resources

Two HR Technology Trends for 2024: From AI to EX

January 15, 2024

Yes, you read that right. We’re calling out just two HR technology trends we think deserve special attention in 2024.

For now.

With the pace of change accelerating exponentially, it’s easier to prepare for the future than predict it.

Rather than look at potential bumps in the road ahead, we’re focusing on two ways HR can leverage emerging technology to propel organizations past change management to change enablement.

By taking advantage of innovations in artificial intelligence (AI) and employee experience (EX) technology, HR leaders can steer initiatives and resources toward building a resilient workforce that adapts quickly to change — turning EX into a competitive advantage for the future.

The Story So Far — AI Already Works

From robots to chatbots, almost every industry uses AI today.

In companies of all sizes, HR employs AI across many core functions, such as automating onboarding tasks and analyzing workforce data. Today, organizations are discovering ways that generative AI can streamline internal and external communications.

Learn more about how artificial intelligence already enhances core HR functions and what’s on the horizon.

AI in HR: From Efficiency to Employee Engagement

At the same time, AI is not a panacea for the challenges of a volatile labor market. As business applications for AI continue to evolve, HR leaders must consider what skills will enable — and entice — their workforce to evolve just as quickly.

Meanwhile … Employee Expectations Shift

Although the “Great Resignation” entered the zeitgeist in 2021, employee quit rates had been rising steadily the decade before.

The pandemic disrupted other disruptions already happening in the workplace, like the massive adoption of mobile devices. Generational shifts in the worker population saw Millennials — considered the first digital natives — and now Gen Z increasingly enter the job market.

Not surprisingly, change in and out of the workplace impacts employee expectations. And with the rise in remote work and ongoing talent shortages, workers have more options than ever.

Employee Experience as a Strategic Priority

A positive employee experience (EX) is good for business, resulting in better recruiting, longer retention, and increased productivity, among other benefits.

It’s also a moving target that takes continuous monitoring and adjustment.

According to Gartner, “Workforce” as a CEO strategic business priority has jumped 33% since 2021, now ranking third behind “Growth” and “Technology Related.”

Consider how these three priorities intersect. There are numerous digital touchpoints across the employee lifecycle — posting a job opening, communicating with candidates, open enrollment, onboarding, training, career transitions, and many moments in between. Each presents an opportunity to enrich EX.

When AI and EX technology are embedded in an HCM platform, they equip HR to build a workforce ready to achieve future outcomes.

Even better, new tech is continuously making it easier for employees to customize individual experiences with self-service and collaboration tools, which relieves some of the administrative burden for HR.

To frame our discussion about the impact of today’s HR technology trends, we borrowed the following question from futurist Elatia Abate:

“Given that we’re here [AI], what do we want to create [EX]?”

Let’s look at how today’s advancing technology helps HR:

- Empower leaders with deeper insights and action planning tools.

- Engage employees while providing them more autonomy.

1. Empowering Leaders With AI

If a task involves the collection and analysis of data — as nearly every HR-related task does — AI can provide leadership with more meaningful views into organizational health. In 2024, cutting-edge tools empower leaders to convert these insights into measurable actions.

As AI becomes more ubiquitous and integrated into HR tech, we can expect functionality to advance in several ways:

- Improved qualitative analysis. Natural language processing and machine learning present an enormous opportunity to parse and analyze nuanced data quickly. What does this mean for HR and business leaders? By extracting subtle sentiment from employee feedback and open-ended survey responses, you can gain a deeper understanding of your workforce and identify risks earlier.

- Broadened quantitative analysis. AI opens the doors for more comprehensive data analysis and integration across data sets. For example, within a fully integrated HCM system, you can compare market-level compensation data with employee data and output tailored recommendations for more accurate workforce forecasting — all while keeping local and federal compliance requirements in mind.

- Faster, better, and more streamlined communication. AI-powered shortcuts make it easier to communicate effectively. Automation, tone analysis, and prompts can take a lot of the guesswork out of written communications, so you can focus on what you’re saying rather than how you’re saying it.

Turning Feedback Into Action

Smarter, statistically validated engagement tools like Paylocity’s Employee Voice not only make it easier to gather employee feedback, but also provide recommendations to act on that feedback at scale.

Dashboards and heatmaps help leaders pinpoint which employee engagement efforts are working and which have room for improvement. Then, based on those results, Employee Voice offers a foundation of best-practice action items already built into the platform.

Leaders can customize plans and add other employees as collaborators to foster transparency and accountability. As engagement initiatives are put in place, leaders and HR can use the tool to track progress over time.

AI-Enhanced Benchmarking

Modern HCM systems also help organizations stay competitive for top talent with internal and external benchmarking capabilities.

By comparing employee performance and compensation history with market pay data, leaders have quick visibility into outliers that need to be adjusted.

A unique tool that pairs AI-powered analysis with EX is Paylocity’s Modern Workforce Index (MWI), which lets leaders benchmark employee engagement scores against similar companies.

Generative AI and Employee Communications

It’s hard to believe ChatGPT thrust generative AI into the public spotlight barely a year ago. Future-focused organizations are already harnessing generative AI applications to make employee communications more efficient — and engaging.

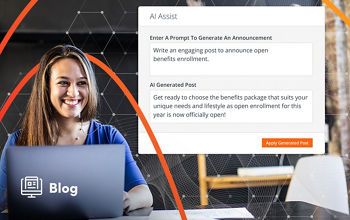

In March 2023, Paylocity announced AI Assist, available throughout the platform to help leaders and employees create highly effective communications in less time. Users can jumpstart creativity, quickly draft ready-to-send messages, and land communications to increase transparency and build stronger culture.

As businesses explore more use cases for AI, they are rightly proceeding with caution. HR leaders should fully vet their technology providers’ commitment to ethical AI development. (Read Paylocity’s AI Ethics Statement.)

2. Engaging Employees with EX Technology (EXTech)

Employee experience is a differentiator in today’s challenging labor market. Employers who level-up their HR technology to engage employees will have a distinct advantage moving forward.

Next-generation EXTech connects workers across the whole organization, which not only boosts morale — it also empowers employees to co-create your company culture.

In addition to meeting core HR and payroll needs, a comprehensive HCM solution helps leaders anticipate shifting employee expectations, set corrective actions in motion, create community proactively, and build a resilient workforce.

To take full advantage of today’s emerging EXTech, leaders should look for solutions that are:

- Integrated — when communication tools are built into the same platform employees use to check their paystub and clock in, staying informed and connected become part of the daily routine.

- Mobile — employees and managers should be able to access everything they need to know and do from one fully functional app so they feel connected no matter where or when they work.

- Consumer-Oriented — whatever technology your employees use in their everyday lives should be embedded across the employee experience, whether that’s the convenience of self-service or social collaboration tools like video, chat, and even generative AI.

Download our eBook on the future of EX technology and discover How to Empower, Engage, and Enable Tomorrow’s Workforce.

Expect to hear more throughout the coming year about advances in EXTech — especially from Paylocity! Some of our exclusive employee-forward tools include built-in Recognition and Rewards, a customizable Learning platform, and advanced Scheduling that gives employees more control over their work-life balance.

The Next Chapter: Implementing Change with HR Technology

Another word for “trend” is “change.” There’s no question AI and EXTech are changing how HR contributes strategically to business outcomes.

While technology is one of the biggest disruptors at play today, it is also the change agent that will amplify HR’s impact in the long term. By empowering leaders and engaging employees, these and other new trends in HR technology give HR more flexibility to focus on tomorrow.

Paylocity leads the way with an intuitive, cloud-based HR and payroll platform that offers real-time, data-based recommendations and simplifies essential functions, while driving a modern workplace and improving employee engagement. Learn more about our solutions.