Everything works together, saving you time and reducing headaches.

- Get up and running quickly with step-by-step help, so you and your team aren’t left guessing.

- Reach live experts when you need help — no bots, no confusing menus.

More than just expense management for

your small business

Loved by small businesses just like you

Small business expense resources

FAQs about small business expense management from Paylocity

How does Paylocity automate expense reporting?

Paylocity fully automates the previously tedious task of completing expense reports. You just take a picture of your receipt with our mobile app, and our AI-powered OCR technology will automatically scan and populate your expense details in seconds. Reimbursement requests automatically flow to the correct approver(s). Upon approval, payment is routed straight to your bank account.

Can employees submit expenses on the go?

Yes! It’s as easy as snapping a photo of a receipt with our mobile app.

How does Paylocity ensure compliance with company policies?

Paylocity ensures compliance with company policies by implementing mandatory fields, setting specific time windows for submissions, and establishing budget limits based on roles and expense types. Clear and straightforward blocking and warning policies guide both employees and approvers.

Can I customize spending rules for different teams or departments?

Yes, expense policies can be customized by team or department.

What happens if an expense is flagged as out-of-policy?

The system can be configured to block an expense request or issue a warning that it requires additional scrutiny or information.

Does Paylocity provide audit trails for compliance purposes?

Paylocity automatically creates an easily accessed audit trail, including receipts and approvals.

Can employees track the status of their expense reports in real time?

Yes, employees can track their expense reports in real time.

Can Paylocity integrate with my existing accounting software?

Paylocity integrates with popular ERPs like NetSuite and QuickBooks. Explore our integration marketplace for more compatible software.

Can Paylocity scale as my business grows or if I expand internationally?

Paylocity for Finance is designed to scale seamlessly as businesses expand internationally. With features like automated workflows, multi-currency support, and compliance tools tailored to global regulations, it ensures efficient financial management across borders.

?ts=1762463548424&dpr=off)