Tired of juggling multiple benefits providers? Manage account activity from one system, connect seamlessly to payroll, and unlock convenience, time-savings, and cost savings.

Flexible Employee Benefits Platform

Benefits made to order — anytime, anywhere.

Flexible Employee Benefits Platform

Benefits Made to Order-Anytime, Anywhere

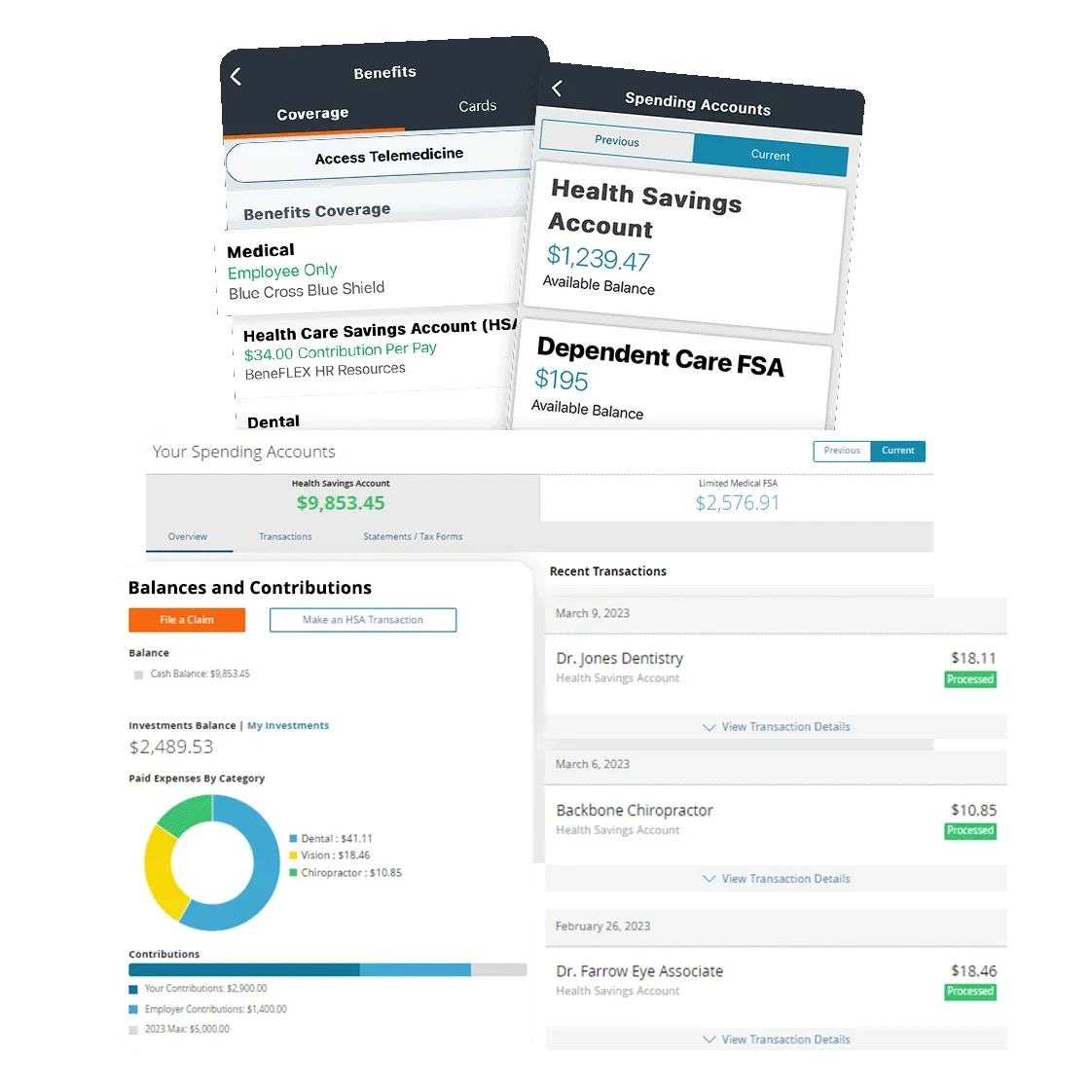

Tired of answering unending questions about balances and policies across multiple benefits providers? The ease of a unified employee experience with a Flexible Employee Benefits Platform is a meaningful change. Account activity and deductions are all managed from the same system, connecting seamlessly to Payroll, which means convenience, time-savings and, ultimately, cost savings. With Paylocity Flexible Benefits, maximizing third-party administrative (TPA) benefit offerings has never been easier – for you or your employees!

Convenient, 24/7 Access to Plans and Funds

Empower employees to access their flexible benefits as easily—and in the same place—as their paychecks and time-off requests.

- HSA

-

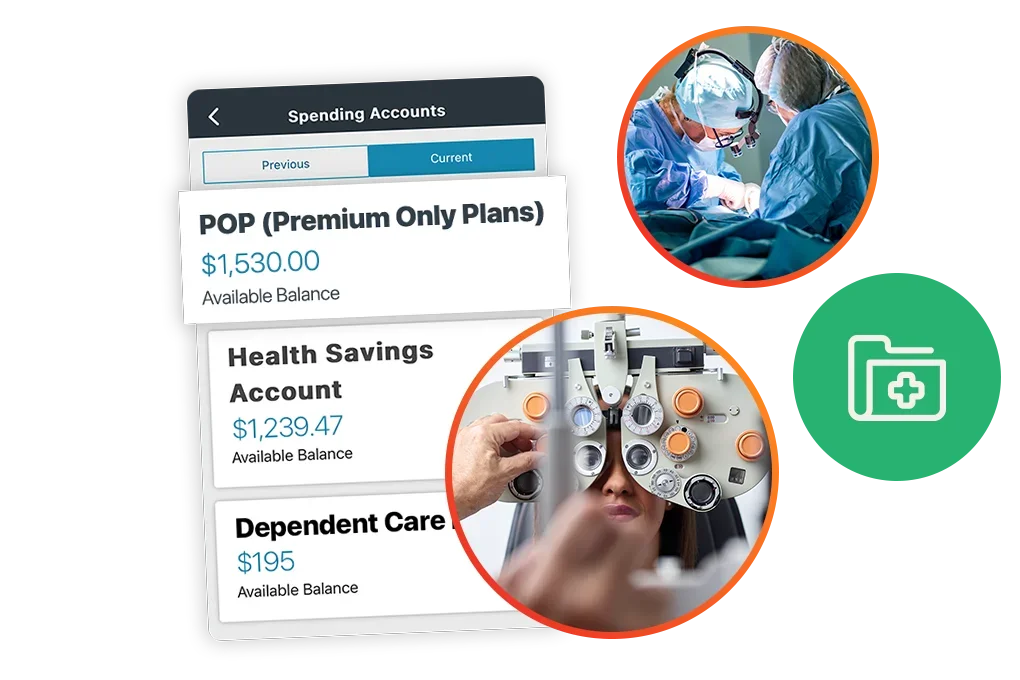

Health Savings Account

A Health Savings Account lets employees with specific health plans save pre-tax dollars for qualifying medical expenses, with funds that roll over year-to-year.

- FSA

-

Flexible Spending Accounts

Flexible Spending Accounts let employees contribute a portion of each paycheck (pre-tax) to pay for qualifying expenses, such as out-of-pocket costs.

- Reimbursements

-

Reimbursements

Health Reimbursement Arrangements are tax-advantaged, employer-funded health benefit plans that reimburse out-of-pocket medical expenses.

- POP

-

Premium Only Plans

Premium Only Plans allow employees to pay most insurance premiums on a pre-tax basis.

- COBRA Administration

-

COBRA Administration

COBRA coverage offers temporary continuation of health benefits under certain circumstances, like job loss.

- Transportation Management

-

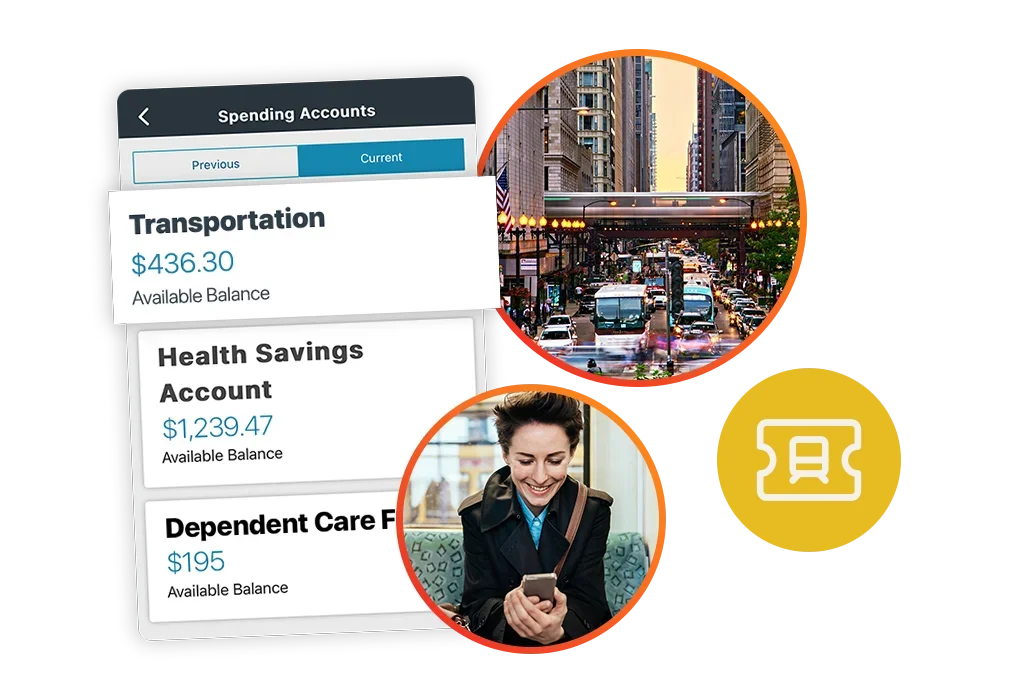

Transportation Management

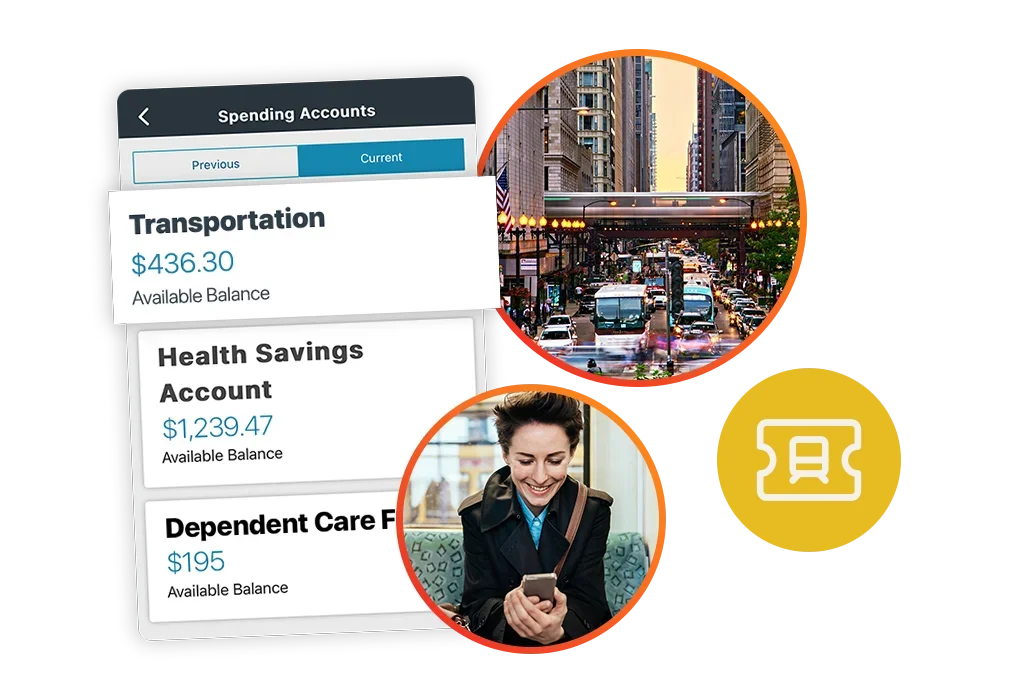

Transportation Management Accounts are a pre-tax benefit for work-related transportation and parking.

Health Savings Account

A Health Savings Account lets employees with specific health plans save pre-tax dollars for qualifying medical expenses, with funds that roll over year-to-year.

Flexible Spending Accounts

Flexible Spending Accounts let employees contribute a portion of each paycheck (pre-tax) to pay for qualifying expenses, such as out-of-pocket costs.

Reimbursements

Health Reimbursement Arrangements are tax-advantaged, employer-funded health benefit plans that reimburse out-of-pocket medical expenses.

Premium Only Plans

Premium Only Plans allow employees to pay most insurance premiums on a pre-tax basis.

COBRA Administration

COBRA coverage offers temporary continuation of health benefits under certain circumstances, like job loss.

Transportation Management

Transportation Management Accounts are a pre-tax benefit for work-related transportation and parking.

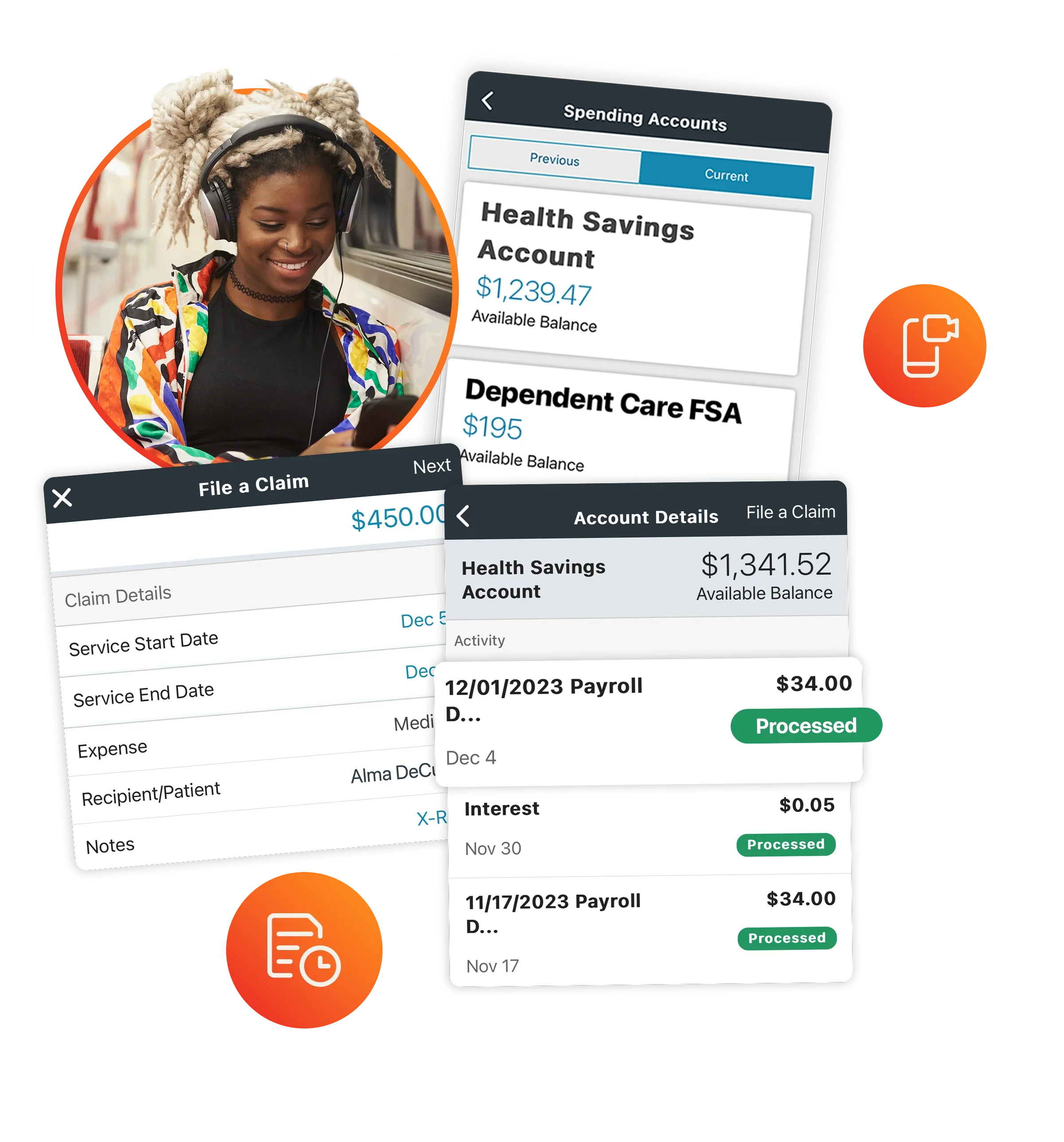

Simplify Flexible Benefit Management and Employee Usage

Access Anywhere

Stand out as an employer by offering useful tools. Employees can review account balances and file claims any time, on mobile or desktop, with real-time event notifications—in the same tool they’re used to accessing to punch in, view paystubs, and more.

Educate Employees

Help employees make informed decisions on the flexible benefits available to them with pre-made video guidance in open enrollment.

Give Employees Smart Tools

Smart debit card technology automatically separates qualified account expenditures at checkout for a timesaving, paperless user experience.

Be Confident About Compliance

Simplify your compliance requirements-from federal and state regulations to COBRA, ACA and HIPAA.

Minimize Redundant Data Entry

Reduce errors and manual work by managing TPA in the same place as Benefits Administration. Reduced discrepancies have a direct impact on time and cost savings.

related resources

Frequently Asked Questions

Flexible employee benefits are a type of employee benefit plan that allows employees to customize their benefits package to suit their individual needs and preferences. With flexible benefits, employees are given a set amount of money to spend on benefits, and they can choose from a range of options to create a personalized benefits package.

Advantages of flexible employee benefits include:

- Increased job satisfaction

- Cost-effective for employers

- Attract and retain top talent

- Improved health and well-being

- Increased employee engagement

- Personalization: By allowing employees to customize their benefits package to suit their individual needs, they feel valued and appreciated by their employer.

- Increased control: Employees who have control over their benefits package are more likely to feel empowered and motivated. By offering a range of options, employees can choose benefits that are relevant to their current life circumstances, such as parental leave or additional medical coverage for a chronic condition.

- Improved work-life balance: By providing benefits that address work-life balance issues, such as flexible work arrangements or access to childcare, employers can motivate employees to work more efficiently and effectively.

- Health and wellness: Offering benefits that support employee health and wellness, such as gym memberships or mental health counseling, can motivate employees to prioritize their health and well-being.

- Retention: Flexible benefits can be a powerful motivator in helping to retain When employees feel that their employer is invested in their well-being and provides benefits that suit their individual needs, they are more likely to stay with the company long-term.

Paylocity can administer the following flexible benefits:

- Health Savings Accounts (HSA)

- Flexible Spending Accounts (FSA)

- Health Reimbursement Arrangements

- Premium Only Plans (POP)

- COBRA

- Transportation Management Accounts (TMA)