Recharge and Airbase by Paylocity: A Single Solution for Multiple Problems

Key Takeaways

- Was in the market for multiple systems, but discovered that Airbaseby Paylocity solved all three needs with one platform.

- Airbase by Paylocity implementation helped facilitate a seamless migration to NetSuite.

- Cut time-to-close from 25–30 days each month to about seven days.

Recharge’s controller expected to adopt several new systems when he reviewed the company’s financial tech stack. In the end, he found everything he needed with Airbase by Paylocity.

Recharge is a fast growing SaaS company providing software to launch and scale subscription-based businesses. Eoin Hession joined the team as Controller with a wealth of experience from his previous roles, including positions as Controller, EMEA & LATAM and Head of Global Financial Shared Services at Airbnb, and Operations Lead at Pfizer.

An unexpected solution: One system instead of three

When Eoin started at Recharge, he immediately identified the processes that needed to change in order to support the company’s aggressive plans for growth. The processes built around company spending were slowing them down, including insufficient reporting from their legacy credit card provider, and an outsourced service for bill paying. The spending process was chaotic and the company’s messy tech stack required a lot of manual effort to move information to their existing accounting system, Xero.

“I envisioned that I would have to implement multiple systems — a new credit card program with improved reporting, an enhanced expense system with more robust control features, and a new bill-paying system.” That plan quickly shifted after an introduction to Airbase by Paylocity. Eoin realized Airbase by Paylocity's integrated spend management platform was the solution for all three areas — and more.

“All of the accountants I have worked with over the years have been crying out for a system like Airbase. It solves a plethora of finance problems.”

Eoin Hession, ControllerOnce he learned about Airbase by Paylocity, Eoin conducted his own due diligence by asking around the controller community. He discovered that “controllers are evangelical about Airbase because it just does what we controllers need it to do.” He was able to provide concrete figures on ROI to his data-driven CFO to make the case for the new system. The timing was perfect, as a number of stakeholders at the company had been asking for increased visibility into department spend — the kind of visibility provided by a spend management solution that manages all facets of company spend. “From what I’ve seen to date, spend management is everyone acting in the best interest of the company,” Eoin explains. “And usually that tends to come a bit later in startups after it becomes really difficult for finance teams to figure out who’s spending what, when, why, and how.”

The fast pace of startups presents further challenges. “They want to move fast and they want to break things. That can be expensive,” Eoin says. “So it’s important to have controls without adding friction with cumbersome processes.” Airbase by Paylocity struck this balance for Recharge.

“The easiest sell for Airbase is the control.”

Eoin Hession, ControllerA pain-free transition, including a seamless migration to NetSuite

Although the benefits of transitioning to Airbase by Paylocity were clear to Eoin and the rest of the finance team, he had some concerns about rolling out a completely new system to Recharge’s already extremely busy employees. He started with a fast, casual training session for the small group of employees and invited them to create a virtual card. The group immediately appreciated the intuitive interface and embraced its use. “Airbase is such a straightforward, user-friendly tool — I was able to easily transition our employees to it,” he remembers.

That warm reception continued as more employees completed onboarding. “There’s a shift in spend culture. We’ve moved away from ‘spend now, ask for approval later.’ It opens the door of transparency from the get-go,” Eoin explains. He describes the reporting capabilities as a “game changer” and notes that he’s already noticed a decrease in zombie spend and other unplanned expenses. The ability to obtain approvals up front has shifted the role of finance in a way that all employees appreciate.

Maximizing ROI with cash back from Virtual Cards

To further increase Airbase by Paylocity's ROI, Eoin has shifted payments to virtual cards whenever possible in order to earn increased cash back. “It is absolutely helping to offset the cost of the platform,” he notes.

Recharge had clearly reached a tipping point in their growth at which cumbersome legacy AP processes weren’t serving them well — the perfect time for an integrated spend management system like Airbase by Paylocity. As is often the case, that growth also surfaced the necessity of an upgrade to a more robust ERP like NetSuite. Recharge went live with Airbase by Paylocity while still using Xero as their accounting system, but shortly afterwards, the team began the often-intimidating process of migrating to NetSuite. To his delight, the migration process was so easy that Eoin describes it as being “like flicking a switch.” He readily acknowledges the role of the Airbase by Paylocity system and team in helping with the migration from Xero to NetSuite. “It felt like the whole project team and the onboarding team were heavily invested in our success.”

“You can’t underestimate how satisfying it is to get those approvals in without any fuss. Users really enjoy it. It gives them a sense of ownership.”

Eoin Hession, ControllerMoving towards continuous accounting

Eoin describes the integration between Airbase by Paylocity and NetSuite as “Phenomenal. It just works seamlessly. You can tell accountants were absolutely involved in building it.” As a result of the integration and the continuous sync of data from Airbase by Paylocity to the NetSuite GL, the Recharge finance team no longer deals with a high-stress monthly close, and a process that used to take 25 to 30 days is now done in less than a week. The extra time has transformed the finance team, and addresses an issue that had long plagued Eoin.

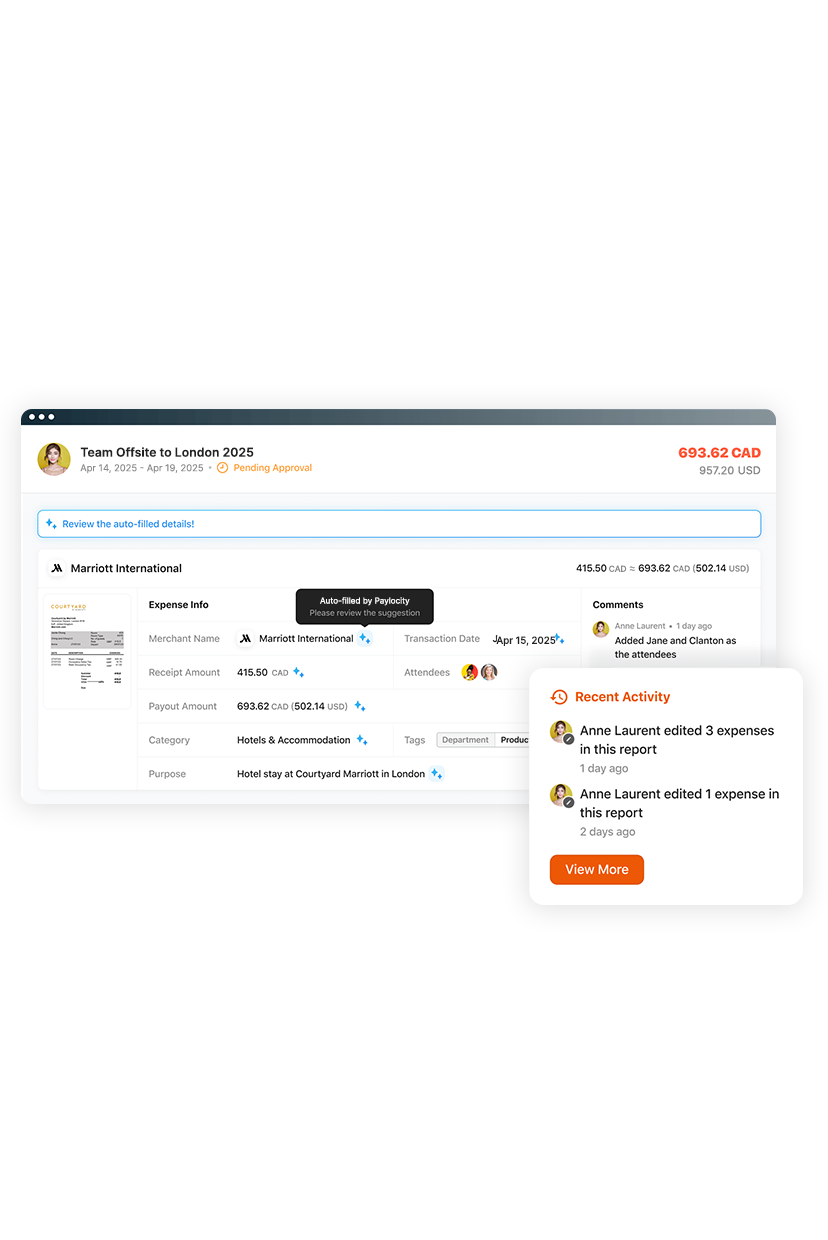

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Airbase by Paylocity automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.

?$Hero-Card$)

?$Hero-Card$)