A Primer on Employee Mileage Reimbursement

Today's workforce is increasingly remote—but until we're all working from the metaverse, business travel will continue to be a reality for many.

But with company cars becoming somewhat of a dated concept, employees today are most likely driving their personal vehicles and then requesting a reimbursement later. Some may even use a rideshare or other non-traditional means of transportation.

Are your employee mileage reimbursement policies up to speed?

While this may sound like a straightforward question, there are actually several nuances for organizations to consider before adopting such a policy. In the following guide, we’ll cover what mileage reimbursement is, address how organizations can manage a policy for it, and answer some frequently asked questions on the subject.

Key Takeaways

- Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes.

- Companies can choose to reimburse the exact amount an employee incurred on the trip or use a specific preset rate for each mile. The IRS provides an optional standard mileage rate.

- Not just any expense or mile driven for work qualifies for reimbursement. Daily commutes aren't eligible.

What is Mileage Reimbursement?

Mileage reimbursement is the amount a company pays an employee to cover the costs of driving a personal vehicle for business purposes. Per the Internal Revenue Service (IRS), companies can choose to reimburse the actual amount an employee incurred on the trip or use a specific rate for each mile the employee drove, usually less than $1 per mile. The IRS further provides a standard mileage rate, but businesses are free to choose a different one if they wish.

However, not just any expense or mile driven for work qualifies for reimbursement. For example, daily commutes to and from your normal workplace aren’t an eligible transportation expense. Instead, qualified transportation expenses include:

- Getting from one office to another within the same city

- Visiting a client or customer

- Attending a business meeting somewhere other than your normal office

- Going from home to a temporary workplace that is not your normal office

Read More: Guide to Employee Expense Reimbursement

2025 Standard Mileage Reimbursement Rate

The IRS annually publishes a standard mileage reimbursement rate organizations can adopt or use as a barometer to choose their own mileage rates. The 2025 mileage reimbursement rates are as follows:

| Amount Per Mile Driven | Purpose | Change from 2024 Rate |

|---|---|---|

| 70 cents | Regular business use | 3 cent increase |

| 21 cents | Medical or moving work (active-duty military) |

Unchanged |

| 14 cents | In service of a charitable organization | Unchanged |

Federal Mileage Reimbursement Laws

Currently, there is no federal law that requires an organization to reimburse its employees for using a personal vehicle for business purposes. California, Illinois, and Massachusetts, however, do have state laws requiring mileage reimbursement.

This is not to suggest, though, there are no legal considerations for adopting a mileage reimbursement policy. For instance, the Fair Labor Standards Act (FLSA) does require employers to reimburse nonexempt employees for any business-related expenses if those expenses cause the employee's wages to fall below the federal minimum wage.

Additionally, mileage reimbursements are not considered "income" by the IRS, and therefore are nontaxable provided the reimbursement is equal to the incurred expenses. If a reimbursement is more than the expenses, the employee needs to return the extra amount, or it will be treated as taxable income.

Also, under the Tax Cuts and Jobs Act (TCJA), employees cannot claim unreimbursed expenses as deductions. Self-employed individuals, however, can claim deductions for all expenses related to owning and operating a car used for business purposes. If their car is used for both personal and business purposes, they can only claim deductions for the business-related expenses.

How Do You Calculate Mileage Reimbursement?

Calculating the correct amount for a mileage reimbursement is quite simple when using the IRS' standard rate. Employers only need to multiply the current rate (70 cents or 0.70 dollars) by the total number of miles an employee drove for business purposes. For example, if Employee A drove 300 miles during the last pay period, her or his employer could provide either of the following as a mileage reimbursement:

| Per Mile Rate | Actual Costs |

|---|---|

| [Total Miles] x [Rate Per Mile] = [Total Reimbursement] 300 x 0.70 = $210 |

[Gas] + [Fuel Cleaner] + [Wiper Fluid] + [Tolls] + [Air for Tires] = [Total Reimbursement] 175 + 15 + 20 + 20 + 5 = $235 |

How to Manage a Mileage Reimbursement Policy

Now that we have the basics buckled in, it's time to switch gears to look at how an organization should establish, manage, and enforce a mileage reimbursement policy.

Mileage Reimbursement Policy Tips

Organizations are normally not required to provide mileage reimbursements to employees, so there is substantial freedom with how to craft and adopt a mileage reimbursement policy.

One of the most important steps to remember is to consider local and regional expenses that vary based on distances. For example, gasoline prices differ from city to city, as does the overall cost of living. Therefore, the average expenses incurred by organizations in California and Utah are going to be very different, and each business should craft their reimbursement policies accordingly so as not to accidentally over- or under-reimburse an employee.

Regardless of geographic location, the policy should also require basic driving standards (i.e., drivers have a license, the car meets safety requirements and is insured, etc.) and provide the specific methodology used to calculate reimbursements. Finally, organizations should clearly communicate the policy to all employees as it would with any other employment policy or compliance requirements.

Reimbursement Methods

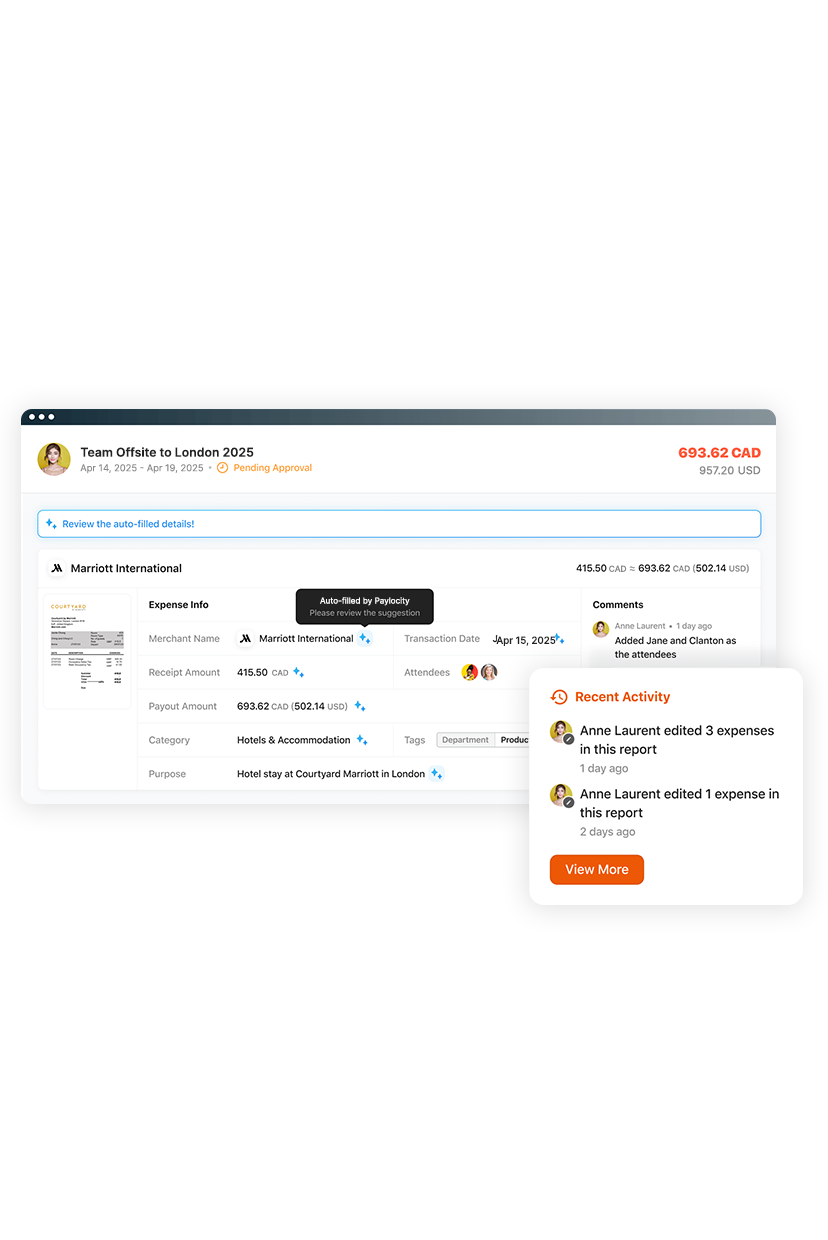

The easiest way to reimburse employees is with an automated expense management platform that tracks submitted expense reports and helps calculate amounts based on the organization's reimbursement policy. It helps if the expense management platform is integrated with your payroll software so reimbursements can be deposited directly into each employee's paycheck.

Adequate Recordkeeping

One final detail organizations should consider is how they store records of submitted expenses and mileage reimbursements. The IRS has specific guidelines for the evidence used to prove expenses and reimbursements, when to record said evidence, and how the evidence should be stored.

Mileage Reimbursement FAQs

Do organizations have to use the IRS' standard mileage rate?

No, organizations can choose to reimburse employees with a different rate but should remember to not over- or under-reimburse employees, as both scenarios have negative consequences for the employee or organization. Companies can instead choose to avoid rates entirely and just reimburse the actual costs an employee incurs while driving for business purposes.

Are mileage reimbursements taxable?

If the reimbursement is based on the IRS' standard rate and equals the expenses incurred by the employee, then no, the reimbursement is not considered taxable income, and the organization may even claim tax deductions for the reimbursed amounts. If an employee is over-reimbursed, then taxes will need to be paid on the overage if the employee does not return it to the organization.

What is a FAVR plan?

A Fixed and Variable Rate (FAVR) plan is when an employer uses both a flat amount (fixed) and a standard mileage rate (variable rate) to reimburse driving costs. The flat amount can go towards more long-term costs, such as car insurance premiums or depreciation of the vehicle, while the mileage rate can cover more immediate costs, such as gas, tolls, etc., based on the varying number of miles an employee drove in a given timeframe.

Why Use Paylocity to Drive Your Mileage Reimbursement Policy?

Mileage reimbursements may not be required by federal law, but having a reimbursement policy can still be a valuable way to improve employee sentiment and retention.

Make it as smooth as possible with a robust Expense Management tool like Paylocity, which allows employees to easily record expenses, submit to supervisors, and receive their reimbursement in a single, integrated payroll platform.

And with the Paylocity Mobile App, it’s an even smoother ride, empowering employees and supervisors to handle all expenses on the go. Request a demo today!

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Airbase by Paylocity automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.