Spend Management vs. Expense Management: What’s the Difference?

"I paid for six floppy disks by check — I'll fill out the expense report and fax it to you."

How would you react if a colleague said this? Probably with a double-take, wondering if you’d slipped into a time warp. Language and technology are constantly evolving, and what’s cutting-edge today can quickly become as obsolete as a Blackberry.

Using outdated terminology might make you sound old-fashioned, but relying on obsolete technology can be far more costly. A recent Snaplogic survey of business leaders found that legacy technology is costing businesses big — nearly $3 million a year. On top of that, the cost of maintaining these old systems keeps climbing, putting even more pressure on company resources.

Many traditional expense management processes are a prime example.

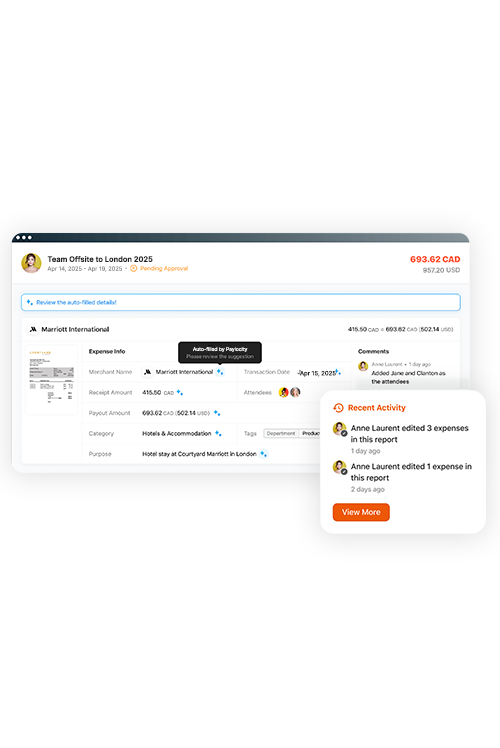

The tedious task of filling out expense reports has become a relic of the past thanks to advancements in spend management. Modern tools, powered by automation and generative AI, have transformed this process into something far more intuitive and efficient — leaving outdated methods in the dust.

Key Takeaways

- Expense management focuses on tracking employee spending, while spend management encompasses all non-payroll expenses with greater efficiency through automation.

- Spend management streamlines procurement, accounts payable, corporate cards, and expense tracking in one platform, providing real-time visibility and improved cost control.

- Automated spend management tools reduce errors, enhance compliance, and improve financial decision-making with real-time data insights.

What is Expense Management?

Expense management is the process of tracking, reporting, and reimbursing employee expenses incurred during business operations. This includes travel, meals, software purchases, and other workforce-related costs.

For years, the process of managing employees’ expenses, particularly around T&E spending, relied on employees paying for something up front, then begrudgingly filling out an expense reimbursement request and attaching a receipt.

The advent of expense management software revolutionized the process by digitizing key steps. Employees can now easily submit requests, attach receipts, and monitor approval statuses — all in one streamlined system.

While this innovation has eliminated much of the manual, paperwork-heavy processes of the past, it’s not without its challenges. For instance:

- Filling out expense reports can be time-consuming and prone to errors.

- Receipts are often lost, resulting in incomplete records.

- Delays in approvals and reimbursements can burden employees and create inefficiencies.

- Administrators struggle to analyze spending in real time, leading to poor decision-making and compliance risks.

Expense Management Example

What does expense management look like in practice?

Let’s say a software company sends its sales team to a three-day conference in New York City and uses an expense management platform to streamline costs.

Employees log expenses like flights, hotels, meals, and transportation in their organization’s expense management app, which automatically checks compliance with company policies (e.g., economy flights, $350/night hotel cap, $75/day meal allowance).

After the trip, the system routes expenses to the correct approvers based on policy rules, and processes reimbursements once approved. Some expense management platforms can even route reimbursement funds directly to the employees’ bank accounts.

What is Spend Management?

Spend management builds on the foundation of expense management but takes it several steps further. It’s a comprehensive approach to controlling and optimizing all types of non-payroll business spending, combining four key functions into a single platform:

- Procurement: Acquiring goods and services.

- Accounts payable (AP): Managing vendor invoices and payments.

- Corporate cards: Enabling seamless company card transactions.

- Expense management: Simplifying employee reimbursement and expense tracking.

Unlike traditional expense tools, spend management integrates these processes into one system for end-to-end visibility and control. Automation and generative AI power the platform, ensuring accuracy and efficiency while reducing manual work.

Spend Management Example

How do spend management and expense management work together to simplify purchasing and payments? Let’s explore a hypothetical scenario:

For example, a mid-sized retail company uses a spend management platform to streamline its financial operations.

- Procurement: The company’s marketing team needs to order $15,000 worth of promotional materials for an upcoming campaign. They submit a purchase request through the platform, which routes it to the procurement manager for approval. When approved, the system automatically generates a purchase order and sends it to the vendor.

- Accounts payable: After the vendor delivers the materials, they send an invoice for $15,000. The platform matches the invoice with the purchase order and delivery receipt, ensuring accuracy before routing it to accounts payable for final approval. The payment is processed directly through the platform, eliminating manual data entry.

- Corporate cards: The company issues corporate cards to team leads for smaller, day-to-day purchases like office supplies or client lunches. These cards are linked to the spend management platform, which tracks transactions in real time. For example, a team lead uses their card to buy $200 worth of supplies, and the system automatically categorizes the expense and flags it as compliant with company policy.

- Expense Management: Employees attending a trade show use the platform’s mobile app to log travel expenses, such as flights, hotels, and meals. Receipts are uploaded and matched to pre-set allowances (e.g., $300/night for hotels, $60/day for meals). Any out-of-policy expenses, like a $400 hotel night, are flagged for review before reimbursement.

Each transaction is automatically booked to the general ledger, creating a full audit trail. At the end of the month, the platform can generate comprehensive reports consolidating all spend data —procurement orders, vendor payments, corporate card transactions, and employee expenses. This gives the finance team a clear view of spending trends, helps identify cost-saving opportunities, and ensures compliance with budgets and policies.

Spend Management vs. Expense Management

Here's a breakdown of how spend management and legacy expense management processes differ:

| Legacy Expense Management | Comprehensive Spend Management | |

|

Scope & Functionality |

Focuses on employee-initiated expenses like travel or meals, largely limited to tracking, approving, and reimbursing spend. | Provides a holistic picture, covering all non-payroll expenses, including procurement and vendor payments, with broader capabilities to manage overall company spending. |

| Automation & AI | Some tools, like digital expense reports, offer improvements over manual processes but still require hands-on input for data entry and approvals. | Features like optical character recognition (OCR) extract details from receipts automatically, while automated approval workflows and real-time data sync save time for both employees and finance teams. |

| Financial Control & Visibility | Limited to post-analysis of spending, with delays in data availability resulting in missed budget insights. | Enables real-time reporting and analytics. Businesses can monitor budgets, ensure compliance, and make better financial decisions with greater agility. |

| Stakeholder Alignment | The separation of tools and departments often leaves gaps in approvals or creates workflow bottlenecks. | Centralizes and aligns all stakeholders by integrating approvals and workflows into one platform, reducing miscommunication and errors. |

Benefits of Integrated Spend Management for Modern Businesses

Adopting broader spend management unlocks several key advantages for organizations of all sizes, helping them optimize financial processes and drive better outcomes. Here's how:

1. Real-Time Data

Spend management platforms provide instant visibility into financial activities across the organization. This real-time access allows businesses to monitor spending trends, detect potential issues early, and improve forecasting accuracy.

With a clear overview of financial health, companies can make proactive adjustments to stay on track with budgets and goals.

2. Streamlined Workflows

Manual processes like invoice processing, approvals, and reimbursements can be time-consuming and prone to errors.

Spend management platforms automate these tasks, saving employees significant time and effort while reducing the risk of mistakes. This automation enhances efficiency, allowing teams to focus on strategic initiatives rather than administrative tasks.

3. Enhanced Compliance

Spend management solutions come with integrated approval hierarchies and customizable workflows to ensure consistent policy enforcement and budget adherence across all departments. These platforms reduce compliance violations and minimize fraud risks, helping to maintain financial integrity and foster trust within the organization.

4. Better Financial Decision-Making

With generative AI-enabled functionalities, spend management platforms provide actionable insights and analytics in real-time. These solutions provide a clear understanding of spending patterns and financial health. This empowers businesses to make informed decisions, allocate resources effectively, and plan strategically for the future.

Incorporating spend management into your organization’s workflow is not just about saving time. It's about building a foundation for smarter, more informed financial operations.

Stop Uncontrolled Spend with Paylocity for Finance

Optimize your company’s spend management with Paylocity for Finance. Get real-time visibility, faster financial close, improved planning, and stronger financial controls.