Guide to Employee Expense Reimbursement

Expense reimbursements: a necessity of business travel and other work-related costs.

It’s no secret that keeping track of expenses can be a headache for both employees and employers. The treacherous waters of paperwork, receipts, and mileage rates might feel overwhelming, especially when organizations rely on manual processes.

Of course, an expense management tool makes the process relatively easy, but it never hurts to lay the foundation with a solid grasp of how employee expense reimbursements work.

Key Takeaways

- Employee reimbursement is when an employer pays an employee back for costs incurred while on the job.

- This can include travel expenses, mileage, and other business-related expenses the employee paid for out of pocket.

- The Fair Labor Standards Act (FLSA) mandates that employers reimburse employees for expenditures that are crucial for the worker to fulfill their job.

What is Employee Reimbursement?

Employee reimbursement is the process of an employer paying an employee back for costs incurred while on the job. This can include travel expenses, mileage, and other business-related expenses the employee paid for out of pocket.

To that end, employers typically have a set of guidelines and policies in place for what expenses are eligible for reimbursement and what documentation is required for the employee to be reimbursed.

If your organization has yet to create a reimbursement policy, know that it’s worth the effort — it can maximize tax benefits for both you and your employees, and it gives employees the guidance and guardrails that will help them manage expectations.

The Fair Labor Standards Act (FLSA) does not require employers to offer employee reimbursement for every single expense, but it does require employers to reimburse employees for job-related expenses that are necessary for the employee to perform their job. It also states if the cost of an expense would bring a nonexempt employee's pay below the federal minimum wage, the employer must increase the employee's pay to make up the difference.

The short version is that employees are reimbursed for the unavoidable expenses directly related to their jobs, especially when those expenses lower their pay below the minimum wage. But it’s not limited to necessities — employers can also opt to reimburse other types of expenses.

Types of Reimbursable Expenses

Employers have a fair amount of discretion when choosing which employee expenses to reimburse, but there are a few that are common among organizations.

Gas

Employees may be reimbursed for gas if they use their personal vehicle for work-related travel. This is known as mileage reimbursement. The employer will normally have a set reimbursement rate per mile that employees can claim for business-related travel, or an organization can choose to reimburse actual costs incurred. Each employee will need to keep track of their business-related miles and submit them for reimbursement, along with any required documentation.

The reimbursement rate can vary by company, but the Internal Revenue Service (IRS) annually publishes a standard mileage rate that many dictates how much a taxpayer can deduct for qualifying transportation expenses. Companies may use the IRS rates as published or use the rates as a guide for setting their own internal reimbursement policies.

Travel

When employees must travel for work, they may be eligible for travel reimbursement. This typically includes lodging, meals, transportation, and any other necessary expenses. Some companies may instead use a per diem or set daily allowance for meals and incidentals, so employees don’t have to submit the particulars.

It's important to note that some organizations limit what type of travel they’ll reimburse. For instance, they’ll pay back air or train fare but not gas for a non-company vehicle (leave the gas guzzler at home) or Uber rides. Evaluate what makes the most sense for your employees’ situations.

Tuition

Tuition reimbursement is a great benefit for employees who want to further their education or improve their skills, and it doesn’t have to be expensive. Organizations can opt to reimburse employees who choose to continue their education and help cover the costs of their tuition and related expenses as a way to invest in their employees' professional development, thus encouraging employees to stay with the organization.

Organizations with this type of reimbursement policy should detail which courses are eligible for reimbursement and how to document them properly. Some may require the courses be directly related to the employee's current or future job responsibilities, while others may be more lenient.

Employees will usually need to submit their grades and any other required documentation to their employer to receive reimbursement, which may be deposited as a lump sum or disbursed after the employee pays for the tuition. Some organizations also have a cap (oftentimes $5,250, for tax deduction purposes) on the total amount of tuition reimbursement they pay out per year.

Health Insurance

For many, health insurance is a major factor when deciding where to work, especially after facing the challenges of a pandemic. Employees are prioritizing health benefits now more than ever, and health insurance premiums can be expensive. Access to health insurance through an employer can offset costs and provide a desirable safety net for employees.

Can employees get reimbursed for health insurance? It’s a popular question, and the short answer is yes — if the employer offers this type of reimbursement as a benefit.

In these cases, the employer sets aside a certain amount of money for each employee to use toward their health insurance premium. Employees can then choose the health insurance plan that works best for them and their families, and the employer will reimburse them for the premium cost (or a portion of it).

This can help make health insurance more affordable for employees, and it’s a way for employers to attract and retain talent.

What Types of Expenses Aren't Always Reimbursable

Beyond understanding which expenses are most commonly reimbursable, employees and employers should understand that there are also types of employee expenses that aren’t reimbursable under most company policies:

- Personal expenses, such as clothing or grooming products, unless they are required for the job.

- Commuting costs, such as gas or public transportation fares, for employees who are not required to travel as part of their job.

- Meals and entertainment expenses, unless they are directly related to business and have been previously approved by the employer.

- Costs associated with relocating for a job, such as temporary housing or storage fees, unless they have been previously agreed upon by the employer.

Of course, these expenses vary among organizations — some employers might offer tuition reimbursement, others might reimburse gym memberships or other wellness activities, and still others might reimburse commuters. It all depends on how you choose to invest in your employees.

Process of Expense Management

The expense management process normally includes the following steps:

- Employee submits an expense report: The employee incurs an expense related to their job, such as travel or office supplies, and then submits an expense report to their employer. This report should include receipts with all the relevant details about the expense, such as the date, amount, and purpose.

- Manager approves the report: The employee’s manager reviews the expense report to ensure it’s valid and complies with company policy. If the expense is approved, the manager will sign off on it.

- The expense is recorded in the accounting system: The approved expense is recorded in the company’s accounting system, which is used to track all financial transactions.

- Employee is reimbursed: The employee is reimbursed for the approved expense. This can be done through a direct deposit, check, or other method the company uses.

- Company analyzes reports: The company uses the expense data to generate reports and conduct analysis to identify areas where they can improve their expense management process.

Tax Accounting

Depending on the type of plan an organization uses, expense reimbursements may be considered taxable income for the employee, and the employer may be required to report it on the employee’s W-2 form.

There are two types of expense reimbursement plans: accountable plans and nonaccountable plans. For a plan to be considered accountable, employers must have proper documentation and meet IRS requirements.

If a reimbursement plan is deemed accountable, the reimbursements are not considered taxable income to the employee. However, if a reimbursement plan is deemed as nonaccountable, the reimbursements are considered taxable income, and the employer is required to report it on the employee's W-2 form.

Employers should always consult with a tax professional to ensure their expense reimbursement plan is compliant with the IRS requirements and they’re properly reporting the reimbursements for tax purposes.

Employee Records

Employee expense reimbursements can have an impact on employee records in terms of payroll, taxes, and compliance. Employers should ensure they’re properly tracking, reporting, and documenting reimbursements to maintain accurate employee records and comply with regulations.

For example, if your organization’s expense reimbursement plan is deemed nonaccountable, the reimbursements are considered taxable income to the employee. This impacts their gross pay, which is subject to payroll taxes, and their W-2.

How Long Should a Reimbursement Take?

The typical timeline for employee expense reimbursements varies depending on the organization’s policies and procedures, the complexity of the expenses, and any disputes or issues that may arise during the process.

Some employers may have a specific deadline for submitting expenses, while others may have a rolling deadline. There may be a set timeline for when reimbursements will be issued, while others may issue reimbursements on a more ad-hoc basis.

Disputing an Expense

When an employee expense is disputed, it means there’s a disagreement between the employee and the employer over the expense’s reimbursement eligibility. This can happen for a variety of reasons, such as a lack of proper documentation, a disagreement over the business purpose of the expense, or a question about whether the expense falls within the employer's reimbursement policy.

Organizations should have a process in place for resolving the dispute and should handle the situation in a timely manner while providing clear explanations of the outcome.

Benefits of Expense Management Software

Employee reimbursement software can be a real game-changer for organizations – and the right expense management software can benefit you and your employees almost immediately. Expense management solutions can make the expense reimbursement process more efficient through:

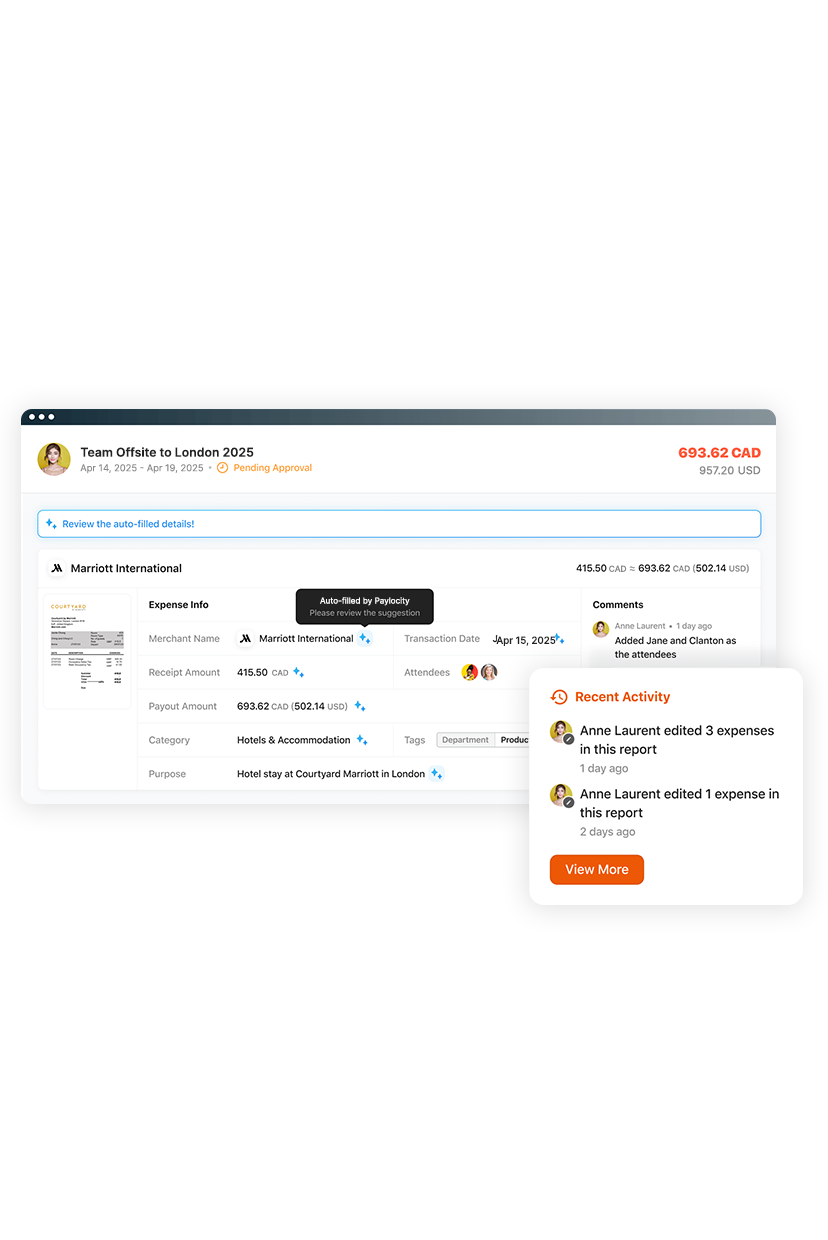

- Automation: Save time by automating the tasks involved in the reimbursement process, including tracking expenses, calculating mileage, and generating reports.

- Convenience: Let employees easily submit their expenses and track the status of their reimbursements by uploading receipts and other required documentation right from their computer or mobile device.

- Accuracy: Ensure that expenses are submitted, tracked, approved, and calculated correctly to prevent errors and disputes.

- Visibility: See all submitted expenses, the status of reimbursement, types of expenses, and more to give you collective insights for strategic decision-making.

- Compliance: Maintain compliance with the FLSA and other regulations related to expense reimbursements.

Change the way you manage expenses and get time back in your day with our expense management solution so you can eliminate spreadsheets, calculators, and signatures along the way with a tool built directly into your payroll software.

Seamless and Adaptable Expense Management

Manual expense reporting wastes time and frustrates employees and finance teams. Airbase by Paylocity automates the entire process with AI-powered, touchless workflows. Simply snap a receipt and get reimbursed fast — no spreadsheets, no delays. Finance gets real-time visibility, accurate coding, and a faster month-end close.