resources

Minnesota Unemployment Insurance Tax Rates 2022

December 20, 2021

At a Glance

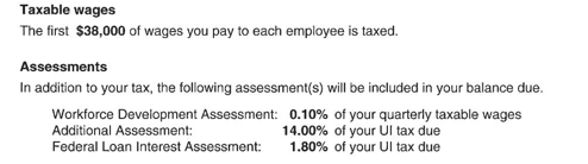

- An additional assessment of 14% will be applied to initial amounts due.

- A federal loan interest assessment of 1.8% also is to be in effect for 2022, down from 4% in 2021.

Introduction

On December 8, 2021, the state Department of Employment and Economic Development said the Minnesota’s unemployment tax costs are to increase in 2022 because of higher tax rates and supplementary assessments. Tax rates for experienced employers will range from 0.5% to 8.9%. These rates include the base tax rate of 0.5%. Tax rates for new employers vary by industry and will range from 1.0% to 8.9% in 2022.

An additional assessment of 14% will be applied to initial amounts due, followed by a special assessment of 1.8% for Federal Loan Interest. The Workforce Development Assessment remains at 0.10. A full breakdown of unemployment tax calculations is on the Minnesota Unemployment Insurance website.

Next Steps

Employers should receive 2022 tax rate notices by December 15, 2021. For more information, visit the Minnesota Unemployment Insurance Program website.

Thank you for choosing Paylocity as your Payroll Tax and HCM partner. This information is provided as a courtesy, may change and is not intended as legal or tax guidance. Employers with questions or concerns outside the scope of a Payroll Service Provider are encouraged to seek the advice of a qualified CPA, Tax Attorney or Advisor.