We’re more than just a provider. We’re a partner to our clients. And that’s what “Forward Together” represents — always innovating, always ensuring progress together.

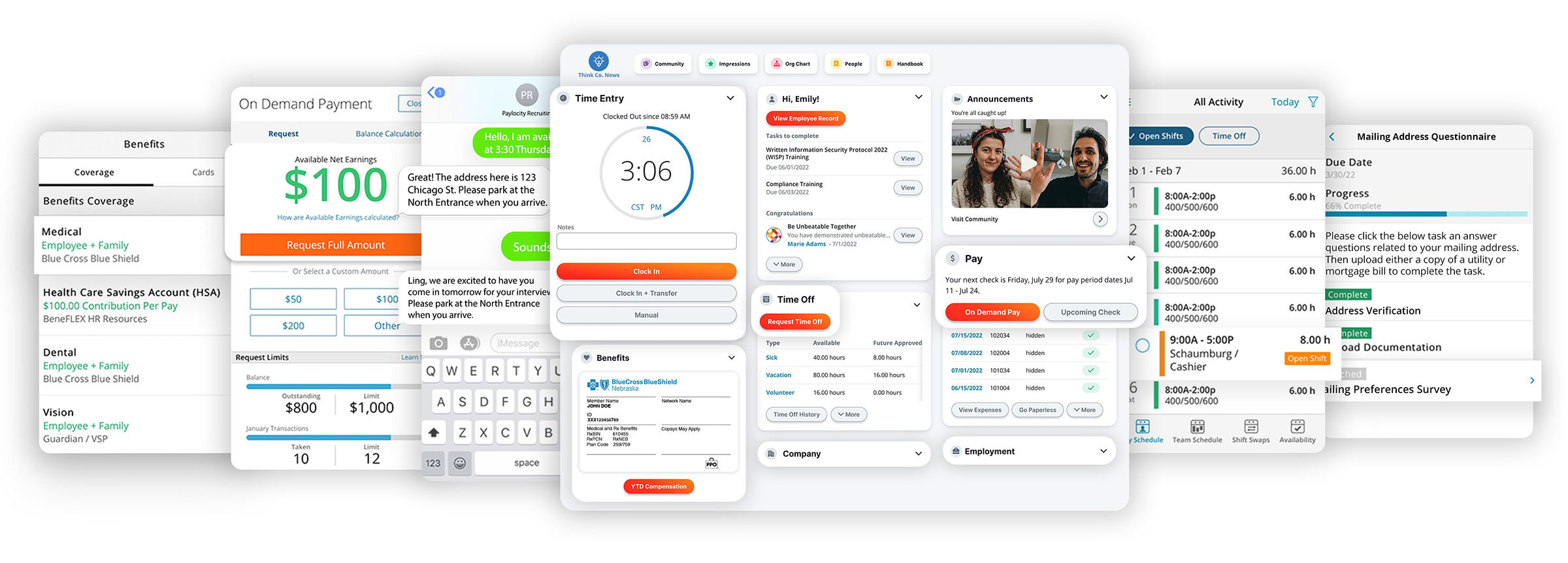

Legacy HR software is designed to give employers what they need to automate, but no single solution has paired the capabilities HR needs with what employees are looking for… until now.

We’re more than just a provider. We’re a partner to our clients. And that’s what “Forward Together” represents — always innovating, always ensuring progress together.

Not all HR technology is created equal. Download our Buyer's Guide to help you find the right solution that will keep your organization competitive and your workforce thriving.