resources

HR Compliance 101: Fundamentals for HR Professionals

February 17, 2023

Employment laws are complex, and the risks of noncompliance are steep. Here are requirements HR pros should know and strategies to stay ahead of ever-changing legislation.

Blog Post

Skip to end of table of contents

Table of Contents

- What Is HR Compliance?

- Employment Laws: Which Ones Do You Really Have to Know?

- Fair Labor Standards Act (FLSA)

- Family and Medical Leave Act (FMLA)

- Occupational Safety and Health Act (OSH Act)

- Employee Benefits Security Administration (EBSA)

- Equal Employment Opportunity Commission (EEOC)

- National Labor Relations Act (NLRA)

- Worker Adjustment and Retraining Notification (WARN) Act

- What Are Common HR Compliance Issues?

- Compliance Is Hard. Now What?

Human Resources compliance is a huge umbrella, and HR professionals are constantly trying to catch all the rules and regulations that rain from the legislative sky.

When you’re responsible for keeping the company covered from every angle, it’s easy to lose sight of why most labor and employment laws exist in the first place: to protect workers.

To be sure, employers must adhere to certain legal requirements or risk significant penalties. But from the employee perspective, these laws ensure their safety, their livelihood, and their human and civil rights.

What Is HR Compliance?

Whether through internal policies outlined in your employee handbook or the many requirements defined by law, nearly every interaction between your company and your employees is governed in some way.

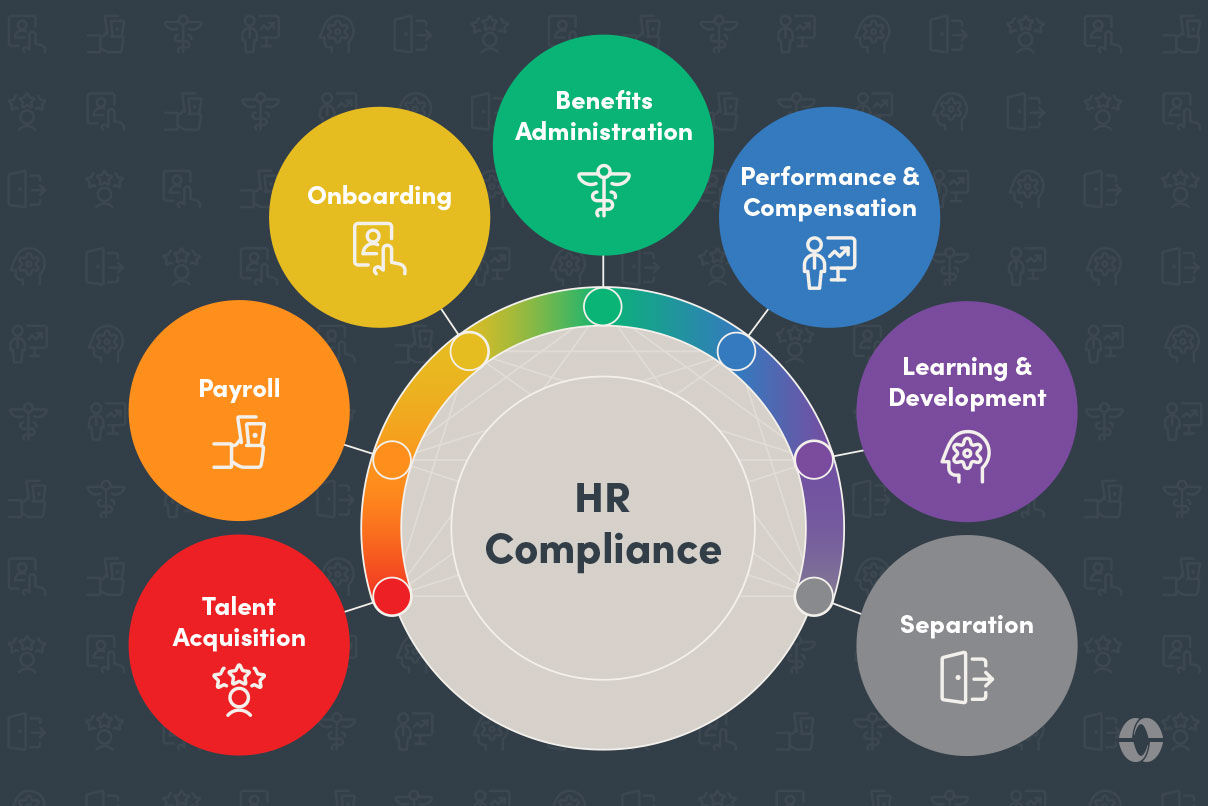

Employers are subject to various federal, state, and local regulations that encompass the entire employment cycle — from recruiting and interviewing through an employee’s last paycheck and even beyond.

There are four primary types of HR compliance that can have a direct impact on your workforce:

- Statutory – employment and workforce legislation, such as minimum wage and age requirements.

- Regulatory – rules determined by a regulatory body, such as the Occupational Safety and Health Administration (OSHA) or a state health department.

- Contractual – agreed-upon obligations and performance standards defined in contracts with partners and employees.

- Union law — rules set forth by a specific union.

These categories are just the tip of the compliance iceberg, and HR professionals have to navigate some pretty turbulent waters — wage garnishment, discrimination, pay transparency, unemployment, to name a very few.

But ultimately, compliance is more than a set of rules that employers must follow. It’s a part of your culture and a demonstration of your company’s integrity.

Why Is HR Compliance Important?

Because there are many different requirements any one employer might have to comply with, repercussions for noncompliance range from penalties for failure to report correctly to audits by an enforcing agency. And, in some cases, wage and hour lawsuits.

Compliance — or a lack thereof — can also damage both your customer-facing brand and your employer brand. Loyal clients will lose faith in your business if they feel their information is compromised. At the same time, showing employees that your company is committed to operating safely, fairly, and within the law helps them feel confident in their work and aligned with your values.

Employment Laws: Which Ones Do You Really Have to Know?

The U.S. Department of Labor (DOL) administers and enforces more than 180 federal laws related to workplace activities. While your company may not have to comply with every one of them, here are some major federal employment laws and governing bodies that HR professionals will almost certainly come across.

Fair Labor Standards Act (FLSA)

It should come as no surprise that the Fair Labor Standards Act (FLSA) made the top of the list. FLSA establishes several key employment standards including minimum wage, overtime pay, recordkeeping of employee time and pay records, and child labor provisions. Currently, the federal minimum wage is $7.25 per hour. But be aware that many states and some local governments have set their own minimum wage.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) applies to employers of 50 or more workers and is intended to promote a work-life balance. The legislation entitles eligible employees to take up to 12 weeks of unpaid, job-protected leave for specified family and medical reasons with continuation of group health insurance coverage.

Occupational Safety and Health Act (OSH Act)

The Occupational Safety and Health Act (OSH Act) passed to prevent workers from being seriously harmed or killed on the job. Essentially, the act outlines an employer’s rights and responsibilities in providing a safe workplace and protects employees’ rights to work in conditions that do not pose a risk of serious harm. Under the DOL, the Occupational Safety and Health Administration (OSHA) sets and enforces protective workplace safety and health standards for most private and public sector workers.

Employee Benefits Security Administration (EBSA)

The mission of the Employee Benefits Security Administration (EBSA) is to ensure the security of the retirement, health, and other workplace-related benefits of U.S. workers and their families. EBSA enables plan participants to exercise their rights under the law and, when possible, to recover any benefits to which they may be entitled. Laws they administer include:

- Affordable Care Act (ACA)

- Employee Retirement Income Security Act (ERISA)

- Comprehensive Omnibus Budget Reconciliation Act of 1985 (COBRA)

- Health Insurance Portability and Accountability Act (HIPAA)

- Genetic Information Nondiscrimination Act (GINA)

Equal Employment Opportunity Commission (EEOC)

The U.S. Equal Employment Opportunity Commission (EEOC) is an independent federal agency responsible for enforcing several federal laws that make it illegal to discriminate against a job applicant or an employee because of the person's race, color, religion, sex (including pregnancy and related conditions, gender identity, and sexual orientation), national origin, age (40 or older), disability, or genetic information.

- Most employers with at least 15 employees are covered by EEOC laws, or 20 employees in age discrimination cases. Most labor unions and employment agencies are also covered.

- The laws apply to all types of work situations, including hiring, firing, promotions, harassment, training, wages, and benefits.

National Labor Relations Act (NLRA)

The National Labor Relations Act (NLRA) protects workers’ full freedom of association, providing employees at private-sector workplaces the fundamental right to seek better working conditions and bargain collectively without fear of retaliation. Note that the act protects most employees whether a workplace is unionized or non-unionized.

Worker Adjustment and Retraining Notification (WARN) Act

Under the Worker Adjustment and Retraining Notification (WARN) Act, employers must follow certain requirements in the case of plant closings and mass layoffs as defined in the legislation. The purpose of the act is to give affected workers and their families enough transition time to seek alternative employment or enter skills training programs.

Noncompliance can pile on the penalties, provoke stressful audits, and invite destructive lawsuits. From employment verification and healthcare to compensation and retirement, complying with federal employment laws can be a time-consuming and costly challenge.

What Are Common HR Compliance Issues?

Of course, breaking any law is never a good idea, but here are five big HR compliance pitfalls to avoid.

1: Discriminatory Employment Practices and Policies

Under the laws enforced by the EEOC, employers must follow comprehensive guidelines that apply to every aspect of employment, beginning before a candidate is hired. As an HR professional, you’re likely familiar with many of the ways discrimination is prohibited — such as in job advertisements, promotion decisions, and providing reasonable accommodations to employees or applicants with a disability.

Keep in mind, however, that everyone in your organization is responsible for complying with antidiscrimination policies, including harassment, retaliation, and disciplinary actions.

2: Incorrect Employee Classification

Complying with the FLSA requires employers to classify employees correctly to determine their eligibility for certain benefits. This can be another confusing — yet mandated — area for HR compliance. The two major employee classifications described in the FLSA are exempt and non-exempt, but other classifications include part-time, temporary, seasonal, and independent contractors.

3: Complying with State and Local Employment Laws

Today, HR professionals must contend with a growing number of state and local employment laws. This certainly increases the complexity of compliance exponentially for companies that have workers in multiple states.

Typically, federal law supersedes state law if there is a difference or conflict. However, in the case of labor regulations, generally the law favors the employee — which is usually the state or even sometimes local legislation. In addition to setting a higher minimum wage, other recent state and local compliance trends have addressed pay transparency, employee privacy, and paid leave.

We would be remiss not to mention that a modern compliance software solution is essential for managing and monitoring your organization’s compliance health, especially for a dispersed workforce.

4: Defining HR Compliance Roles and Responsibilities

Depending on your industry, your location(s), and the composition of your workforce, the organization of compliance roles and responsibilities may include individuals and teams within and outside of HR, such as payroll, data privacy and information security, facilities, business continuity, learning and development, and others. Managing new hire onboarding at your company, for example, requires timely activation across several functions to ensure employment eligibility and accurate documentation.

In the end, however, businesses rely on the HR team to help create and enforce policies that comply with all the laws that regulate employment from recruitment to termination. Obviously, this is a very big job. An HR team may include a compliance officer, manager, specialists, and/or may also leverage services from an external consultant.

5: Keeping Everyone in the Compliance Loop

Another big challenge in maintaining compliance is making sure everyone is clearly informed of your policies and procedures, which includes supervisors and employees. Hiring managers and people managers often need guidance and even formal training to avoid discriminatory practices when interviewing candidates and evaluating performance. Employees are also responsible for understanding their rights and, of course, following the law. Communicating changes to employment laws and your policies is essential in helping everyone do their part to keep your workplace compliant.

Learn More: Guide to Employee Compliance Training: Keep Your Workforce Safe, Healthy, and Above-Board

Compliance Is Hard. Now What?

We know that compliance is just one of the many areas where HR is expected to be the expert. It’s important to note too that although HR professionals need to know the labor laws that apply to their organization, they do not practice law or offer legal advice to employees.

To map out an effective compliance strategy, one good place to start is an audit to identify gaps and high-risk areas. According to SHRM, an HR compliance audit generally consists of two parts: (1) an evaluation of internal policies, practices, and processes; and (2) a review of employment data. Warning signs to watch for include:

- High or increased turnover and absentee rates

- Inaccurate timekeeping

- Form I-9 errors

- Missing employee information or insufficient record retention

- Job misclassification

Again, it’s hard not to point out the advantages of using an integrated solution like Paylocity’s Compliance Dashboard. Through the tool’s intuitive interface, you can visualize and assess your company’s data completeness and readiness for multiple compliance-related processes — from automating I-9 work authorization verification to managing the Affordable Care Act (ACA) to analyzing and reporting on EEO data.

Plus, Paylocity keeps HR teams informed about legal updates with a live newsfeed and frequent compliance alerts. See how we can help you achieve your compliance goals with a live demonstration.

Keep Up With Compliance

Between constantly changing employment laws and updates to the Affordable Care Act (ACA), keeping your workplace compliant can be a time-consuming and costly challenge. Eliminate the stress and stay up to date with our Compliance Dashboard. View compliance alerts and get a bird’s eye view of what you need to do to avoid fines and penalties.