Struggling to keep up with payroll and HR in Texas? From local ordinances to statewide labor laws, we’ll help you save time and focus on growing your business.

Payroll services in Texas

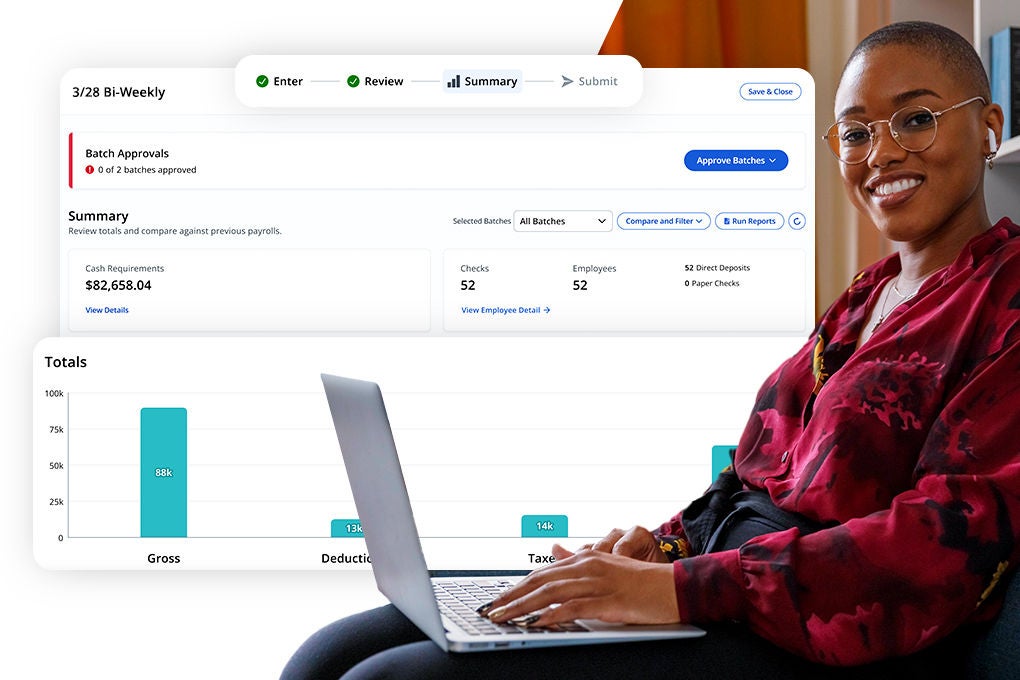

How Paylocity helps Texas employers

Payroll that gets it done

- Seamless automation: Eliminate repetitive tasks with automated workflows that boost accuracy and save time.

- Smart safeguards: Built-in audits and integrations flag issues before they become errors.

- Transparent calculations: Easily manage overtime, bonuses, and local tax changes, even across overlapping jurisdictions.

Your extra HR team member

- Automated workflows: Use ready-made templates for common tasks or build custom processes that fit your business.

- One employee record: A single source of truth for employee data keeps everything organized and compliant.

- Effortless Time & Labor: Schedule quickly, track clock-ins and meal breaks, and standardize time-off requests.

Compliance made simple

- Compliance dashboard: Get a clear view of requirements with updated forms and expert HR support.

- Built-in data access: Quickly find work authorizations, EEO/FLSA data, pay records, certifications, and industry updates.

- Always up-to-date forms: Access the latest state and federal forms right from the platform.

Challenges facing employers in Texas

Texas maintains a complex compliance landscape that requires a careful balance between federal standards and state mandates.

As an employer, you must grapple with:

- Stricter employment regulations ranging from pay equity to final paycheck mandates.

- Industry-specific overtime requirements for nurses.

- State-based workplace discrimination standards.

Texas payroll fast facts

Minimum wage

$7.25

State income tax rate

None

Right to work laws

Yes

State unemployment tax rate

- 2.70% (new employers)

- 0.32% - 6.32% (experienced employers)

Texas tax and compliance resources

FAQs about paying employees in Texas

Does Texas have a state income tax?

No, Texas does not impose or collect state income tax.

Is Texas a right to work state?

Yes, Texas is a right to work state under § 101.001 et seq. of its annotated labor code.

What are the Texas final pay laws?

In Texas, employees who voluntarily resign from a job must receive their final paycheck by the next regular payday. Involuntarily terminated employees, however, must receive their final paycheck within six days.

Are there Texas work break laws?

No, Texas currently has no laws regarding work breaks.

More than just payroll

Why employers in Texas choose Paylocity

Dallas Stars put HR and payroll pains on ice

By partnering with Paylocity, this NHL franchise streamlined its HR processes, setting the organization up for success through major growth.