Struggling to keep up with payroll and HR in Massachusetts? From local ordinances to statewide labor laws, we’ll help you save time and focus on growing your business.

Payroll services in Massachusetts

How Paylocity helps Massachusetts employers

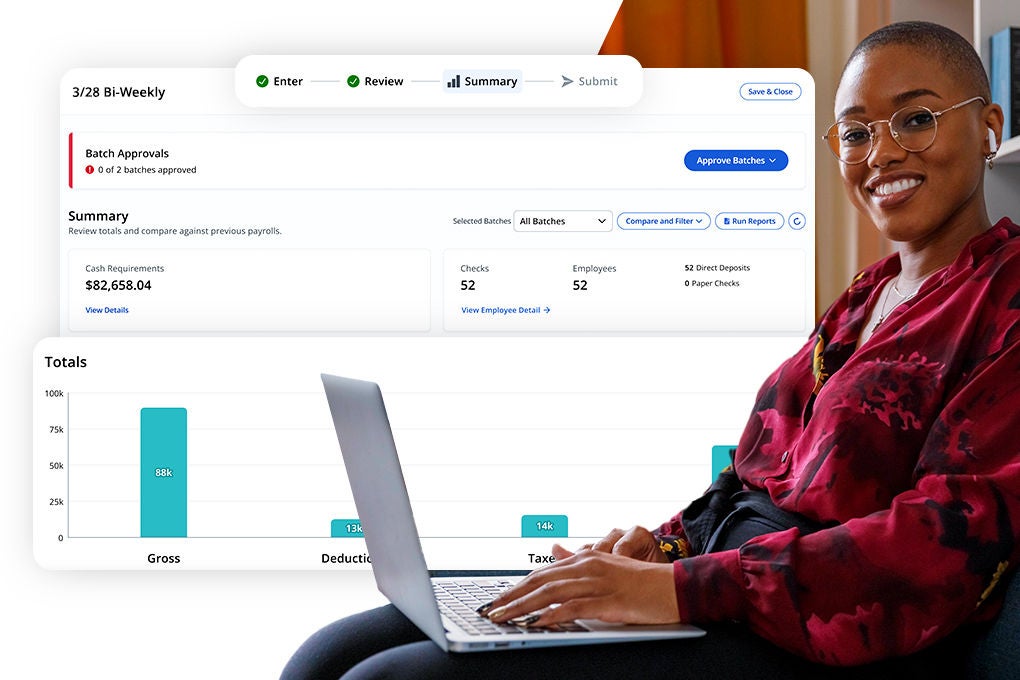

Payroll that gets it done

- Seamless automation: Eliminate repetitive tasks with automated workflows that boost accuracy and save time.

- Smart safeguards: Built-in audits and integrations flag issues before they become errors.

- Transparent calculations: Easily manage overtime, bonuses, and local tax changes, even across overlapping jurisdictions.

Your extra HR team member

- Automated workflows: Use ready-made templates for common tasks or build custom processes that fit your business.

- One employee record: A single source of truth for employee data keeps everything organized and compliant.

- Effortless Time & Labor: Schedule quickly, track clock-ins and meal breaks, and standardize time-off requests.

Compliance made simple

- Compliance dashboard: Get a clear view of requirements with updated forms and expert HR support.

- Built-in data access: Quickly find work authorizations, EEO/FLSA data, pay records, certifications, and industry updates.

- Always up-to-date forms: Access the latest state and federal forms right from the platform.

Challenges facing employers in Massachusetts

Massachusetts maintains a complex compliance landscape that requires a careful balance between federal standards and state mandates.

As an employer, you must grapple with:

- Stricter employment regulations ranging from pay transparency to paid sick leave.

- Higher state minimum wage rates.

- Additional safety and health requirements under the Massachusetts State OSHA plan.

Massachusetts payroll fast facts

Minimum wage

$15.00

State income tax rate

5.00%

Right to work laws

None

State unemployment tax rate

- 3.76% (new employers; construction)

- 1.87% (new employers; non-construction)

- 0.56% - 18.55% (experienced employers)

Massachusetts tax and compliance resources

FAQs about paying employees in Massachusetts

Does Massachusetts have a state income tax?

Yes, Massachusetts state income tax uses a flat rate of 5.00%, meaning it applies to all taxpayers regardless of their income levels, except for those who have an annual taxable income greater than $1 million. Such taxpayers must pay an additional 4.00% income tax.

Is Massachusetts a right to work state?

No, Massachusetts is not a right to work state, but it can pass right to work laws in the future if it wishes to do so.

What are the Massachusetts final pay laws?

In Massachusetts, employees who voluntarily resign from a job must receive their final paycheck by the next regular payday. Involuntarily terminated employees, however, must receive their final paycheck immediately.

Are there Massachusetts work break laws?

Yes, under the state’s meal break law, employers must provide employees with at least a 30-minute unpaid meal break if an employee works more than six hours in a calendar day.

More than just payroll

Why employers in Massachusetts choose Paylocity

Iconic restaurant chain serves up excellent employee collaboration

New England-based restaurants leverage Paylocity to strengthen their culture and propel growth.