Individual coverage health reimbursement arrangement (ICHRA)

Summary Definition: A tax-free, employer-funded benefit that reimburses employees for individual health insurance costs and medical expenses.

What is an individual coverage HRA?

An Individual Coverage Health Reimbursement Arrangement (ICHRA) is a specific type of health reimbursement arrangement (HRA) for reimbursing employees for health insurance costs (e.g., premiums, copays, etc.) and other qualified medical expenses.

Introduced as a more flexible alternative to traditional group health plans, ICHRAs offer employers predictable cost control while providing employees with greater freedom in choosing their coverage.

Key takeaways

- An ICHRA is a type of health reimbursement arrangement that allows employers to offer health benefits without sponsoring a group health plan.

- Employers can customize ICHRA administration by employee class (e.g., full-time, part-time, seasonal, etc.), but must follow federal ICHRA rules on eligibility, affordability, and minimum class sizes.

- Employees must enroll in a qualifying individual health insurance plan to use ICHRA benefits, but the offer may impact their eligibility for Affordable Care Act (ACA) marketplace premium tax credits.

What is the difference between an HRA and an ICHRA?

As an HRA, ICHRAs reimburse employers for eligible healthcare costs. However, unlike a standard HRA medical plan, ICHRAs also reimburse individual health insurance premiums and aren’t tied to a group plan. They also have different HRA rules for employers, coverage scopes, and eligibility criteria compared to the standard HRA plan.

| HRA account type | HRA program key features | Best for |

| ICHRA (individual coverage HRA) |

|

Replacing group plans with individual coverage for a segmented or remote workforce |

| GCHRA (group coverage HRA) |

|

Enhancing coverage for employees already enrolled in group health plans |

| QSEHRA (qualified small employer HRA) |

|

Small employers needing a simple, compliant alternative to group health insurance |

| EBHRA (excepted benefit HRA) |

|

Offering supplementary benefits that complement existing group plans |

How does ICHRA reimbursement work?

To receive ICHRA benefits, employees must first enroll in an individual health insurance policy such as an ACA Marketplace plan, Medicare, or other coverage that meets IRS criteria.

When enrolled, they must submit proof of a paid premium or an eligible medical expense to the employer or plan administrator. A health insurance reimbursement is then issued up to the monthly limit set by the employer.

However, employees who accept individual coverage health reimbursement arrangements may lose access to premium tax credits through the ACA marketplace, depending on whether the ICHRA arrangement is considered affordable.

Individual coverage HRA affordability requirement

ICHRA plans are considered “affordable” if the employee’s share of the premium for the lowest-cost plan (after the employer’s reimbursement) is less than 9.96% of their monthly household income. If the offer meets this threshold, the employee and any dependents covered by the ICHRA are ineligible for premium tax credits.

If individual coverage health reimbursement arrangements aren’t affordable, employees may decline the offer and qualify for ACA premium tax credits, provided they meet other eligibility criteria. However, they cannot combine an ICHRA plan with the tax credits.

Other ICHRA plan rules

Aside from affordability, employers and employees with an ICHRA plan must meet several other IRS rules for health insurance reimbursement, including:

- Qualified expense reimbursements: Funds can only be used for IRS-approved medical expenses, including premiums, deductibles, and copays.

- Uniform terms within employee classes: Employers must apply the same plan terms (e.g., reimbursement rules and eligibility) to all employees within a class. However, allowances may vary (up to a 3:1 ratio) by employee age or family size.

- Advance written notice: Eligible employees must receive a detailed written notice at least 90 days before the plan year begins, or upon becoming newly eligible. The notice must outline how the ICHRA insurance works and how it may impact premium tax credit eligibility.

- Plan flexibility: Employers can set monthly reimbursement limits and define eligible expenses, as long as they follow regulatory guidelines and apply them consistently within each class of employees.

Who can use an individual coverage health reimbursement arrangement?

Any company, from small businesses and startups to large corporations, can implement ICHRA plans. This lack of size requirements makes ICHRA health insurance an appealing option for employers seeking to offer flexible health benefits without the administrative burden of a group health insurance plan.

Moreover, applicable large employers (ALEs) can use an individual coverage health reimbursement arrangement to meet the ACA's coverage requirements, provided the arrangement meets the ACA's affordability and minimum value standards.

For employees, one of the key advantages of an ICHRA is its ability to support varied benefit levels across different employee classes, including:

- Full-time, part-time, and seasonal employees

- Salaried and non-salaried employees

- Employees in different geographic locations and abroad

- Employees working under a collective bargaining agreement

- Temporary employees from a staffing agency

- A combination of the above categories

ICHRA pros and cons

Like any health benefits model, individual coverage health reimbursement arrangements come with notable advantages and trade-offs.

| ICHRA pros | ICHRA cons |

| Personalized coverage: Employees have the freedom to choose plans that meet their unique needs, rather than being limited to a group plan. | Employee learning curve: Workers must understand how to research and enroll in individual health insurance. |

| Tax-advantaged: Reimbursements are exempt from income and payroll taxes for both employers and employees. | Impact on tax credits: Employees offered an affordable ICHRA plan lose eligibility for ACA premium tax credits. |

| Simplified administration: ICHRA plans eliminate the employer’s need to sponsor or manage a group health plan, while still satisfying ACA guidelines. | Compliance complexity: Employers must manage ICHRA classes, affordability rules, notices, and eligibility verification. |

| No contribution limits: Employers can offer any amount they choose every month. | No dual offerings: Employers can’t offer a group plan and ICHRA health insurance to the same employee class. |

Other individual coverage HRA considerations

For employers, one of the most important ICHRA healthcare considerations is determining which employee classes will receive the offer and whether to customize offerings between classes.

Timing, though, is also crucial, especially when it comes to enrollment windows. Launching an Individual Coverage HRA at the beginning of a calendar year, for example, allows employees to align with the ACA Marketplace’s open enrollment period. Conversely, starting an ICHRA mid-year may require a special enrollment period (SEP) for employees to select new individual coverage.

For employees, using ICHRA health insurance requires a far more active role in health insurance participation and decisions. Unlike traditional group health insurance with an HRA account, where enrollment is automatic or managed by the employer, Individual Coverage HRA participants must research and enroll in their own qualifying coverage.

For instance, if the ICHRA plan is considered affordable, employees should be aware of its impact on other ACA benefits, such as premium tax credits. In other words, employees need to recognize the additional responsibilities that come with using ICHRA insurance and exercise caution accordingly.

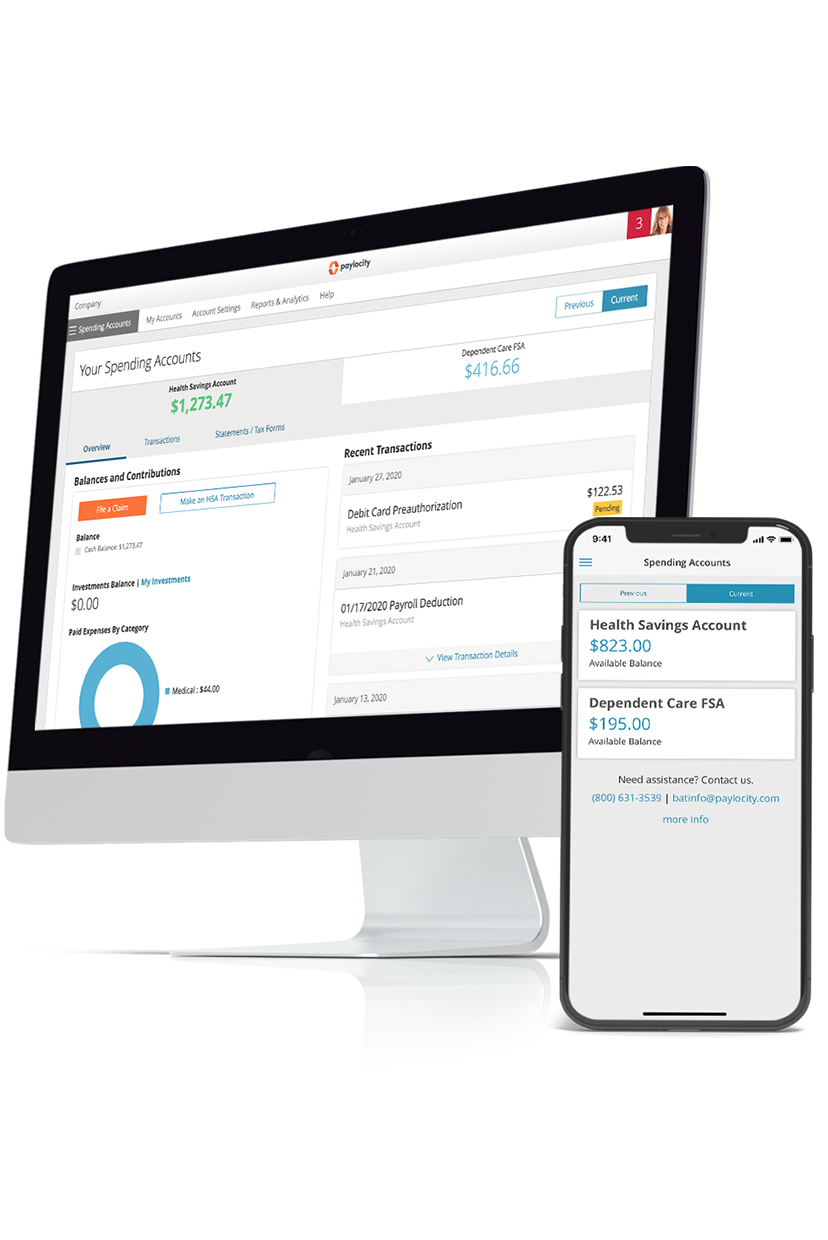

Flexible Benefits, Anytime, Anywhere

Simplify benefits management with an all-in-one platform that connects seamlessly to Payroll. Say goodbye to endless questions about balances and policies across multiple providers. With our Flexible Benefits solution, employees can manage their benefits from one place, while you save time, ensure compliance, and reduce costs. Maximizing third-party administrative offerings has never been easier — for you and your team.