Building Business Expense Reports: What to Include, Avoid, and Automate

Every dollar spent on behalf of your company should start and end with an accurate expense report.

When done right, expense reporting gives finance teams the visibility they need to manage budgets, stay compliant, and close the books with confidence.

Whether you're an employee tracking business travel or a finance pro standardizing submissions, expense reports are essential for transparency and control. This guide breaks down the components of expense reporting, explores different types of reports you might encounter, and provides tips on building an efficient, accurate, and audit-ready process.

Let’s get into the details — and eliminate the guesswork.

Key Takeaways

- An expense report records business-related expenses incurred by employees, used for reimbursement and financial tracking.

- Accurate and timely expense reporting supports better financial visibility, compliance, and budgeting across the organization.

- Common mistakes include misclassified expenses, missing receipts, and delayed submissions, leading to compliance risks, budget inaccuracies, and frustrated employees. Clear policies and the right tools prevent these issues.

What is Expense Reporting?

Business expense reports track expenses incurred by individuals within a business while performing their job responsibilities. Typically, an employee submits a business expense report to provide verification that they spent money related to their job.

Expense reporting is a systematic approach to tracking, managing, and analyzing business spending. Expense reports are important in helping businesses maintain financial control, ensure compliance, and make informed decisions to optimize resources.

But, despite their importance, completing expense reports has long been one of the most hated tasks among employees.

If you’ve ever returned from a business trip with a crumbled pile of receipts, you know that pain. And it doesn’t help that most legacy expense reporting solutions are cumbersome and slow.

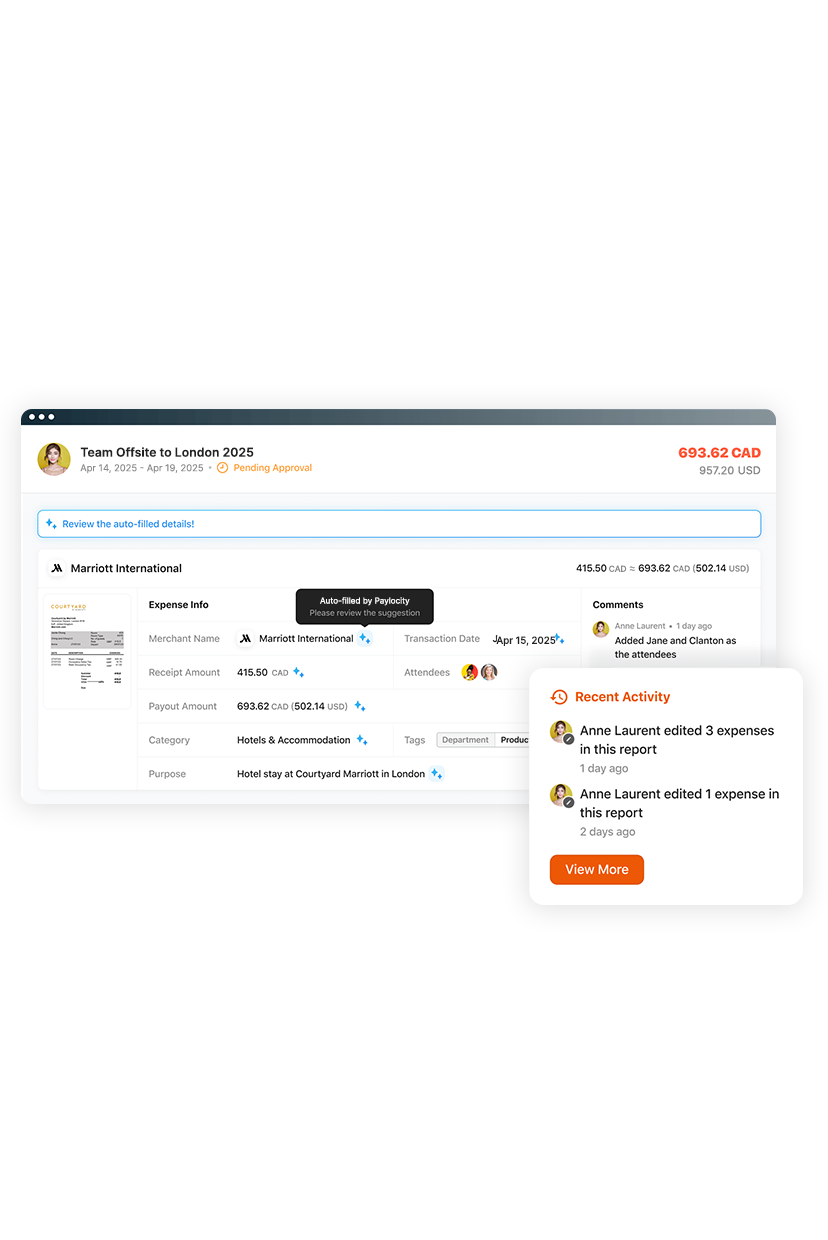

Fortunately, modern expense reporting software now leverages new generative AI technology to make this often-dreaded process more accurate and much easier for employees.

Let’s take a closer look at business expense reports and how your business can optimize the process.

Types of Expense Reports

Expense reports can be categorized based on different business tracking needs. Here’s an overview of each category:

Monthly expense reports:

- Purpose: These reports capture all expenses incurred by employees over a one-month period.

- Suitability: Well-suited for tracking regular monthly operational expenses, such as utilities, office supplies, and subscription services.

- Benefits: Provides a comprehensive overview of ongoing monthly expenditures and facilitates budget planning.

Long-term expense reports:

- Purpose: Focuses on expenses that occur over an extended period, often spanning several months or even years.

- Suitability: Ideal for tracking major capital expenditures or projects with long-term costs, such as equipment purchases, facility renovations, or software development.

- Benefits: Offers insights into the total cost of long-term projects and helps manage cash flow over an extended timeline.

Recurring expense report:

- Purpose: Tracks expenses that repeat regularly, such as monthly or quarterly subscriptions, lease payments, or insurance premiums.

- Suitability: Useful for managing fixed and predictable expenses that recur regularly.

- Benefits: Enables businesses to identify and plan for recurring financial obligations, ensuring timely payments and budget predictability.

Travel and entertainment (T&E) expense reports:

- Purpose: Travel expense reports are specifically designed to track expenses related to business travel and entertainment.

- Suitability: Essential for businesses with employees who frequently travel for work or incur entertainment expenses on behalf of the company.

- Benefits: Facilitates reimbursement for travel-related expenses such as flights, accommodations, meals, and client entertainment. Helps monitor travel budgets and ensures compliance with travel policies.

How to Create Effective Business Expense Reports

Here are some tips on how to streamline expense reporting:

1. Clarify What Counts as a Business Expense

The first step is always alignment — especially between employees and finance. A well-documented expense policy prevents a flood of gray-area purchases.

Most reimbursable expenses fall into buckets like travel, meals, lodging, office supplies, client entertainment, or job-related software. Make sure every employee understands what qualifies and how to document it. That’s where policy documents, onboarding guidance, and just-in-time reminders come into play.

From a finance perspective, each category should tie directly to your chart of accounts. That way, expense data flows cleanly into your general ledger (GL) without constant cleanup.

2. Collect Proper Documentation (Receipts Matter)

Receipts are the backbone of audit readiness, and they protect both employees and the business. While a $4 coffee might seem harmless, scaled across hundreds of employees, even small undocumented transactions add up to risk.

Encourage digital capture over paper shuffling — whether that’s through mobile receipt scanning apps, expense software, or forwarding email receipts. The more seamless the process, the more likely people will comply.

Ideally, receipts should be attached to each transaction with enough detail to verify amount, vendor, date, and business purpose, so you have a clean audit record.

3. Standardize the Submission Format

Whether using spreadsheets, Google Forms, or a dedicated expense platform, the data you collect should be consistent and structured. Every submission should include the transaction date, vendor, amount, purpose, category, and an associated GL code or department tag.

If you're still operating in spreadsheets, lock the format. If you’re using a dedicated spend management solution, ensure your templates align with backend accounting rules. This keeps the submission process cleaner and makes reconciliation easier.

If your expense management platform automates expense approval requests, determine the approval workflows by role, dollar amount, and expense type. That will ensure each request is routed to the correct approver.

Expense Report Template

To make things easier (and avoid the back-and-forth), use a standardized expense report template (like the one below). It includes all the key details approvers and finance teams need to process reimbursements quickly and accurately.

|

Report Name |

Dates |

||||

|

Approvers |

Total Amount |

||||

|

Employee |

Date |

Merchant |

Receipt Amount |

Category |

Purpose |

4. Educate on Proper Categorization

Employees don’t need to memorize your GL structure, but they do need to know which categories are appropriate for which types of spend. Even better: use a platform with AI and machine learning that automatically categorizes expenses for greater accuracy and less hassle.

At minimum, each report should flow logically into your expense accounts—travel, meals, software, and so on. This keeps your actuals accurate and budget comparisons meaningful.

5. Layer in Approvals and Controls

Good expense management is about accuracy and governance.

Build a review process that fits your risk profile. Most companies use a tiered approach: a direct manager approves first, followed by a finance or AP review for policy compliance. You also might add extra review steps for high-dollar items or exceptions to policy.

For maximum efficiency, invest in a spend management solution that allows for approval workflows customized to your organization’s expense policies.

It should also allow you to easily configure mandatory fields, set submission timeframes, and establish budget limits. If an employee submits a request that is outside company policy, it will be flagged or blocked.

6. Reconcile, Report, and Pay Out

After reports are approved, match expense line items to corporate card statements, verify totals, and flag any duplicates. You can often automate this reconciliation if your system integrates with your accounting platform. Otherwise, consistency in format (see step three) will save you time.

Once verified, process reimbursements promptly. Employees appreciate timely payouts, and it reduces noise for you. Most finance teams set a service-level agreement for reimbursements.

Learn More: Guide to Employee Expense Reimbursement

Common Pitfalls in Expense Reporting

Lack Of Discipline Around Indirect Expenses

When there’s no clear oversight of indirect expenses, like office supplies, travel, or software subscriptions, costs can quickly spiral. Legacy procurement tools offered control, but were too complex for many mid-market teams and lacked a user-friendly experience.

As a result, employees weren’t sure what was in policy, stakeholders were left out of the loop, and finance teams spent far too much time cleaning up after the fact.

Without structure, duplicate expenses, policy violations, and budget surprises become the norm, not the exception.

Misclassifying Expenses

When spending is assigned to the wrong category, reporting becomes distorted, decision-making suffers, and budgets veer off track. It can also cause compliance issues, especially when expenses are filed incorrectly for tax or regulatory purposes, putting potential deductions at risk or opening the door to penalties.

Precise categorization improves visibility, helps surface cost-saving opportunities, and ensures clean, reliable financial data across the organization.

Delayed Submissions

Delayed expense reports don’t just inconvenience employees, they create ripple effects across financial operations.

Late submissions slow down month-end close, disrupt forecasting, and reduce your ability to track real-time spend. From the employee side, delays in reimbursement can lead to frustration, strained personal finances, and lower morale. Over time, a lax reporting culture can weaken policy compliance altogether.

The fix? Clear expectations, automated reminders, and an intuitive submission process that make it easy to stay on track.

Stop Uncontrolled Spend with Airbase by Paylocity

Optimize your company’s spend management with Airbase by Paylocity. Get real-time visibility, faster financial close, improved planning, and stronger financial controls.

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Paylocity for Finance automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.