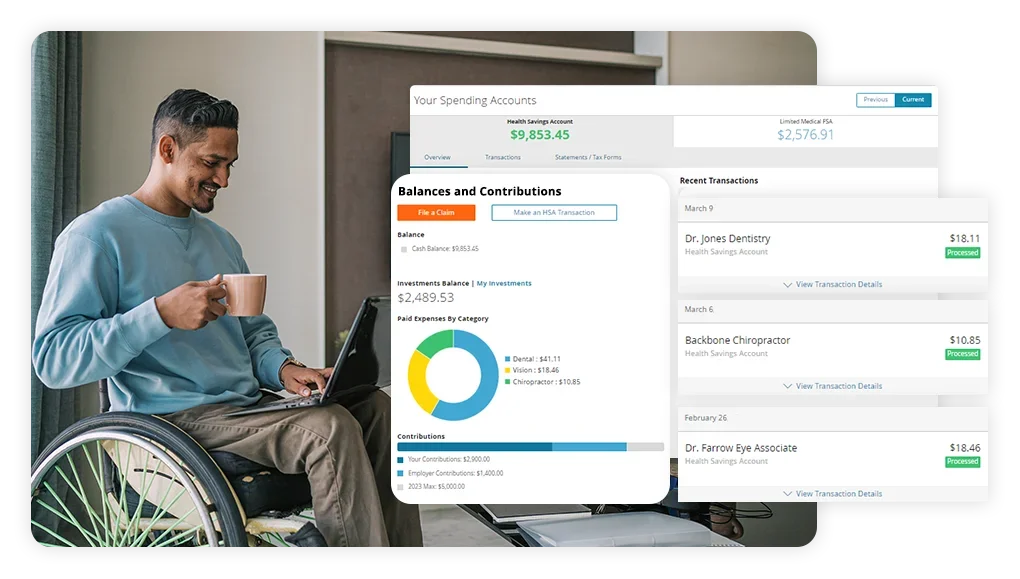

With Paylocity, seamlessly manage COBRA benefits and other flexible contribution plans like FSAs, HSAs, and transportation accounts. Employees can conveniently review balances and file claims – all in one familiar location, alongside their paycheck and time-off access.

Benefits Administration Software

A friendly and full-featured benefits platform.

Benefits administration doesn’t have to be a chore. Easily set up enrollment, navigate compliance, and automate processes — while providing employees a simple, intuitive experience.

Transform Benefits from Frustrating to Frictionless

Go Beyond the Basics with Flexible Benefits

What Employees Love About Benefits

The Power of Access

Using Paylocity, employees can manage enrollments, check spending accounts balances, file claims, and more from any device. Notifications remind employees of critical information, helping them take full advantage of their coverage.

Ease and Transparency

Benefits Decision Support

No more guessing games when it comes to selecting the right plan. Personalized recommendations based on employees’ specific preferences and situations creates more certainty that their benefits meet their unique needs.

related resources

Frequently Asked Questions

Benefits administration software is a software solution designed to automate benefits administration. These software solutions typically have features for enrollment, premium calculation, medical expense deduction, and payments to benefits providers.

A payroll and benefits administrator applies compensation and benefits policies in an organization. They may calculate wages, process payroll, deduct benefits, lead open enrollment, and submit benefits applications.

To administer employee benefits, you must choose which benefits to offer, educate employees, hold open enrollment, deduction premiums, and pay benefits providers each month.

The four major types of employee benefits are medical insurance, life insurance, retirement plans, and disability insurance. Most other benefits fall under one of these categories.

Learn More: The 14 Best Employee Benefits to Dazzle Your Talent

Fringe benefits are perks you provide to your employees outside of salary. Some common examples include tuition reimbursement, life insurance, disability insurance, meals and snacks, free subscriptions, and more.